Outside the commercial value, the deal will also signal the strengthening of a bond between the two political leaders of Russia and India

The acquisition of Essar Oil by Russian oil major Rosneft and Trafigura-UCP combine is more than a commercial deal between the two companies.

Essar Oil's refinery and the oil terminal at Vadinar in Gujarat will give Russia's state-owned major a strategic place in the Asian oil market which is expanding rapidly, strengthening President Vladamir Putin's foreign policy influence by controlling crucial oil assets.

The deal, signed when Putin came to Goa for the Brics Summit last year, was not just an agreement between the two companies. It has heavy political overtones that are hard to miss.

Despite the Intelligence Bureau flagging off concerns of Russian port being close to the military installations in India and being in proximity to the India-Pak border did not deter the Indian government.

For long, Russia had dreams of selling oil to the Indian sub-continent, a market captured by the gulf producers. This deal has brought in that elusive market that is highly price-sensitive, where demand is far from being saturated.

Rosneft's chief executive officer Igor Sechin said after the deal was concluded on Monday, "The global hydrocarbon market conditions remain unstable with high crude oil and oil product pricing volatility. In such conditions, the company keeps focusing on further operating efficiency improvement, including on the maximisation of the existing assets synergy on the domestic and international markets."

The Vadinar refinery creates unique opportunities for synergies with existing Rosneft-owned assets and will help improve the efficiency of supply to other countries within the region, he added.

Rosneft, headquartered in Moscow's Balchug district near the Kremlin, across the river Moskva, is readying itself to enter India both in the upstream and downstream segments of the business. It will have to face the tough competition from the state-owned Indian Oil Corporation (IOC), which has an installed capacity of 81 million tonne per annum. IOC also owns 11 of the 23 refineries in the country and the largest number of retail outlets - over 32,000 across the country. The state-owned public sector undertakings -- IOC, BPCL and ONGC (which is merging with HPCL) will jointly control more than 90% of the retail outlets with private players having the rest.

In comparison, the Vadinar refinery has a capacity of 20 million tonne per annum. The largest private player in the country, Reliance Industries Ltd (RIL) operates the world's biggest oil refinery complex in Jamnagar with a capacity of 1.24 million barrels per day. On its part, Rosneft wants to double its retail outlet network immediately from the existing 3,000 outlets that it inherits from the deal.

"The Russian-owned Rosneft, which gets to own a refinery with a capacity to produce 40,000 barrels of oil a day, also gets to own a deep-water port in a region fast becoming central to Russia's foreign policy outlook as well," Nick Trickett wrote in the Bear Market Blog of the Foreign Policy Institute.

Rosneft, Russian's biggest tax payer, is getting a critical access into the growing Asian market, particularly to the downstream oil industry, which is expected to grow exponentially.

But having more players, hotting up competition is the need for India where import dependency on crude is rising as the switch to non-renewable energy is taking longer than expected.

An India Ratings report said crude oil production grew 83.8% during May 2017 aided by higher production by ONGC and Oil India Ltd. Notwithstanding higher domestic crude oil production, import of crude also grew during the period on account of higher domestic consumption, which rose 6% over the previous month and grew by 5.3% over the previous year resulting in higher import dependency for crude oil which was 83.8% of imports in May 2017.

ENERGY TIES

- For long, Russia had dreams of selling oil to the Indian sub-continent

- This deal gives it entry in a highly price-sensitive market

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

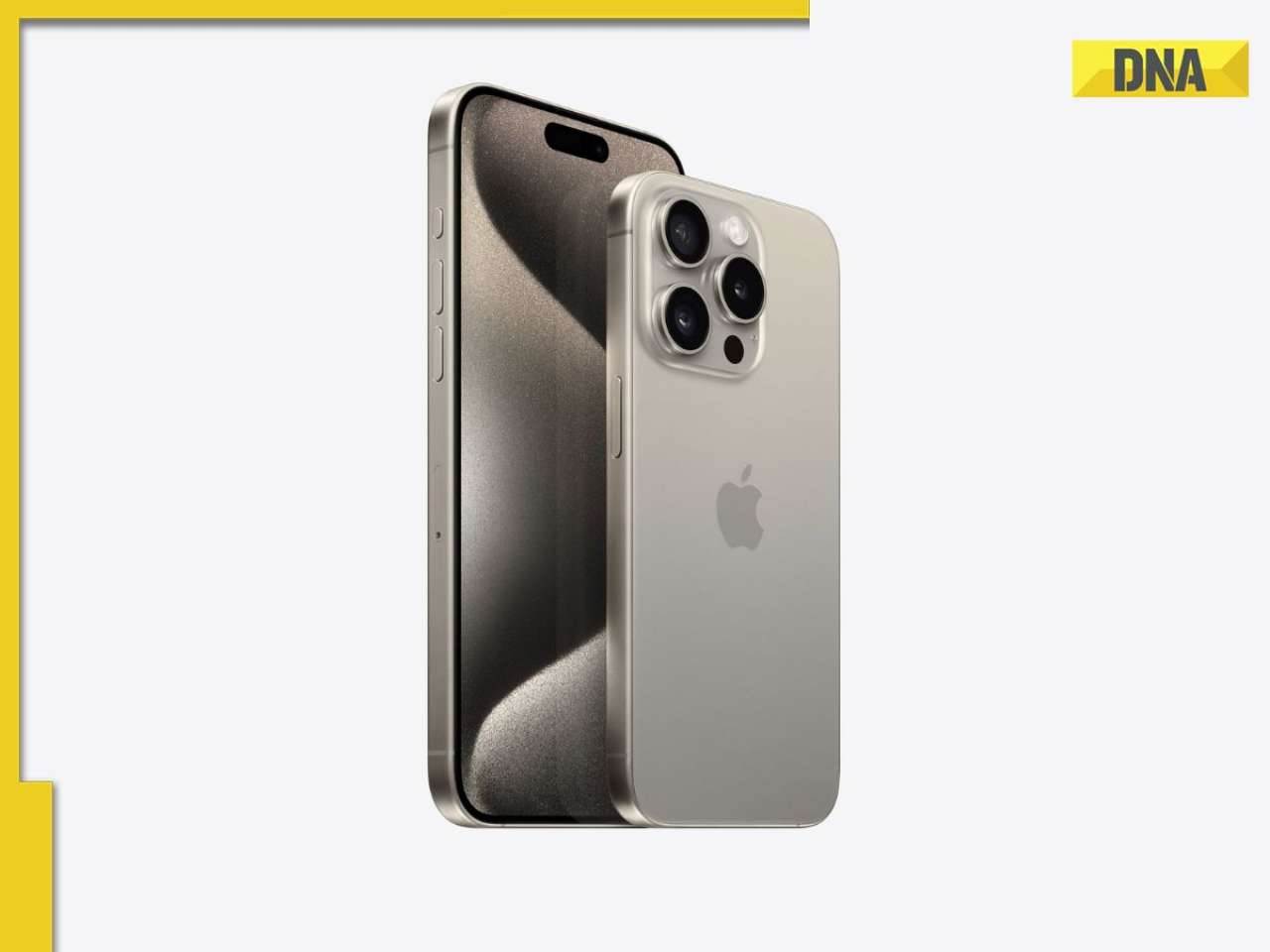

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)