My ex-boss John Chambers (former executive chairman and CEO of CISCO) once said every company will become a technology company eventually as no business in this world can be successful without adopting the technology.

I take that insight to categorise startups in three broad classes; startups that use technology to create efficiency and better customer experience, startups that apply technology to create new use cases and startups that create new technology to address a new market or an existing market differently.

Broadly, the unique application of technology and the creation of new technology is what I call “Tech”. By that definition Tech or Deep-tech is not a startup segment but merely a characterisation of what they do to create value. Thus, Tech or Deep-tech can apply to all vertical segments of startup activity including e-commerce, fintech, food-tech, industrial, agri-tech, supply-chain and others. While there has been an unprecedented rise in funding in so-called Tech or Deep-tech startups backed by a new age venture capitalists (VCs), much still needs to be done to complete a startup’s journey from ideation to market scale.

I am listing below five key trends that will shape the start-up industry, and therefore the asset class.

Emergence of new generation “product” VCs

Previously, we had two types of VCs – consumer internet VCs and B2B or enterprise VCs. Most of the major dry powder was in the hands of the consumer VC, some of whom aspired to become a B2B VC but lacked the insight, knowledge and the risk appetite to do so. What we have observed over last 30 months is the emergence of half a dozen or so VCs willing to call themselves product VCs with a singular focus on intellectual property right (IPR) led innovation. These are mostly second-generation VC partners, entrepreneurs or corporate honchos, who clearly have the knowledge, operational strength, and business network to be a true partner in the product startup’s path to success. They have the ability to define the right set of metrics and measure them diligently rather than harping on a number of subscribers, gross merchandise value (GMV) or unit economics. They are rightfully called our new ‘specialist VCs’.

Corporates will graduate from running accelerators to corporate venture capital (CVC) programme

On the last count, there were about a couple of dozens of corporate accelerators announced by both global MNC’s India backend and Indian firms. These programmes are a great initiative with about half of them in the B2B or product space. They are very early stage initiatives that primarily help corporates learn about what’s out there as an idea, shape the thinking and provide a platform for their employees a taste of mentorship. This, however, is a slow long-drawn process. In today’s world of digitisation, corporates need to capture innovation and harvest them quickly from startups, where the idea is well evolved and prototype developed. A co-creation roadmap can be executed. A CVC programme can be defined and structured to achieve these objectives. It is unfortunate that not many Indian powerhouses have a CVC programme and probably miss the point that they need to impact themselves with a market disruption enabled by a startup to learn, adapt and accelerate their digitisation and customer experience goals. This will change in the next few years as corporates bring immense value to product startups through their CVC programs even as they themselves benefit from it.

Coming of age of a well-oiled product innovation ecosystem

We all know the seed and pre-series A stage is an important phase in a startup’s formative existence. The challenges pertaining to the access to seed or pre-series A capital have somewhat been mitigated by several angel investors coming from product background and are part of the angel networks. The accelerator and incubators are also complemented by the startup mission run by several state governments. From my personal experience of working with them, I have found them to be extremely effective and professional. The role and importance of the central government’s startup mission – a Fund of Funds for Startups that has a product and technology focus – also cannot be undermined. Interestingly, some of our local specialist VCs have them as their limited partner (LP). At least a dozen startups in Tech or Deep-tech have come up and scaled primarily due to government projects like Smart cities, Digital India, Digital Payment or Pre Payment instrument (PPI) and others. Conclusively, we can say that the conjoint product innovation eco-system has finally come together, albeit in its early avatar.

Interplay of mobility, AI and IoT will continue to be innovation domain

When it comes to innovation, India will follow a pattern similar to its global peers. However, the emphasis may be on the interplay rather than breakaway research in any of them. It’s also important to note that product and technology are not geography-specific. It is, therefore, imperative that product startups in India aim to create a unique intellectual property portfolio, preferably global patents, and eventually create global proof points through customer validation in the European or the North American markets. No doubt, it is expensive to sustain an international operation but that’s where a specialist VC or a CVC partnership may come handy. On the business model side, there are the three Ss – software, services and subscription – for which India’s time has arrived, India for India and India for the world.

Countering challenge of product startup funding

Although leading indicators are favourable and ecosystem – though not fully evolved – is effective with a huge validation of domestic demand, the journey of the platform, product or tech startups is expected to be a little bumpy. One imminent challenge is the paucity of product VCs in the growth stage. As of now, most of the specialist VCs are small funds. Most of the startups being funded by them are expected to come up for growth stage fundraising sooner than later. The size of this round of fundings is expected to be bigger by the sheer nature of product business. Hopefully, the traditional consumer internet VCs would find this as a good opportunity to diversify their portfolio and be eager to participate as some of the risks would have been mitigated by then. If this does not happen then there could be a huge vacuum in the funding continuum, creating disappointment to founders and VCs that have backed them. This will be a huge setup for the cause of Deep-tech startups in our country.

ROAD AHEAD

- Deep-tech is not a start-up segment but merely a characterisation of what they do to create value

- However, much still needs to be done to complete a start-up’s journey from ideation to market scale

The writer drives corporate strategy at Tejas Networks, is also associated with E&Y Lead advisory

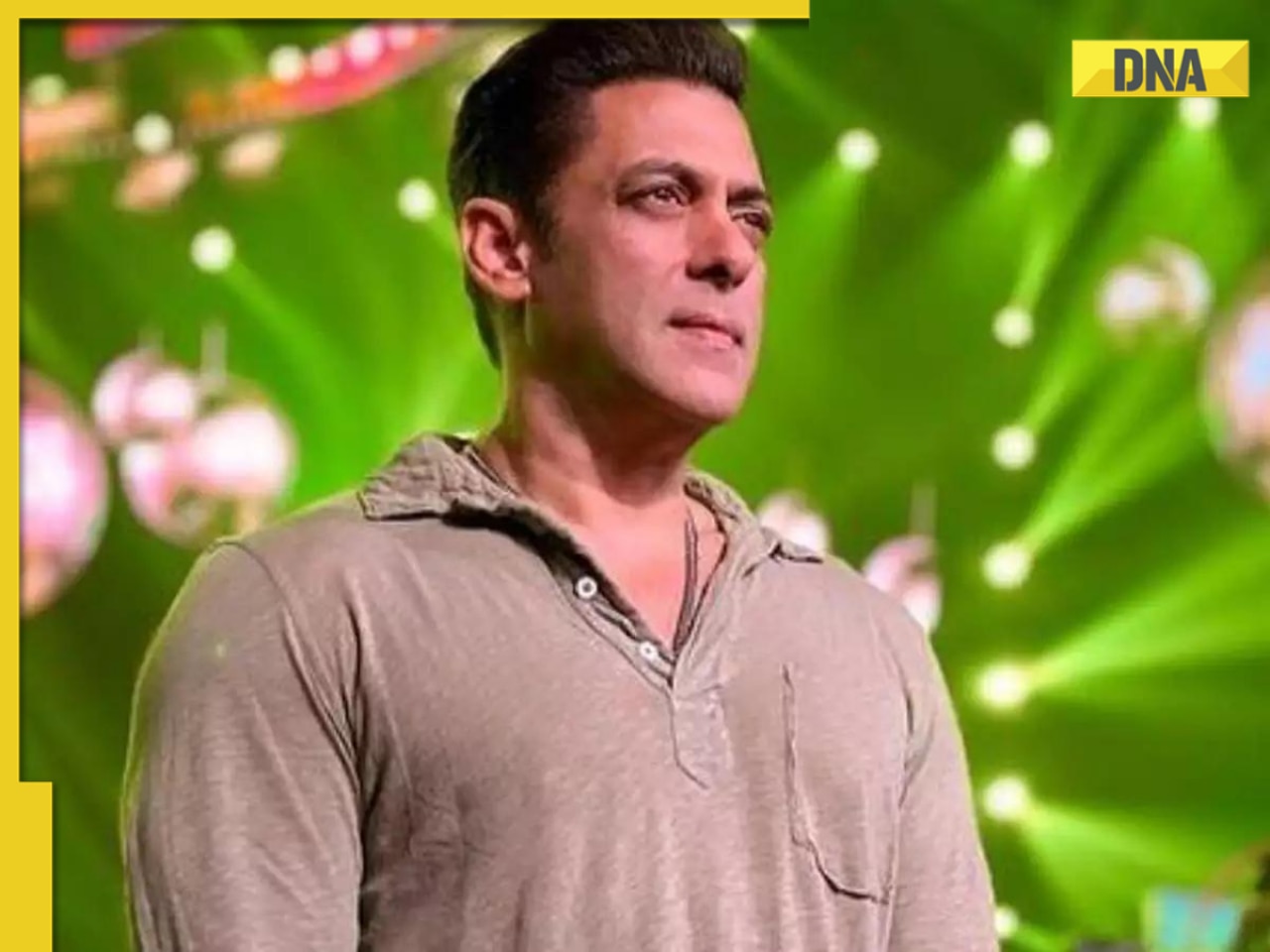

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)