Recently, newspaper reports carried the announcement of the fourth-quarter results of Tech Mahindra.

After the third-quarter results, we had discussed the accounting issues with respect to certain transactions which had the raised the hackles of some analysts (DNA, February 10, 2010).

TechMa did send their comments on the issues raised in that article. In this article, we will revisit the very same transactions and attempt to decipher the underlying motives behind them and why they may not be real commercial transactions.

The saga of such transactions between TechMa and its associate company British Telecom (BT) began in the financial year ending March 31, 2008, and continued till the financial year ending March 31, 2010.

We revisit the same transactions to determine whether they represent commercial rationality.

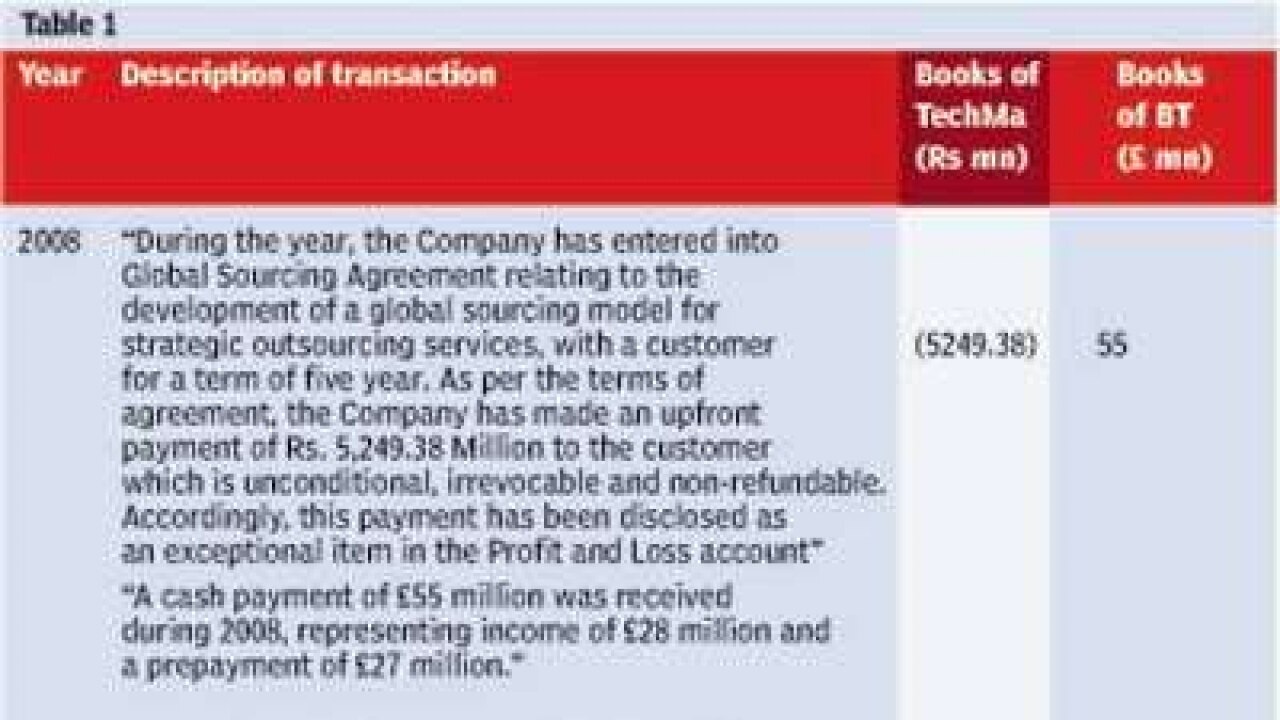

The details of the transactions as reported by Tech Ma and BT over the three years are captured in Table 1 below:

One look at the table is enough to indicate that there was a pay out

in first two years and in the third year the amount came back.

The small difference could be due to exchange rate movements. It would also be interesting to see whether similar transactions would be entered into in 2010-11.

Would a company enter into similar transactions on arms length basis with un-related parties?

When any company enters into an agreement to render services for a period of five years the normal commercial practice is for the customer -receiver of the services-to pay a mobilisation advance or a deposit to enable the vendor to mobilise the required resources and not be at a loss.

Here the process is turned upside down with the vendor paying the customer contrary to the practice just described. The reverse case is not normal and if paid must result in some benefit.

It is possible that customer was in need for finance and the vendor was in a position to provide the same and the transaction was routed as commercial contract to extract some tax advantage.

It means the amount paid upfront must come back in the form of higher revenue such that the present value of the higher revenue in future years is equal to the amount paid upfront If this were the case it should reflect in higher gross margin earned over the subsequent years.

Table 2 produces the results prior to and post such transaction:

While the margin in 2009 shows a marked increase the same needs to be sustained in future years which it does not appear to be from the quarterly results.

The increased revenue does not appear from the financials reported by the company.

The question that comes to mind include:

a) What was the explanation given to the audit committee to justify this transaction?

b) Did the audit committee raise any question on the propriety of these transactions? The committee consisted of Anupam Puri, chairman, Clive Goodwin, Raj Reddy and Paul Zuckerman.

c) What explanation was given to the statutory auditors and how did they derive comfort from the transaction as a normal transaction?

The transaction in 2009 is even more interesting.

The note says that payment was made for getting an exclusive negotiating window for 90 days. That is, after the 90 days the client is not obliged to place any order.

In such cases the payment must be financially justified on two grounds a) the exclusivity improves the chances of getting the order and b) the expected value of additional profits from the probable contracts that can be bagged exceeds the payment on present value terms.

This must be contracts, which the company otherwise may not be able to bag.

This must be reflected in the incremental revenue. Going by the figures culled from the annual report of BT the turnover over the four years generated from BT is as per Table 3 below:

As can be seen the payment is made in the financial year 2009 when the turnover has decreased.

In the year 2010 BT has negotiated for reduction in the rates and made a onetime payment for the same. It can be easily seen that in 2008 Tech Ma makes a payment for a contract which implies they got higher rates for a period of 5 years and 2010 BT negotiates for a reduction in rates and other terms and makes a upfront payment for the facility.

The same questions would haunt any reader of the accounts once again?

On what basis was the payment determined? Was it only a reduction of the higher amounts determined earlier?

Why did this amount circulate in this fashion from Tech Ma to BT and back from BT to Tech Ma.

What was the underlying purpose with such transactions which are strange and not normal commercial transactions? Are they genuine business transactions at all?

These are only questions that one can raise, for the answers are neither in the accounts of BT nor in the accounts of Tech Ma. Can the company explain it fully once and for all?

Ramesh Lakshman is a chartered accountant.

He can be contacted at rl@rlco.biz