Sentiment in domestic markets should be strong this week. The immediate trigger is the spectacular showing of Prime Minister Modi and the BJP in the UP state elections. Markets will now bet on political stability sustaining into and beyond the 2019 general elections.

There are other positives as well. Crude oil prices have dropped nearly 10% this year, and the rig count in the US continues to rise steadily. The long-awaited GST should roll out on July 1. The short-term headwinds of demonetization will wear off and the long-term benefits should start to kick in.

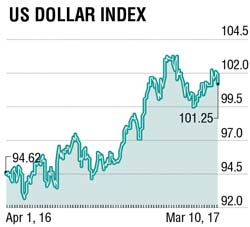

Risks do linger in the external sector, though. Global markets expect reflation, with tax cuts, infrastructure spending and deregulation in the US. The US Federal Reserves will debate this week if they are behind the curve for possible reflation, and a rate hike is near certain. The bigger risk is perhaps that reflation does not happen, and that the global economy with weakness in China, Europe and elsewhere stands exposed again.

Tax cuts and infrastructure spending are unlikely to be approved by the US Congress without some plan to contain fiscal pressures. The earlier idea of border taxes may now be falling out of favour. While it is difficult to predict what the Trump administration will do, the current sound bites centre on countries that have either weakened their currency or have high barriers to imports. On the latter, India's name has come up in recent debates. With a substantial trade surplus with the US – both on goods and on services – India has to be watchful.

Tax cuts and infrastructure spending are unlikely to be approved by the US Congress without some plan to contain fiscal pressures. The earlier idea of border taxes may now be falling out of favour. While it is difficult to predict what the Trump administration will do, the current sound bites centre on countries that have either weakened their currency or have high barriers to imports. On the latter, India's name has come up in recent debates. With a substantial trade surplus with the US – both on goods and on services – India has to be watchful.

In the meantime, market players will likely continue their bets for a strong rupee, particularly with high forward premium, and a stable to soft US dollar globally. Exporters could increase hedges while importers and those with borrowings in foreign currency could refrain from hedging. Unhedged portfolio inflows could continue as well. As in the recent past, the RBI intervention to buy US dollar will likely define where the USD/INR settles.

In the medium run, currency strength on the back of increased unhedged bets is unhealthy. The rupee is relatively overvalued, and we continue to import $60 billion of manufactured goods from Greater China despite our underemployed workforce. Unhedged currency bets will also make our currency vulnerable to sharp corrections at times of global market volatility.

While the stars are aligning for India's economic prospects, and the immediate rupee trend is positive, we should guard against complacency.