Last week, CARE Ratings brought out two reports on the Indian banking sector.

Both pointed to the pain the country will have face. The new government will have to try to undo some of the worst ravages the banking industry has been made to go through during the past five years.

Just a week earlier, Uday Kotak, MD & CEO, Kotak Mahindra Bank, said that Indian banks would need at least Rs 3.5 lakh crore of capital on priority basis. He said that public sector banks (PSBs) have already begun to feel the constraints of capital needed to finance the 15% growth in credit that is expected. Well-managed private and foreign banks with healthy balance-sheets are, therefore, likely to gain.

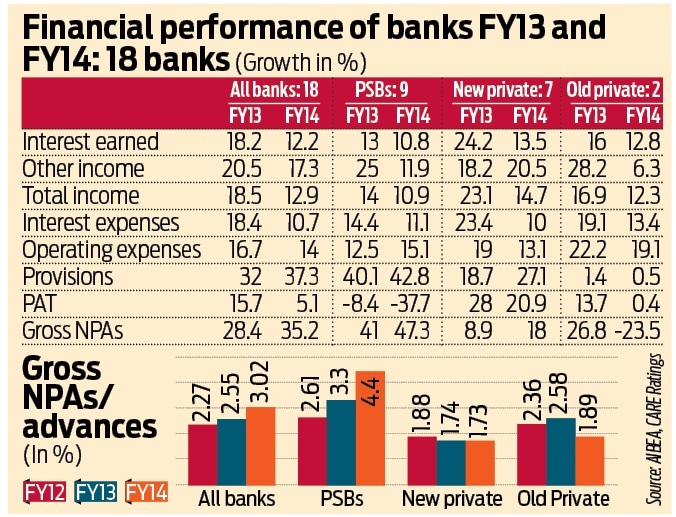

The CARE reports underscored such a view (see table). Of the 18 banks that declared results by last week it was clear that PSBs were bleeding (though admittedly some of the larger PSBs like SBI, PNB, BoB, BoI and Union Bank were yet to declare their results).

Watch the NPA (non-performing assets) figure. They have soared during the last three years from 2.27% of all credit outstanding to 3.02% in fiscal 2014. And this is without taking into account the bigger banks which have a bigger chunk of the NPAs. And even if the percentage appears to be small, the actual numbers are huge. Do bear in mind that the total credit outstanding is Rs 56.57 lakh crore.

Study the NPA numbers again. While the average NPA for banks is 3.02%, it is 4.4% for PSBs, and under 2% for private banks. Clearly, PSBs could not stanch their wounds. Obviously, political pressure, corruption, and loan-writeoffs had an equal part to play in this assault on PSBs. And this does not include the extremely unhealthy gambit of farmer loan waivers.

Many experts believe the NPA problem could be a lot bigger than is currently being stated. As discovered in the United Bank of India episode, most bad debts were taken in smaller values through multiple accounts, thus escaping the reporting norms laid down by the Reserve Bank of India (RBI). As one banker put it, "It was a problem of nomenclature". Solve that, and like with a magic wand, all NPAs can shrink, but the malaise and the risk continue to grow bigger.

Hence, the going will not be easy for PSBs. First because, last year itself, credit off-take grew by 14%. If the economy does take off, as the markets expect, under the leadership of the new prime minister, Narendra Modi, this credit rate will grow faster. Banks will thus have to provide for more capital to take up more lending.

But there are strains that are already showing. Even though total credit off-take grew, at least eight sectors did not register higher growth rates than in fiscal 2013. Two sectors – food credit and credit card outstanding – actually witnessed a negative growth. The first could be on account of bad agricultural policies that hurt farmers much more than the government admits. The second could be as a result of jobs lost or the precariousness of jobs still held. Neither is a comforting sign.

As the CARE report showed, the top four industries: infrastructure, basic metals, textiles and chemicals, which account for a little over 60% of outstanding credit as of March 31, 2014 had all witnessed lower growth in fiscal 2014 relative to fiscal 2013. This may be juxtaposed with the observation made by the RBI in its Financial Stability Report that infrastructure, metals and textiles were some of the concern areas from the point of view of NPAs.

Yet, these are the very sectors that could provide employment growth. If money is not available for their growth, employment generation could get stalled. One option could be to adopt the proposal made by the RBI committee headed by PJ Nayak – that government holding in all banks be reduced to less than 50%. That could insulate PSBs from additional politically sponsored schemes like unwise loans and write-offs. The other is to invite FDI to fund employment generation sectors.

It remains to be seen what the new government does.