Demand for the greenback from banks and importers and little support from local share market too weighed on trade.

The rupee remained under pressure against the US dollar for the third-straight day today, depreciating 7 paise to end at a fresh 3-week low of 64.59 on steady demand of the US currency amid a global oil rout.

Forex market traded with a broadly hesitant tone on growing uncertainty about global economic growth as sell-off in crude prices remained unabated, triggering volatility in financial markets.

Demand for the greenback from banks and importers and little support from local share market too weighed on trade.

This is the lowest closing for the home currency since May 30.

Meanwhile, local equities relinquished strong early gains and ended almost flat in another cautious session as traders booked profit after the benchmark Sensex hit a fresh record high during the day amid bearish global sentiment.

World stock markets too reacted to tumbling crude oil prices.

RBI Governor Urjit Patel had argued for avoiding premature policy action citing "high uncertainty" on inflation outlook while voting for status quo on interest rates at the monetary policy review earlier this month, as per the minutes of the MPC meeting.

Foreign funds continued to offload Indian equities worth Rs 152.82 crore yesterday, as per provisional data.

The rupee opened a tad weak at 64.53 per dollar from overnight close of 64.52 at the Interbank Foreign Exchange (Forex) market. Soon, it recovered to hit a fresh intra-day high of 64.45 briefly in early morning before succumbing to dollar pressure once again.

After touching a session low of 64.60 towards the fag-end trade, the local unit ended at 64.59, showing a fall of 7 paise, or 0.11 per cent.

The Indian unit has lost 16 paise in last three days.

The RBI, meanwhile, fixed the reference rate for the dollar at 64.4950 and for the euro at 72.0732.

Globally, the greenback traded marginally lower against other major currencies on Thursday despite upbeat US housing sector data as traders turned their attention to the upcoming report on jobless claims.

The dollar index, which tracks the US currency against a basket of six major rivals, was down at 97.19.

In cross-currency trades, the rupee bounced back against the pound sterling to close at 81.87 from 82.00 per pound, but dropped further against the euro to settle at 72.15 from 71.94 earlier.

The home currency also lost further ground against the Japanese Yen to finish at 58.00 per 100 yens from 57.94.

In forward market today, premium for dollar showed a steady-to-easy trend in the absence of market moving factors.

The benchmark six-month premium payable in November was quoted at 127-128 paise from 126-128 paise, while the far forward May 2018 contract edged up to 271.5-272.5 paise from 269-271 paise Thursday.

On the International commodity front, crude prices edged up on Friday, recovering some of their steep losses made during the week.

The brent crude futures were up 28 cents at USD 45.50 a barrel in early Asian trade, while US' West Texas Intermediate (WTI) crude futures traded at USD 43.04 a barrel.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

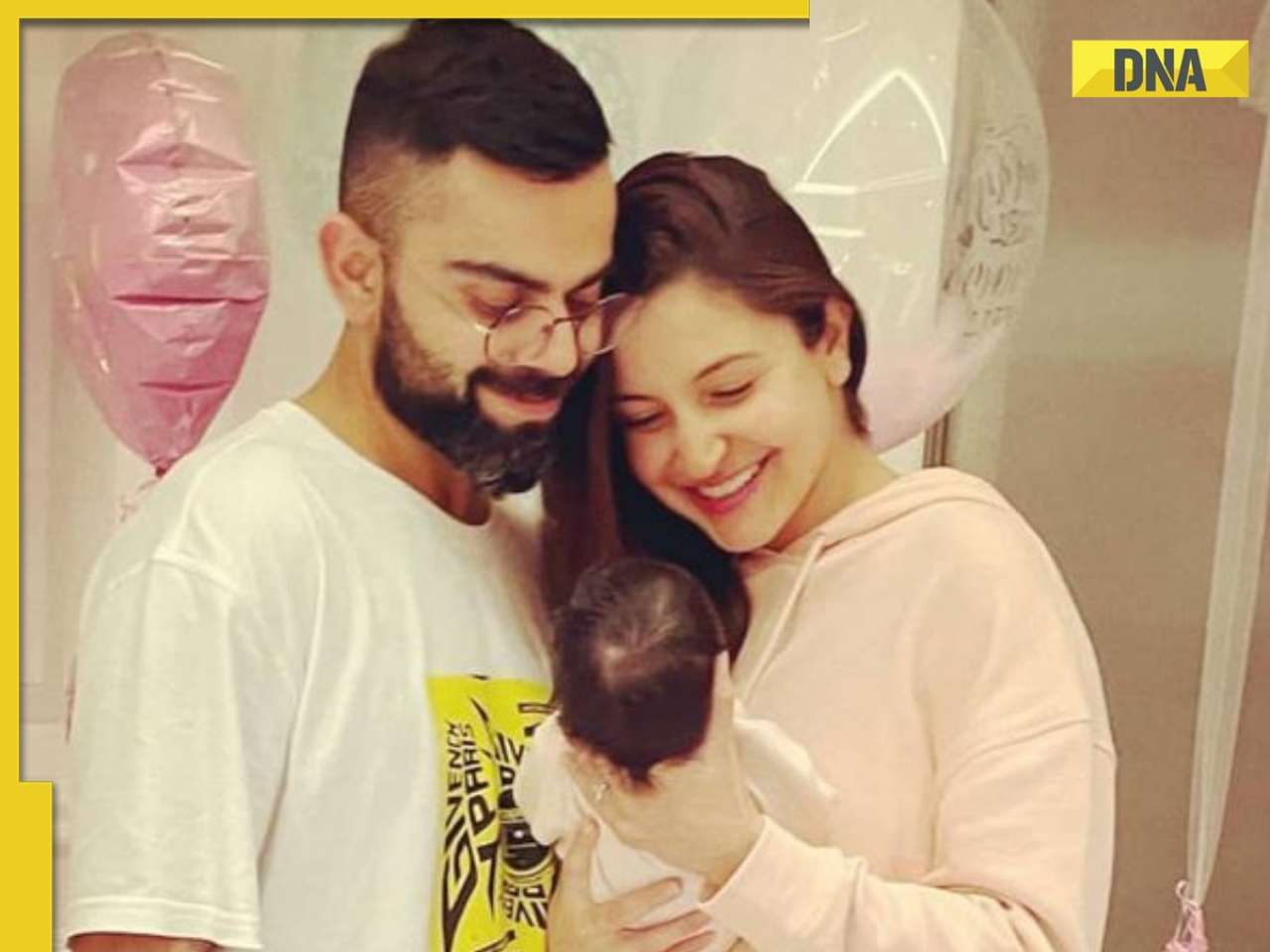

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

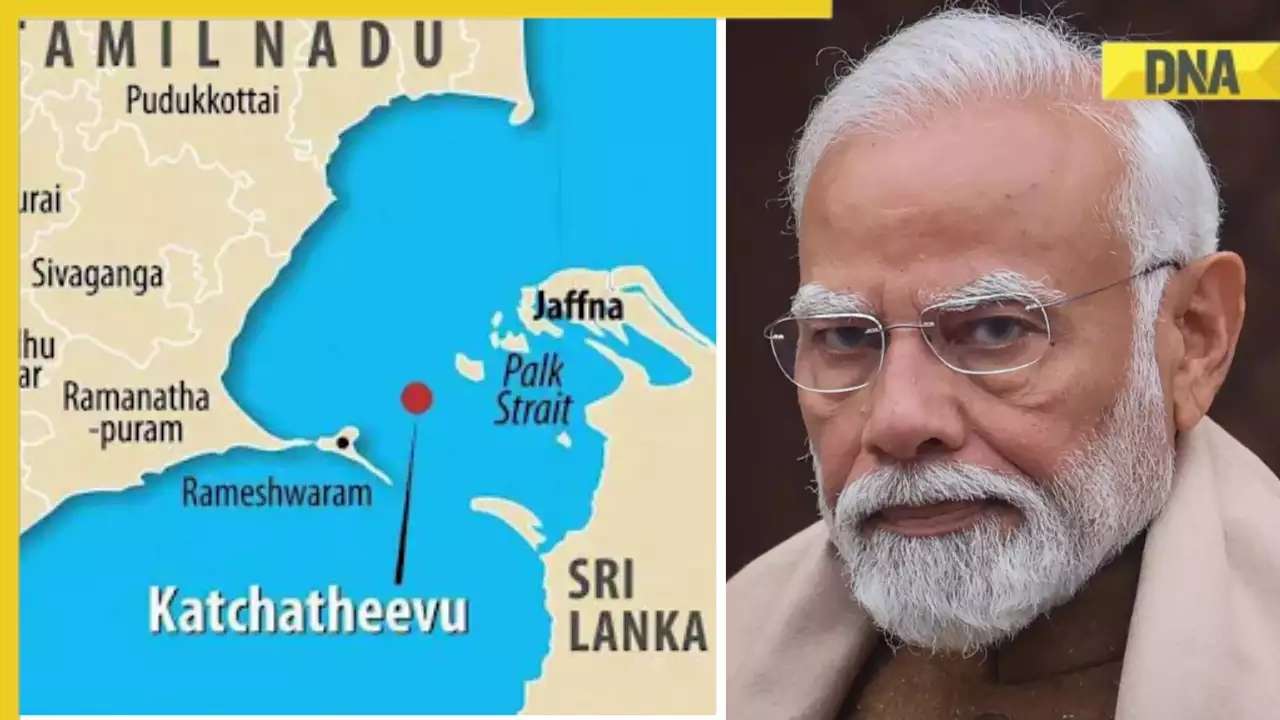

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

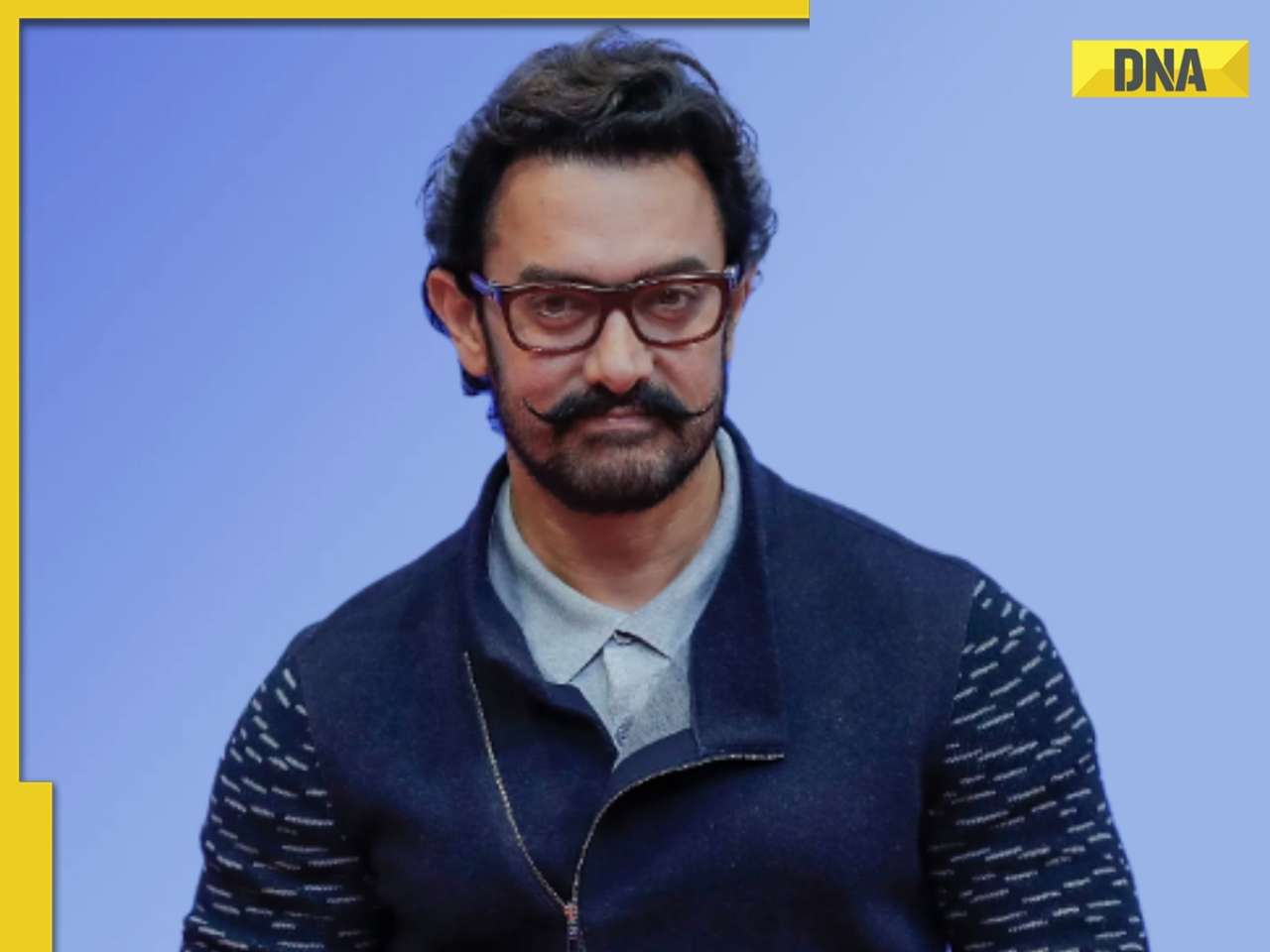

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

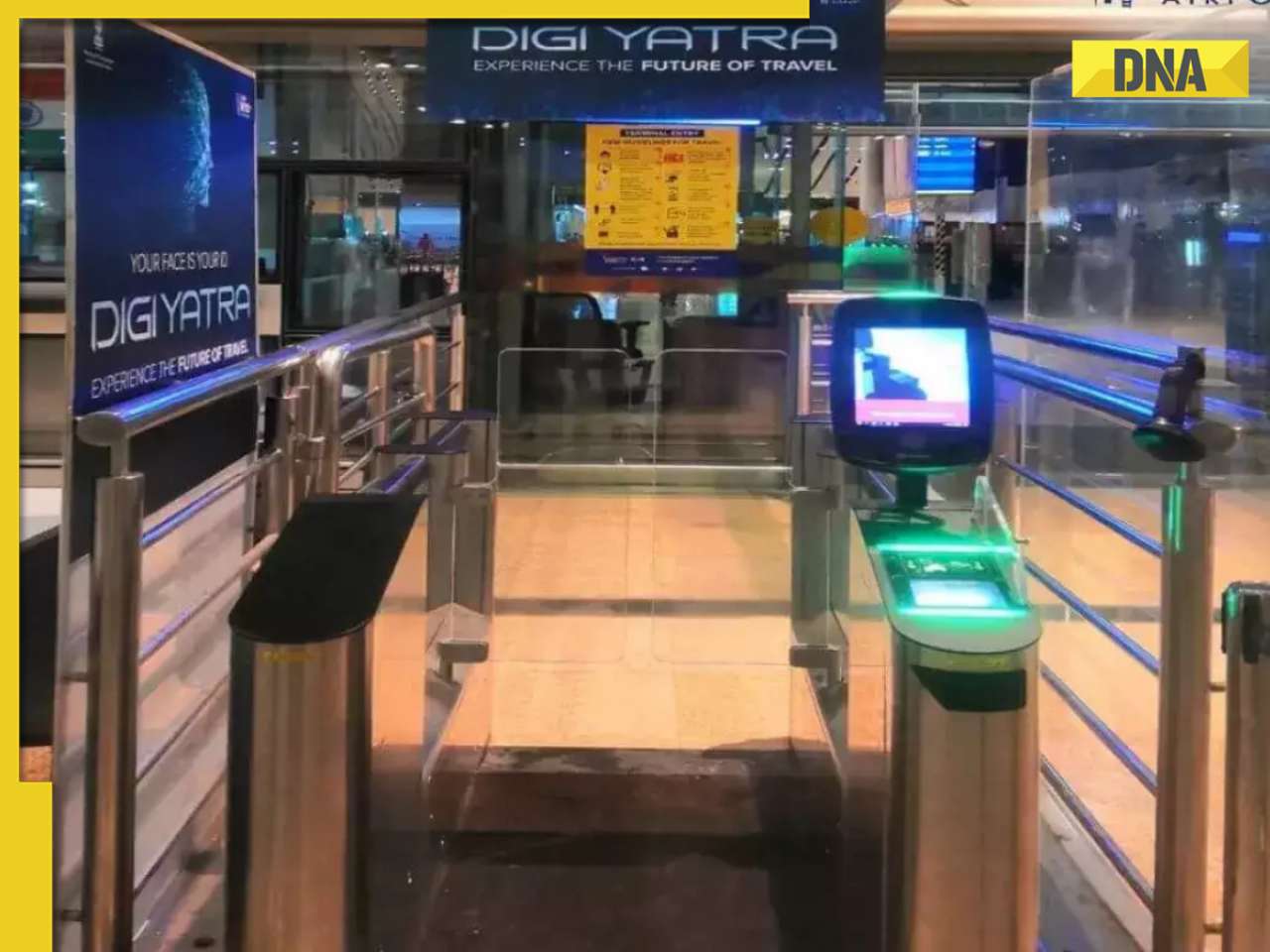

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)