Most of us know about the game of chess; most of us are likely to have played chess at one time or the other, too. And it’s common to believe that the inventor of the game of chess must have been a genius.

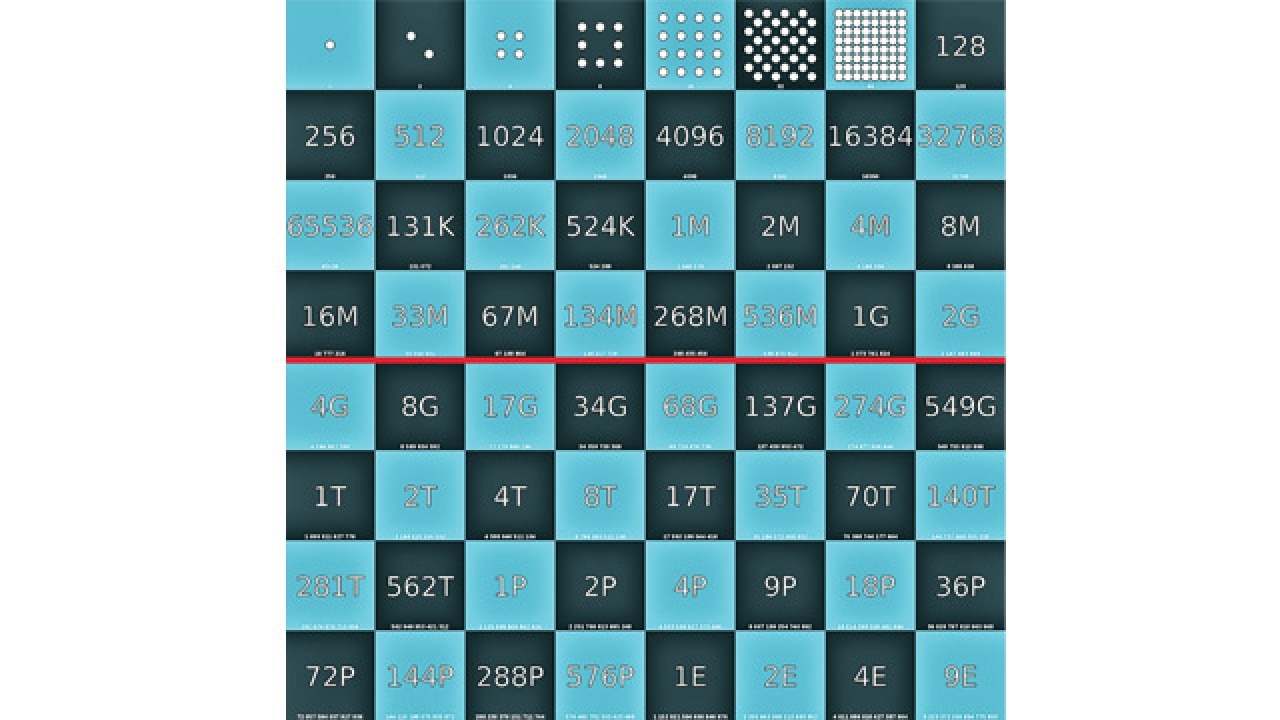

If the story about the emperor and the inventor of chess is true, then the inventor certainly was clever! The story goes like this… the inventor of the game of chess demonstrated it to an Indian emperor who was very impressed with the game. To show his appreciation, he told the inventor to name his reward. The inventor simply asked for one grain of rice for the first square of the chessboard, and wanted that grain of rice to be doubled for every next square, i.e., two grains for the second square, four grains for the third square, etc. The emperor readily agreed since he believed the inventor was asking for so little! Unfortunately for the emperor, his treasurer returned a week later to inform him that they did not have enough grains of rice to reward the inventor; in fact, it would take many centuries to produce so many grains of rice! Take a look at the visual to understand how many grains of rice the inventor had actually demanded as a reward.

In terms of money, Re 1 put in the first chess square, and doubled for every next square would yield as much as the grains of rice the inventor of the game demanded! This is called compounding.

In terms of money, compounding implies earning ‘interest on interest’. Compounding does wonders to your wealth; reinvesting your income results in growing your wealth at a faster pace. No wonder why Nobel-winning scientist Albert Einstein called compounding ‘the eighth wonder of the world’.

Let’s consider compounding with respect to debt funds offered by mutual funds. In debt funds, compounding works best when you opt for the ‘growth’ option in which case dividends remain invested, thereby earning you further returns.

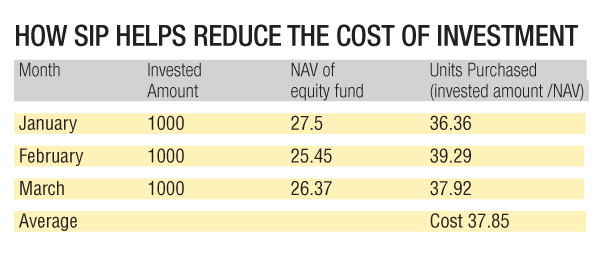

You can also make fresh investments by undertaking a systematic investment plan (SIP). In this case, you invest a fixed sum every week, month or quarter at the prevailing net asset value (NAV) of the fund. Net asset value is the ‘price’ of each unit of the fund, which is arrived at, by dividing the sum of all investments made by the fund based on their market value by the number of units issued by the fund. Additionally, there are other incidental additions and deductions to arrive at the NAV. Every fresh investment you make starts earning you returns and over time, your debt fund investment value will become substantial.

An even better option to take advantage of compounding is to undertake SIP in an equity fund since debt funds have limitations in terms of the returns that they can generate. As we are aware, equity investing has historically proven to be the best asset class in terms of returns.

If you consider the last 20 years, equity markets have offered a compounded annual growth rate (CAGR) of 10.7 per cent*. In comparison, interest on public provident fund (PPF), which is indicative of debt interest rates, has been 8 per cent** per annum.

With equity markets expected to be volatile, SIP investing will help you enter the markets at different levels, which will result in your cost of investment being lower than the market value. Take a look at the box on your left to understand SIP helps reduce the cost of your investment.

This also results in your investment returns growing over time if you continue your SIP investment over a long term. You should also choose the ‘growth’ option in your equity fund in order to allow the dividends to remain invested to earn you further income. To conclude, benefit from the 8th wonder of the world — compounding — through SIP in equity.

The author is a Class XI student of Dhirubhai Ambani International School, who is passionate about investing.

*Nifty 50 CAGR

**Source: www.indiapost.gov.in