Concerned over weak industrial performance and slack in domestic private sector investments, India Inc is pitching for a rate cut and deeper reforms.

Concerned over weak industrial performance and slack in domestic private sector investments, India Inc is pitching for a rate cut and deeper reforms.

"Given that the industrial performance remains weak and private investments have not picked up, the moderating trend in prices opens up space for a more accommodative stance in the monetary policy,'' Federation of Indian Chambers of Commerce and Industry (Ficci) said in its internal report.

The report, which was discussed at the industry chamber's national council meeting here today, said though the Reserve Bank of India cut the repo rate by 25 bps earlier this month, a steeper cut is needed at this juncture.

While it sees the impact of GST waning over the next few months, the industry chamber said persisting volatility in the manufacturing sector is a matter of concern and calls for deeper reforms, especially at the state level.

A turnaround in domestic private investment is critical to push growth and employment generation in the economy, it said.

It said that economic growth has taken a beating mainly on account of weak manufacturing growth while the introduction of GST led most firms to undertake de-stocking, halting fresh manufacturing of goods. As the initial impact of the GST smoothens out, economic growth is likely to return to a trajectory of around 7%, it said.

The manufacturing sector, which has a total weight of 77.6% in the index of industrial production, contracted 0.4% in June, entering the contractionary zone after 32 months. Major manufacturing items such as chemicals, coke and refined petroleum products, textiles, food products, electrical equipment and machinery and equipment reported contraction during the month, it said.

"The latest round of Ficci's business confidence survey reports a muted sentiment and corroborates with the situation at ground level. The expectation of respondents with regard to operational parameters such as profits, sales, and investments indicate that a turnaround is yet to find a solid base. The companies continue to operate at suboptimal capacities and the capacity utilisation rates have not seen improvement for some time now,'' the report said.

Further, the latest survey results also report a strain in demand conditions, it said, adding around 73% of the respondents cited weak demand to be a constraining factor for businesses as against 59% in the previous round.

It said rural demand was expected to pick up, backed by a good monsoon and expectations of robust food production. Also, the upcoming festive season will provide some thrust to consumption activity.

On the fiscal position, Ficci said the government seems confident of meeting its fiscal deficit target of 3.2% of GDP for the current fiscal. The government is optimistic about higher revenue generation from tax and non-tax sources, such as disinvestment receipts in the latter part of the year.

Moreover, the GST collection of Rs 92,283 crore in July indicates an increase in the tax base as GST brings in greater efficiency and makes it more difficult to evade taxes. Some businesses are yet to claim their input credit for pre-GST stock which may impact overall collection to the government. However, revenues greater than the targeted number in the first month of GST itself injects optimism about future earnings, it said.

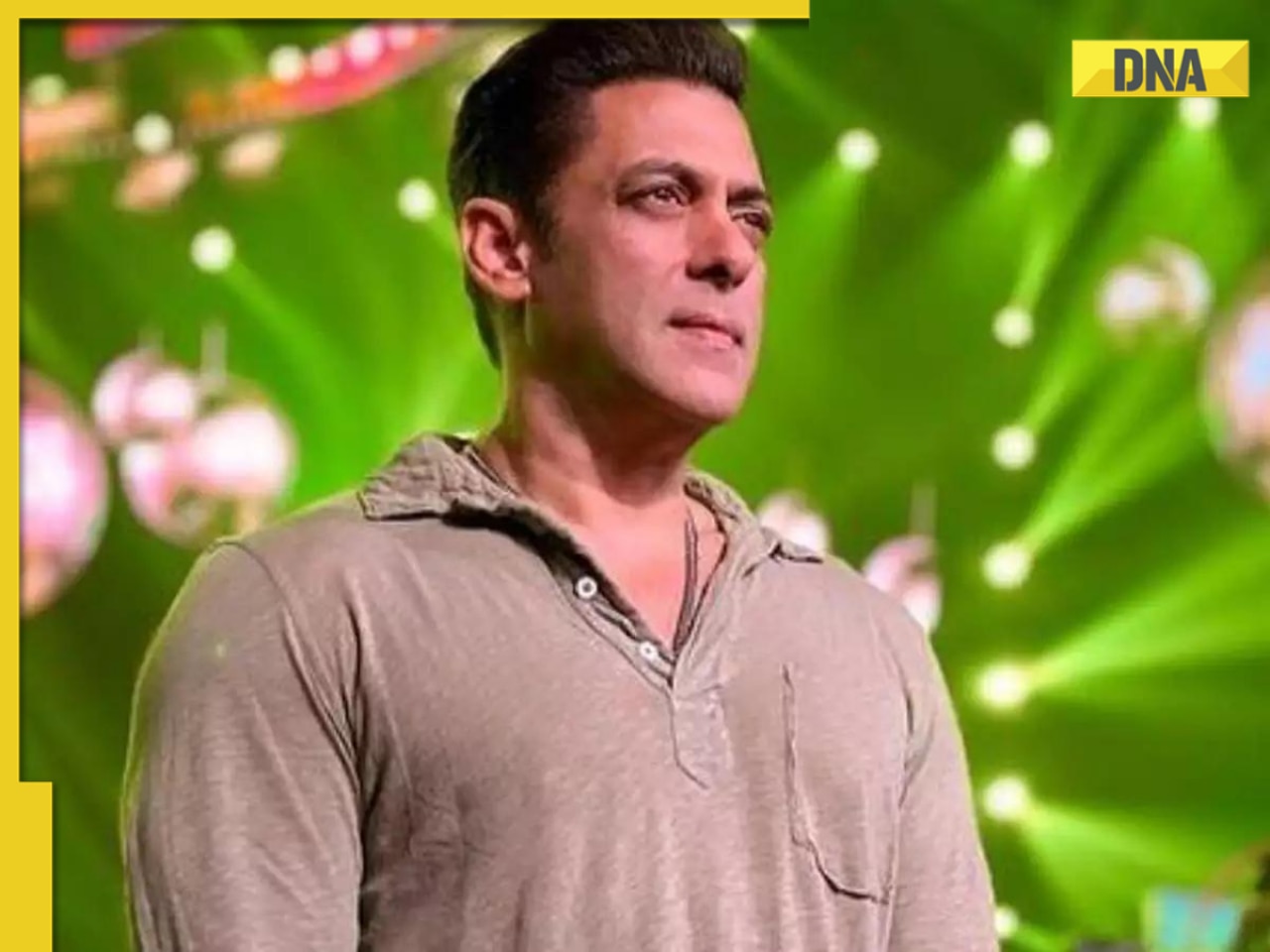

![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() Vellore Lok Sabha constituency: Check polling date, candidates list, past election results

Vellore Lok Sabha constituency: Check polling date, candidates list, past election results![submenu-img]() Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...

Meet NEET-UG topper who didn't take admission in AIIMS Delhi despite scoring AIR 1 due to...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now

Remember Tanvi Hegde? Son Pari's Fruity who has worked with Shahid Kapoor, here's how gorgeous she looks now![submenu-img]() Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now

Remember Kinshuk Vaidya? Shaka Laka Boom Boom star, who worked with Ajay Devgn; here’s how dashing he looks now![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur

DNA Explainer: Reason behind caused sudden storm in West Bengal, Assam, Manipur![submenu-img]() Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins

Firing at Salman Khan's house: Shooter identified as Gurugram criminal 'involved in multiple killings', probe begins![submenu-img]() Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'

Salim Khan breaks silence after firing outside Salman Khan's Mumbai house: 'They want...'![submenu-img]() India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat

India's first TV serial had 5 crore viewers; higher TRP than Naagin, Bigg Boss combined; it's not Ramayan, Mahabharat![submenu-img]() This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3

This film has earned Rs 1000 crore before release, beaten Animal, Pathaan, Gadar 2 already; not Kalki 2898 AD, Singham 3![submenu-img]() This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit

This Bollywood star was intimated by co-stars, abused by director, worked as AC mechanic, later gave Rs 2000-crore hit![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad

RCB vs SRH IPL 2024 Dream11 prediction: Fantasy cricket tips for Royal Challengers Bengaluru vs Sunrisers Hyderabad ![submenu-img]() IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants

IPL 2024: Phil Salt, Mitchell Starc power Kolkata Knight Riders to 8-wicket win over Lucknow Super Giants![submenu-img]() IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?

IPL 2024: Why are Lucknow Super Giants wearing green and maroon jersey against Kolkata Knight Riders at Eden Gardens?![submenu-img]() IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS

IPL 2024: Shimron Hetmyer, Yashasvi Jaiswal power RR to 3 wicket win over PBKS![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)

)