The city-based BoI has hired Barclays, Citi, HSBC and JP Morgan for the issue, which will be listed on the Singapore exchange and is part of the bank's $5 billion medium term note programme.

State-run Bank of India today raised USD 750 million by selling five-year bond to international investors at a coupon of 3.12 per cent, it lowest pricing so far.

Bank of India's USD 750-million issue was a big success with the offer getting response for USD 3 billion.

Two sources at investment bankers told PTI that what is important is the pricing which was fixed at 185 basis points over the US treasury, thus yielding a coupon of 3.125 per cent per annum.

I-bankers said this is BoI's first dollar money issue in two years and the lowest pricing so far.

A call to the bank chairperson and managing director Vijaylaxmi Iyer remained unanswered.

For the five-year dollar money, the bank had given an initial pricing of 2.05% over the US treasury which came down to 1.85% at close, they added.

Yesterday, Reliance Communications became the first domestic firm to raise overseas debt this fiscal by selling $300 million worth sub-investment grade or junk bonds to international investors at 6.5%.

The city-based BoI has hired Barclays, Citi, HSBC and JP Morgan for the issue, which will be listed on the Singapore exchange and is part of the bank's $5 billion medium term note programme.

It can be recalled that the bank had planned to raise the money in February, but deferred the plans due to enough liquidity on slow credit growth.

The bank has a board approval to raise USD 5 billion through MTN beginning 2005 and has so far raised $2.5 billion.

I-bankers said there were 255 orders from investors who were majority Asians (69%), 3% Europeans, and the remaining 1% offshore American investors.

In terms of investor profile, the bankers said the 56% were fund managers, 35% banks and 7% private banks and the rest 2 insurers and pension funds.

The issue has been rated by both Moody's and Standard & Poor's at Moody's Baa3 and BBB- respectively, on par with their ratings on the sovereign considering the fact that the bank is majority owned by the government.

It can be noted after a record $20 billion debt raising in 2014, the corporate withdrew from the overseas debt market as the Fed taper talk loomed and other global volatility increased.

Since mid-February there has not been practically any serious issuers in the market. State-run oil marketer BPCL is currently in the market to raise some funds.

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

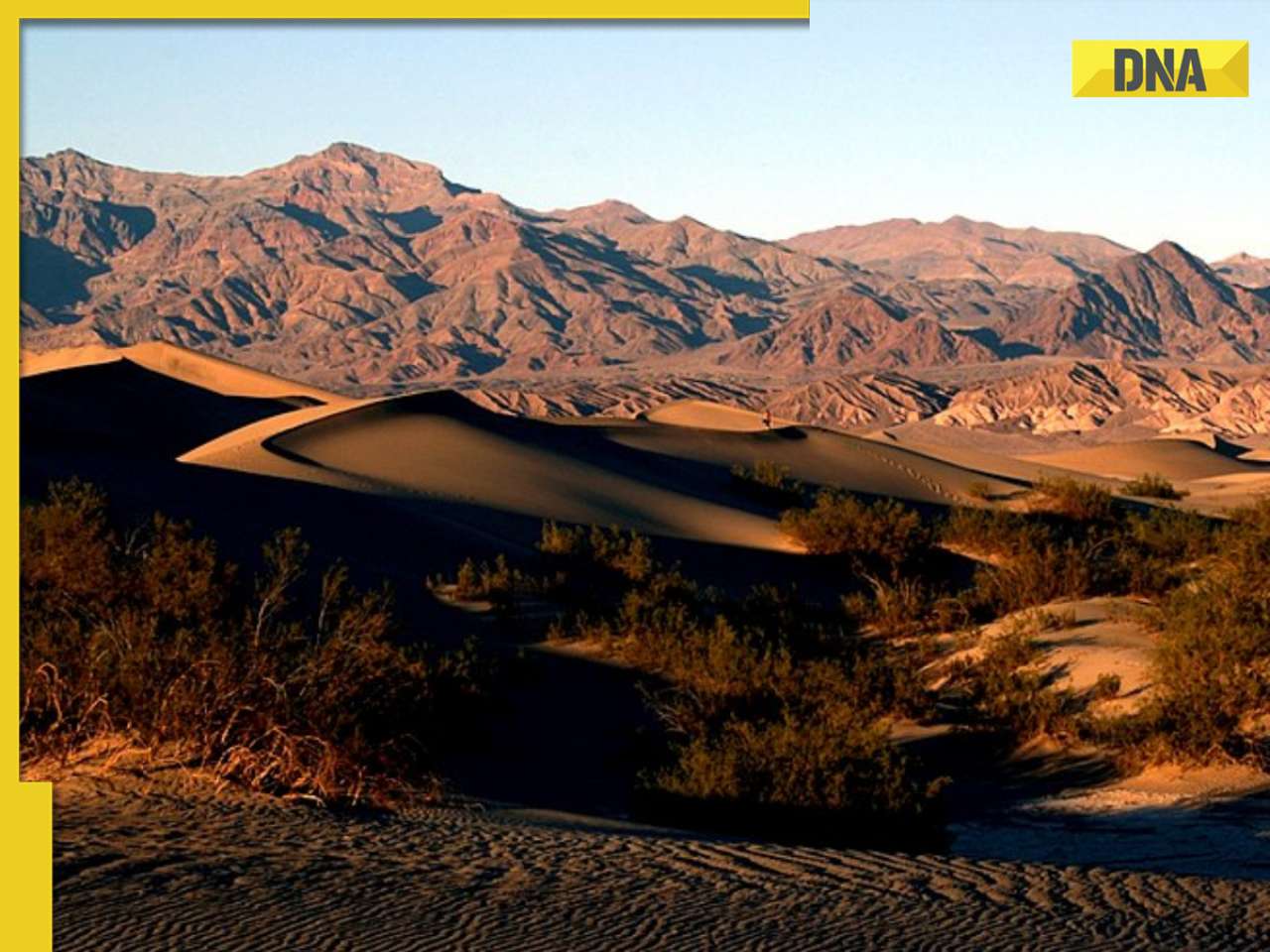

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

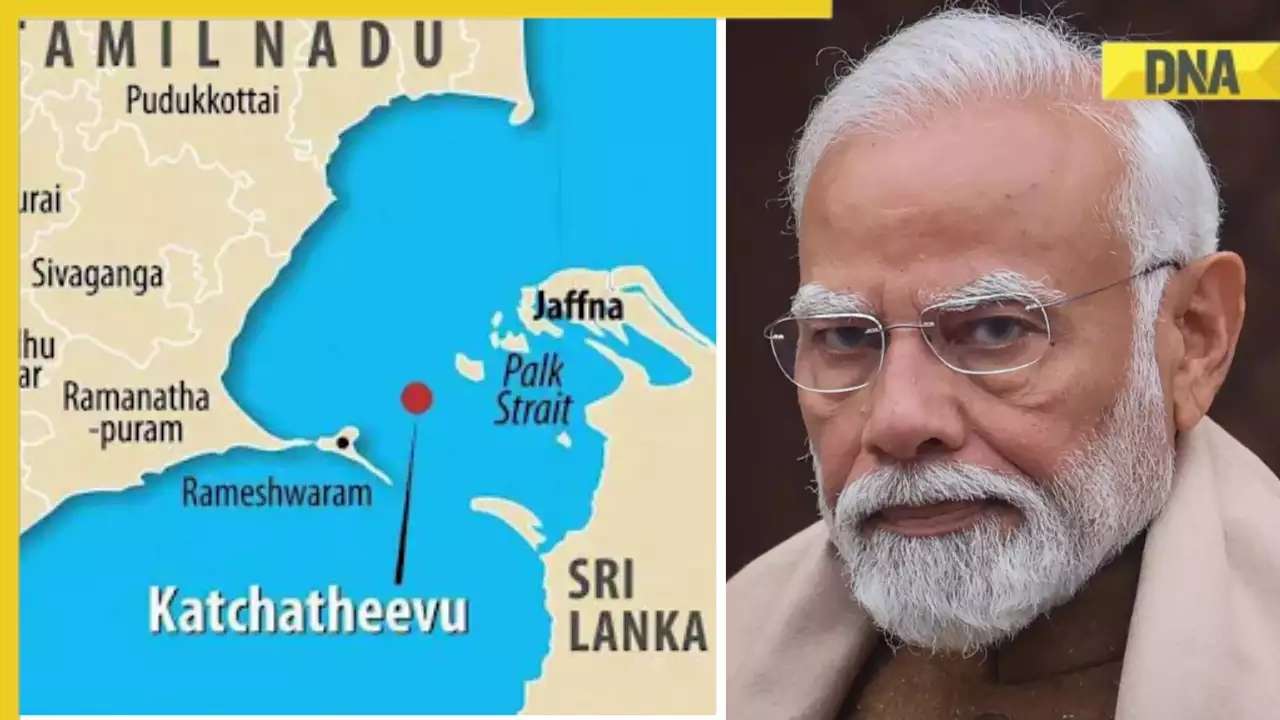

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)