The dollar and U. S. Treasury yields rose on expectations the Fed will signal its readiness to begin reducing its bond portfolio at its September meeting.

The dollar held above a 13-month low on Tuesday after readings on U.S. factory and services activity beat expectations ahead of the start of a Federal Reserve meeting later in the day, but Asian stocks were subdued with few catalysts to drive them.

The dollar and U.S. Treasury yields rose on expectations the Fed will signal its readiness to begin reducing its bond portfolio at its September meeting.

The dollar index, which tracks the greenback against a basket of six major peers, was steady at 93.951 on Tuesday, up from Monday's low of 93.823, its lowest level since June 2016.

The dollar was little changed at 111.065 yen on Tuesday, after touching a six-week low on Monday.

The 10-year U.S. Treasury yield was at 2.2499 percent on Tuesday, not far from Monday's close of 2.253 percent and above Friday's three-week low of 2.225 percent.

On Monday, Markit's U.S. manufacturing and services flash surveys both beat expectations, while euro zone business growth at the start of the second half of the year slowed.

The euro, which posted losses on Monday after earlier hitting a near two-year high, inched up 0.1 percent to$1.1653.

"As Europe's business surveys continue to outperform those of the U.S., last night was a minor victory at best for the greenback," said Matt Simpson, senior market analyst at ThinkMarkets in Melbourne. "The expectation of a slightly dovish Fed and a White House seemingly in turmoil is likely to weigh further on the greenback for the foreseeable future."

Jared Kushner, President Donald Trump's son-in-law and senior advisor, told Senate investigators on Monday he had met with Russian officials four times last year but said he did not collude with Moscow to influence the 2016 U.S. election.

The ongoing probes into Russia's meddling in the election by congressional panels and a Justice Department special counsel, as well as weak U.S. economic data and reduced inflation expectations, have weighed on the dollar for much of the month.

In stocks, MSCI's broadest index of Asia-Pacific shares outside Japan edged up less than 0.1 percent, with some markets looking for fresh impetus after hitting multi-year highs in recent weeks and few drivers in the region to guide them.

"Limited moves within global markets may leave Asian markets to chart their own course in the day," said Jingyi Pan, market strategist at IG in Singapore. "It would be no surprise to see markets holding once again for key items into the latter half of the week."

Australian stocks jumped 0.8 percent, clawing back all of Monday's 0.6 percent loss. But Japan's Nikkei slipped 0.1 percent, and South Korea's KOSPI retreated 0.2 percent.

Chinese shares also fell, with the bluechip CSI 300 index down 0.3 percent and the Shanghai Composite dropping 0.1 percent. Hong Kong's Hang Seng slightly advanced.

Overnight on Wall Street, the Nasdaq set a record high as investors bet on solid earnings from technology companies. But the S&P 500 and the Dow closed in negative territory, following European stocks, which lost 0.2 percent.

In commodities, oil prices extended their recovery on a pledge by leading OPEC producer Saudi Arabia to cut exports in August to help reduce the global crude glut. Haliburton Co's executive chairman also said the U.S. shale drilling boom would probably ease next year.

U.S. crude jumped 0.6 percent to $46.63 a barrel, after closing up 1.25 percent on Monday.

Global benchmark Brent added 0.6 percent to $48.90, extending Monday's 1.1 percent rise.

The marginally stronger dollar kept gold's gains in check , with the precious metal pulling back slightly to $1,254.96 an ounce.

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

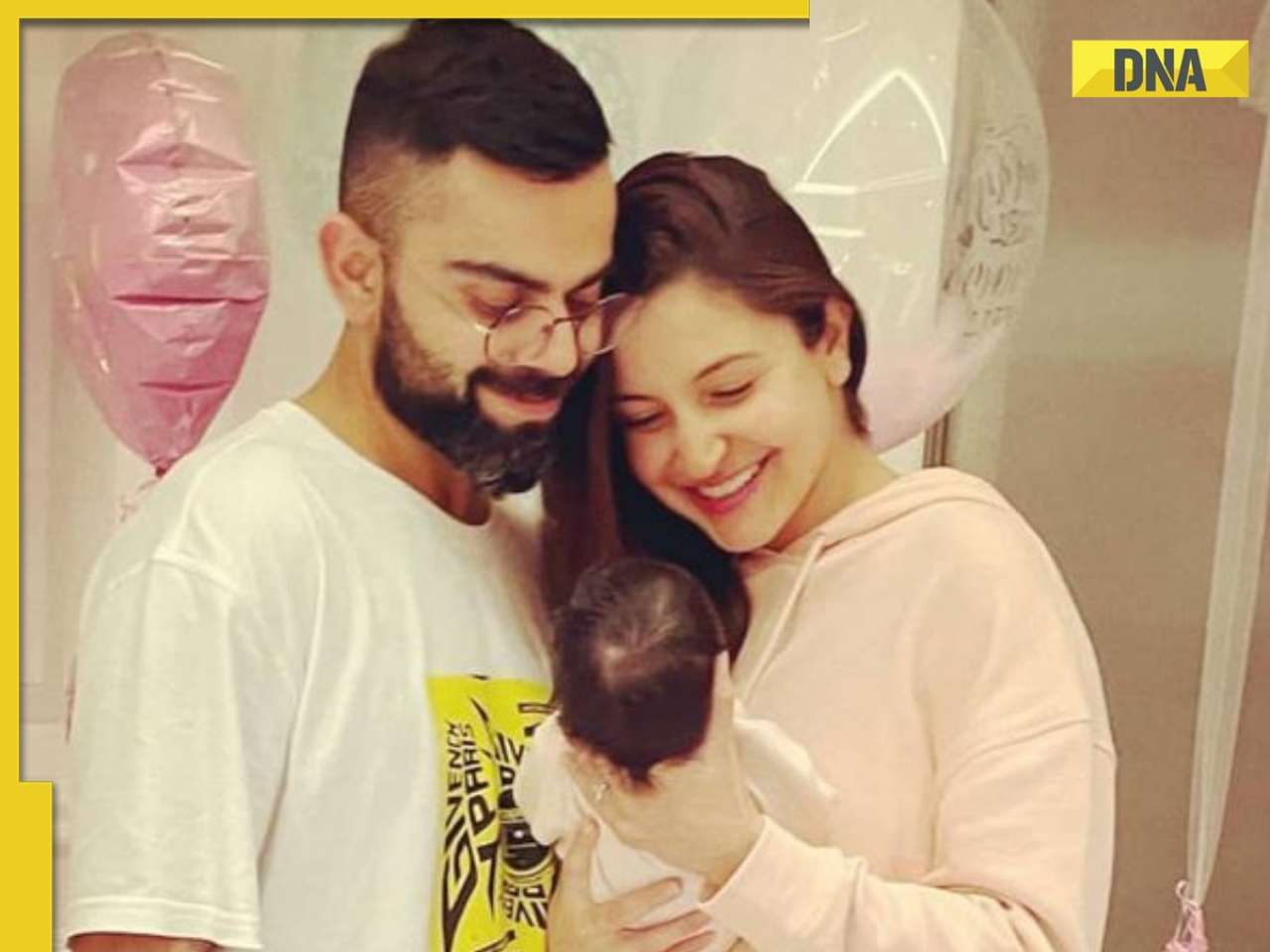

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

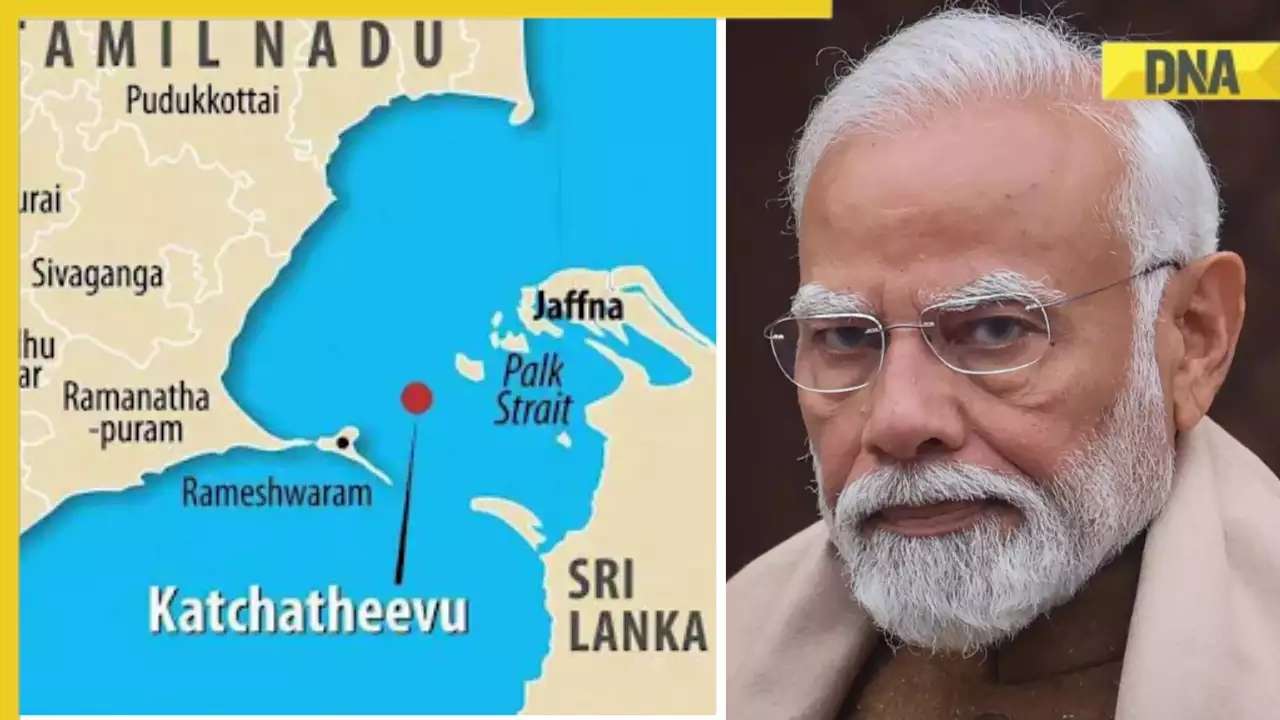

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

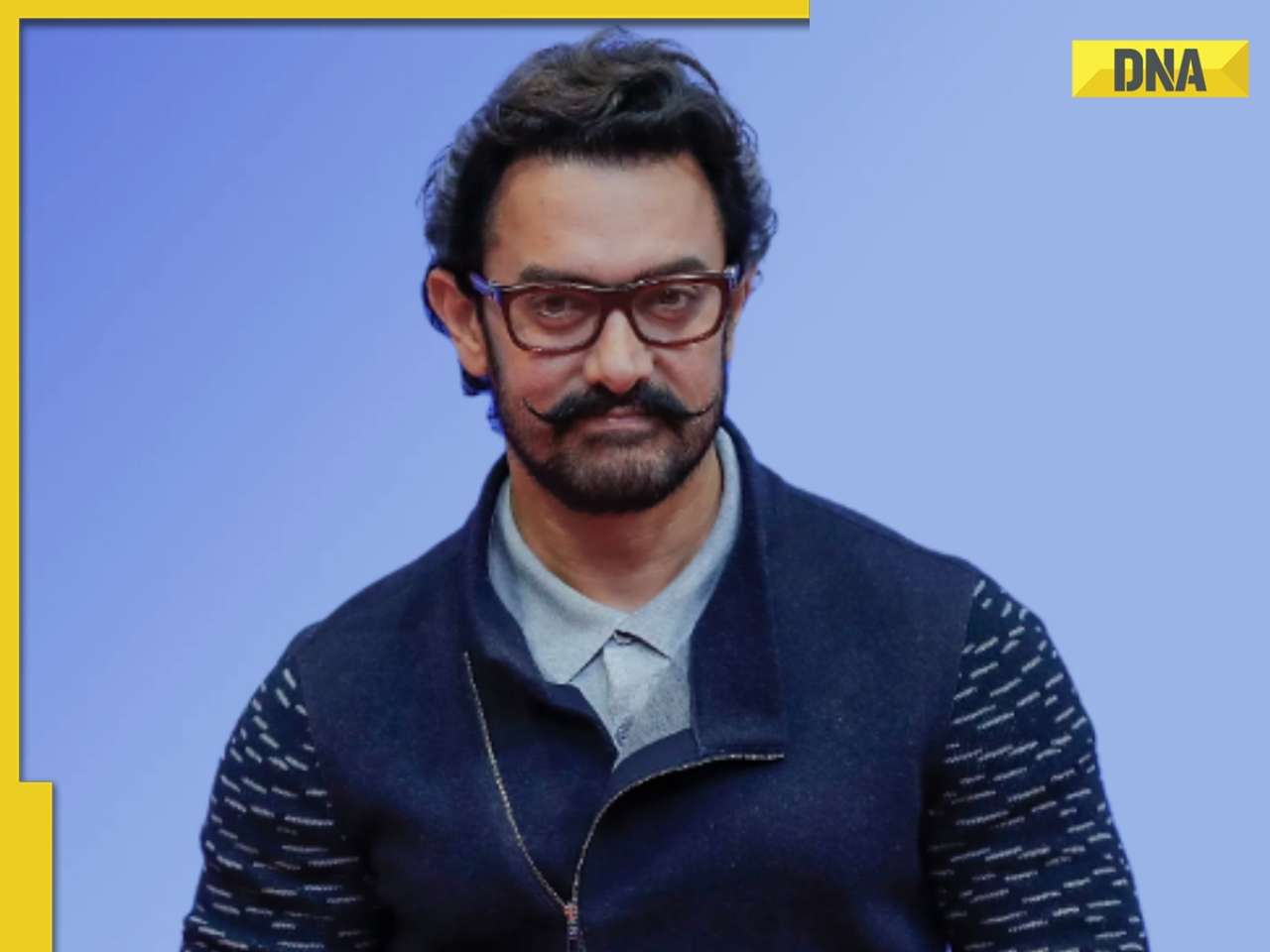

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

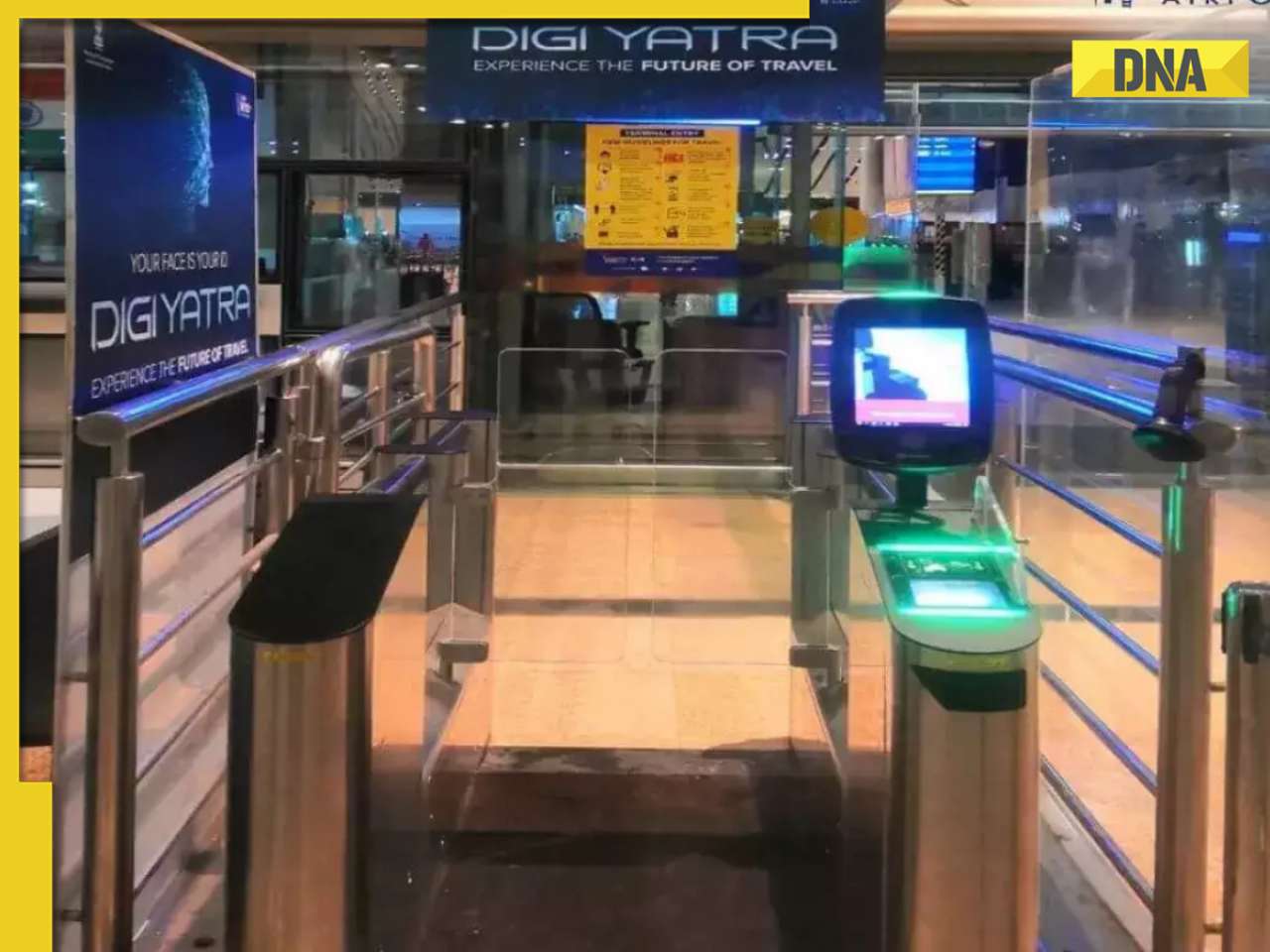

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)