HDFC Standard Life Insurance has filed draft papers with capital markets regulator Sebi to raise an estimated Rs 7,500 crore through an initial public offering.

HDFC Standard Life Insurance has filed draft papers with capital markets regulator Sebi to raise an estimated Rs 7,500 crore through an initial public offering.

The public issue comprises sale of 1,91,246,050 equity shares, amounting to 9.55 per cent stake, by HDFC Ltd and up to 1,08,581,768 scrips or 5.42 per cent holding by Standard Life Mauritius, according to the draft red herring prospectus (DRHP) filed with Sebi.

Currently, HDFC owns 61.41 per cent stake in HDFC Standard Life and Standard Life has about 35 per cent, while the remaining is with employees and PremjiInvest.

According to sources, the initial public offer (IPO) is expected to be worth Rs 7,500 crore.

This is the third insurance company to file draft IPO papers with Sebi this month. The other two are New India Assurance Company and General Insurance Corporation of India.

"The objects of the offer are to achieve the benefits of listing the equity shares on the stock exchanges.

"The listing of equity shares will enhance the 'HDFC Life' brand name and provide liquidity to the existing shareholders. The listing will also provide a public market for equity shares in India," HDFC Standard Life said.

HDFC Standard Life Insurance is a joint venture in the ratio of 61.5:35 between India 's biggest mortgage lender HDFC Ltd and UK's Standard Life.

Morgan Stanley India Company, HDFC Bank, Credit Suisse Securities (India) Pvt Ltd, CLSA India, Nomura Financial Advisory and Securities (India) Pvt Ltd are the global co- ordinators, while Edelweiss Financial Services, Haitong Securities, IDFC Bank, IIFL Holdings, UBS Securities are the book running lead managers to the issue.

Last month, HDFC Standard Life had announced its plan to list its shares through an IPO and put on hold its proposed merger with Max Life in the absence of regulatory approval.

The board of HDFC Standard Life on July 17 approved an enabling resolution for an IPO by way of offer for sale by HDFC and Standard Life in the ratio as mutually agreed amongst them up to a maximum of 20 per cent of the paid up capital.

Last month, ICICI Lombard General Insurance Company and SBI Life Insurance Company had approached Sebi to launch their respective initial public offers.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

![submenu-img]() Meet IIT graduate who designed EVM, worked with Microsoft and Google, he works as…

Meet IIT graduate who designed EVM, worked with Microsoft and Google, he works as…![submenu-img]() Tata Motors planning Rs 8360 crore plant to make luxury cars in India, to set up…

Tata Motors planning Rs 8360 crore plant to make luxury cars in India, to set up…![submenu-img]() Meet man who has bought most expensive property on Bengaluru's 'Billionaire Street', Sudha Murty also...

Meet man who has bought most expensive property on Bengaluru's 'Billionaire Street', Sudha Murty also...![submenu-img]() Israel-Iran news live: Israel conducts air strike in Iran in retaliation to missile attack, says report

Israel-Iran news live: Israel conducts air strike in Iran in retaliation to missile attack, says report![submenu-img]() Neeru Bajwa says Punjabi film industry lacks professionalism: ‘We are not going anywhere until…’

Neeru Bajwa says Punjabi film industry lacks professionalism: ‘We are not going anywhere until…’![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..

Remember Sana Saeed? SRK's daughter in Kuch Kuch Hota Hai, here's how she looks after 26 years, she's dating..![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() Neeru Bajwa says Punjabi film industry lacks professionalism: ‘We are not going anywhere until…’

Neeru Bajwa says Punjabi film industry lacks professionalism: ‘We are not going anywhere until…’![submenu-img]() Meet actress who married a CM against her family's wishes, became his second wife, her net worth is..

Meet actress who married a CM against her family's wishes, became his second wife, her net worth is..![submenu-img]() Meet India's richest actress, who started career with two flops, was removed from multiple films, is now worth...

Meet India's richest actress, who started career with two flops, was removed from multiple films, is now worth...![submenu-img]() Meet hit director's niece, who was bullied for 15 years, Bollywood debut flopped, will now star in Rs 200 crore project

Meet hit director's niece, who was bullied for 15 years, Bollywood debut flopped, will now star in Rs 200 crore project![submenu-img]() Abhilash Thapliyal discusses Maidaan, reveals he lost chance to play PK Banerjee in Ajay Devgn's film for this reason

Abhilash Thapliyal discusses Maidaan, reveals he lost chance to play PK Banerjee in Ajay Devgn's film for this reason![submenu-img]() IPL 2024: Ashutosh Sharma's heroics in vain as Mumbai Indians return to winning ways with 9-run victory over PBKS

IPL 2024: Ashutosh Sharma's heroics in vain as Mumbai Indians return to winning ways with 9-run victory over PBKS![submenu-img]() LSG vs CSK, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs CSK, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Chennai Super Kings

LSG vs CSK IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Chennai Super Kings![submenu-img]() PBKS vs MI IPL 2024: Rohit Sharma equals MS Dhoni's massive record, becomes 2nd player to....

PBKS vs MI IPL 2024: Rohit Sharma equals MS Dhoni's massive record, becomes 2nd player to....![submenu-img]() Major setback for CSK as star player ruled out of IPL 2024, replacement announced

Major setback for CSK as star player ruled out of IPL 2024, replacement announced![submenu-img]() Canada's biggest heist: Two Indian-origin men among six arrested for Rs 1300 crore cash, gold theft

Canada's biggest heist: Two Indian-origin men among six arrested for Rs 1300 crore cash, gold theft![submenu-img]() Donuru Ananya Reddy, who secured AIR 3 in UPSC CSE 2023, calls Virat Kohli her inspiration, says…

Donuru Ananya Reddy, who secured AIR 3 in UPSC CSE 2023, calls Virat Kohli her inspiration, says…![submenu-img]() Nestle getting children addicted to sugar, Cerelac contains 3 grams of sugar per serving in India but not in…

Nestle getting children addicted to sugar, Cerelac contains 3 grams of sugar per serving in India but not in…![submenu-img]() Viral video: Woman enters crowded Delhi bus wearing bikini, makes obscene gesture at passenger, watch

Viral video: Woman enters crowded Delhi bus wearing bikini, makes obscene gesture at passenger, watch![submenu-img]() This Swiss Alps wedding outshine Mukesh Ambani's son Anant Ambani's Jamnagar pre-wedding gala

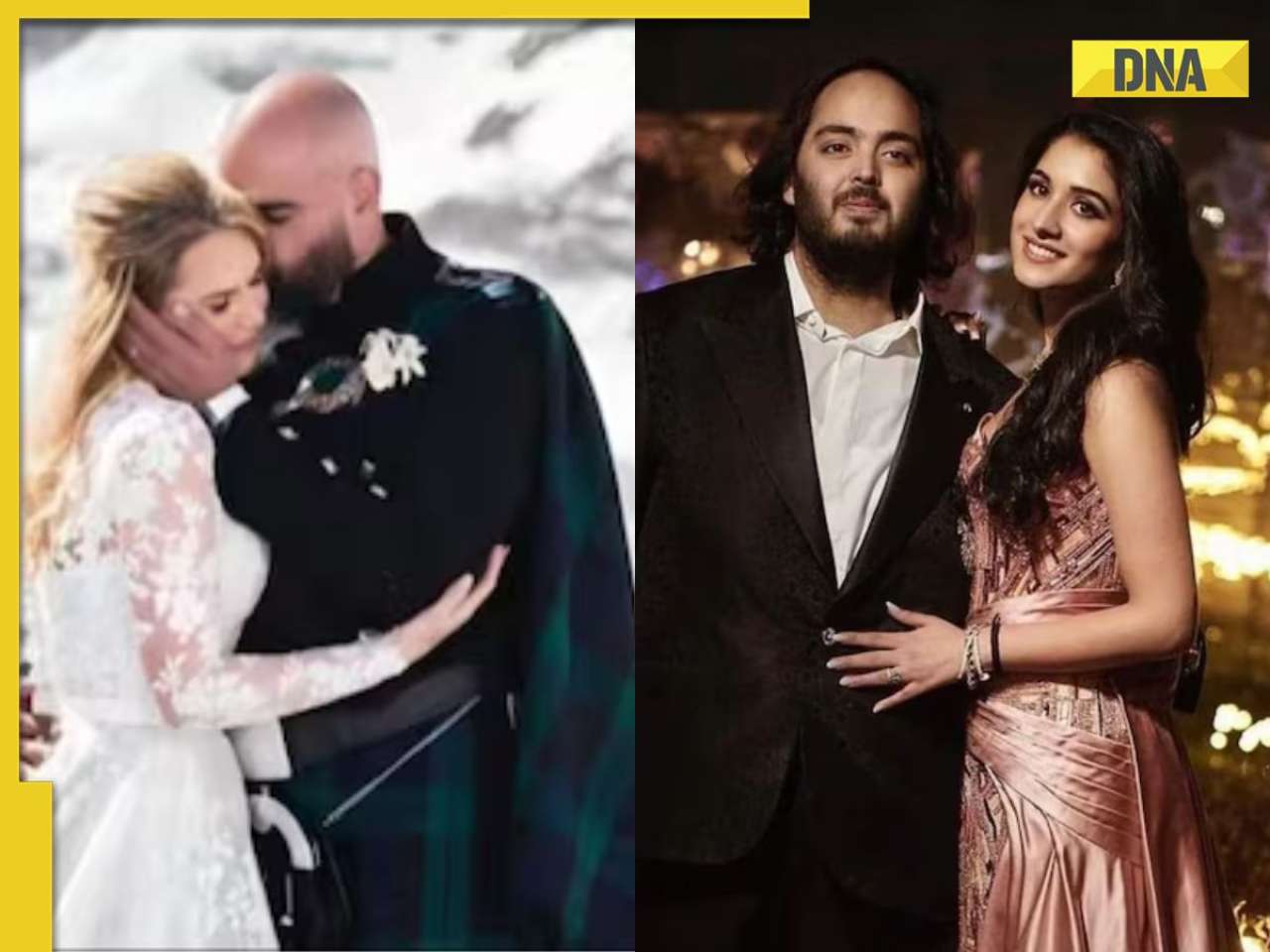

This Swiss Alps wedding outshine Mukesh Ambani's son Anant Ambani's Jamnagar pre-wedding gala

)

)

)

)

)

)