In the recently announced budget Mr. FM had allowed an additional deduction on account of investing in National Pension Scheme (NPS); it was made available to public around six years ago but it did not garner any attention because of the complex procedures in opening NPS account and its tax treatment at the time of maturity too played a role in dissuading investors.

The recent announcement in the Budget did not alter any of features of NPS but the additional deduction of Rs 50,000/- under Section 80CCD is surely going to be a great incentive. The said limit is over and above your existing limit of Rs 1.5 lakh u/s 80C.

Should you invest in NPS?

Though the additional benefit under tax is a great boost and makes it an attractive investment option for retirement but one should not just go with the tax benefits only but you should only invest in NPS based on your assessment of overall risk and after your comprehensive financial planning.

Why I am telling you this is because of the limit NPS puts on the maximum exposure to equity allocation and has been capped at 50% of the entire corpus. If you are young then it seems to be more conservative for you based on a logic that if you are investing in NPS when you are say around 30 years of age or less and have more than 25 years of retirement time. If that is the case then also you can invest in NPS as one of the retirement planning product but do invest separately in other equity related instruments like ELSS or direct equity.

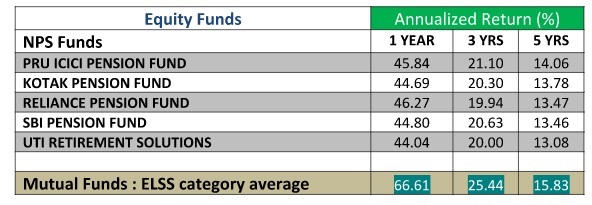

The other reason is also based on the fact that if you see a longer horizon then ELSS tax saving mutual funds schemes will be able to generate much better returns in comparison to NPS due to no restriction on equity investment. Please check the table to see the comparison between the returns of NPS and MF ELSS.

How much to invest?

You can invest the amount of Rs 50,000/- at one go also or even can divide the amount in a monthly mode the way you invest via SIPs of a mutual fund. There are three types of funds, which you can choose from, and these are “E” (equity market), “G” (Government Securities) and “C” (Fixed instruments & other than government securities.

Tax treatment on Maturity!

At the time of retirement; minimum 40% of pension wealth is required to be invested for purchasing an annuity and maximum 60% of the pension wealth can be withdrawn in lump sum. And the 60% of the corpus you are allowed to withdraw will be taxable. Now if you compare the same with any other retirement products say PPF or a Provident Fund both are tax-free on maturity.

“Rishabh Parakh is a Chartered Accountant and the Chief Gardener & Founder Director of Money Plant Consulting, a leading Tax & Investment Planning Advisory Service Provider. He also runs a personal finance blog called “Mango Investor” aka AAM Niveshak at www.mangoinvestor.com . Readers are invited to send their feedback to rishabhparakh@moneyplantconsulting.net”