Despite the ferocity in the bears' growls, many believe that the gold rally will get even more frenzied than ever before. It is only a matter of time, say analysts. True, gold prices may pause for a while, even stumble. But this could well be the lull before the proverbial storm, they say.

At the heart of this optimism is the cynical view that the world will continue to see excessive liquidity. True, the US began quantitative easing (QE) to ward off potential stagflation. But now it may not be able to suck in the excessive liquidity.

As Incrementum AG explains in its recent report (In Gold We Trust – 2014), "If one wants to understand the future, one must look at the past . . . The root of the calamity is the unbacked, government-regulated monetary system.

Together with a growing number of economists, we are convinced that the global monetary system needs an anchor again. Gold can play an important role in this context. . . . The political calculation is simple: there are few creditors and many debtors. True reform is politically unpalatable, as 'austerity' is certain to lose elections. Inevitably, politicians will choose inflation."

On September 4, the European Central Bank cut its main refinancing rate from 0.15% to 0.05%, and the deposit rate, from -0.1% (yes, minus 0.1%) to -0.2. ANZ Bank (www.anz.com) issued an advertisement in Australian newspapers on September 3 inviting deposits in British Pounds, HK and Canadian dollars, Japanese yen, and Danish, Norwegian and Swedish kroners. It probably knows that a 0% rate is better than a minus rate. The pre-condition is that the amounts must be large – over GBP 175,000.

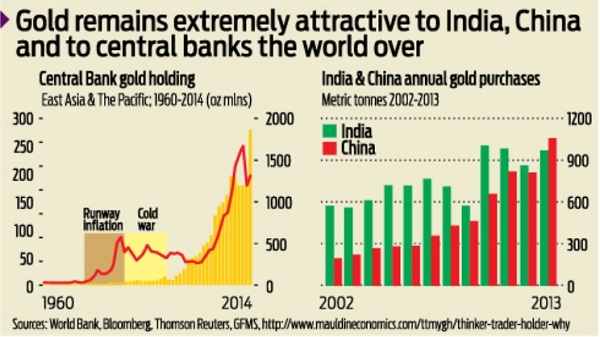

The fact is that, thanks to the misadventures of the US, governments all round the world fear deflation and inflation. They also fear a flight from paper money. That is why even governments have been intervening in the gold market (see chart of central bank gold holdings).

Says a market watcher, "These countries are printing notes. But whilst the stock of money is going up, the velocity of circulation has been dropping. So they have come to negative interest rates to get people to spend and stave off deflation. The risk is that if velocity goes up, there could be high inflation. Operators like these – if in the stock market -- would have been behind bars. But who is going to regulate the governments?" The world debt to GDP number is close to 300%. It may be time to be prepared for some major abrupt global changes.

Gold thus remains the time-tested hedge against inflation.

There is a second fear. The Cyprus Bank bailout saw bank depositors lose over 50% of their money as it got confiscated by the government to make good the national deficit. All of a sudden, almost every major depositor has begun to realise that when he deposits money with a large solvent company like Google or GE, he remains a secured creditor. But when he deposits money with a bank, he becomes an unsecured creditor. In case there is a run on the bank, other creditors get their money first. Depositors get the crumbs, if any, at the very end.

With banks becoming a risk, and currency losing its value, is it back to gold? Some punters say it could climb to $1,500 an ounce (approximately Rs.28,935 per 10 gm without duties or levies) in the short term, but even to $2,300(Rs 44,368/10 gm) in the long term. The possibility of larger forex inflows into India (http://www.dnaindia.com/money/report-is-hot-money-fuelling-the-indian-market-rally-2017439) could actually pour oil on this fire.

Our motto, however, remains "caveat emptor" – let the buyer beware.