Budget 2018 presents an opportunity for the government to unleash significant investment potential in the power sector

The government's initiatives aiming to deliver '24X7 power for all' and promote renewables as the future source of energy have led to calibrated reforms in the power sector in the past two to three years. The targeted 175 gigawatt (gw) renewables capacity by 2022 has had a decent onset with cumulative renewables capacity at around 60 gw. There is a need to accelerate the pace of new capacity addition over next five years or so to get even closer to the targeted capacity. Yet, the potential of renewables sector remains far from fully unleashed.

The investment drive towards clean energy projects arguably has witnessed intermittent setbacks, largely self-inflicted, owing to financing challenges and nosediving tariffs for solar and wind projects. Evolving tax policies have pushed the sector to the receiving end too. Sunset on tax holidays and limitation on tax deductibility of borrowing costs led to financing woes; GST transition has added to the overall cost of constructing solar and wind projects. Recurrent flip-flops on levy of anti-dumping duty and customs classification of panels have not helped the cause of investors either.

Yet the industry believes these are temporary hiccups. It is in this backdrop, the developers and investors will look up to the Budget to redeem legacy tax issues and for the power sector to be conferred a special infrastructure status through a more conducive regulatory and tax framework which encourages rapid capacity addition, including in newer areas of sustainability and energy efficiency.

From tax wishlist standpoint, an across-the-board reduction in the corporate tax rate, grant of investment-linked tax deduction and rationalisation of the minimum alternate tax (MAT) continue to be the two key asks of the power sector, both in the context of generation and distribution and transmission projects.

End of income-linked tax holiday with effect from April 2017 has impacted significant pipeline of capex investments. MAT liability (of 20% on book profits) materially neutralises the economic benefit of accelerated tax depreciation for special purpose vehicles. Further, introduction of weighted tax deduction for expenditures incurred on energy-efficient and emission reduction technologies could help catalyse large capex in cleaner technologies.

Limitation on tax-deductibility of interest cost introduced vide Finance Act 2017 as a measure to curb tax base erosion and profit-shifting, has hit the capital-intensive infrastructure (including power projects) the most. Given the highly-leveraged nature of capex, a '30%-of-Ebitda' rule for interest deductibility invariably causes material increase in overall cost of capital, and in some cases, renders investments economically unviable. It is imperative that for capital-intensive infrastructure projects, Ebitda-based interest disallowance is either withdrawn or rationalised.

GST levy on procurements for power projects perpetrates the inverted duty/ tax structure for the power sector, especially since generation/distribution of electricity is yet not subsumed in the GST fold. It is critical to redeem the added cost of constructing and operating such assets, by either exempting or zero-rating of all procurements for setting up and operation of renewable energy projects. To further promote solar roof tops, installation under EPC contract should be classified as 'solar power generating system' liable to GST at 5%. Exempting renewable energy certificates (RECs) from GST levy would also yield attractive, albeit marginal, incentive for developers. Besides, a policy guidance on consistent policy framing by states and measures to minimise payment defaults by utilities could relieve the overall stress of the renewables industry at large.

Overall, Budget 2018 presents an opportunity for the government to unleash significant investment potential in the power sector. Tweaking of tax rules to incentivise large capex could be one big step forward in this endeavour.

Sumit Singhania - Partner, Deloitte India

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

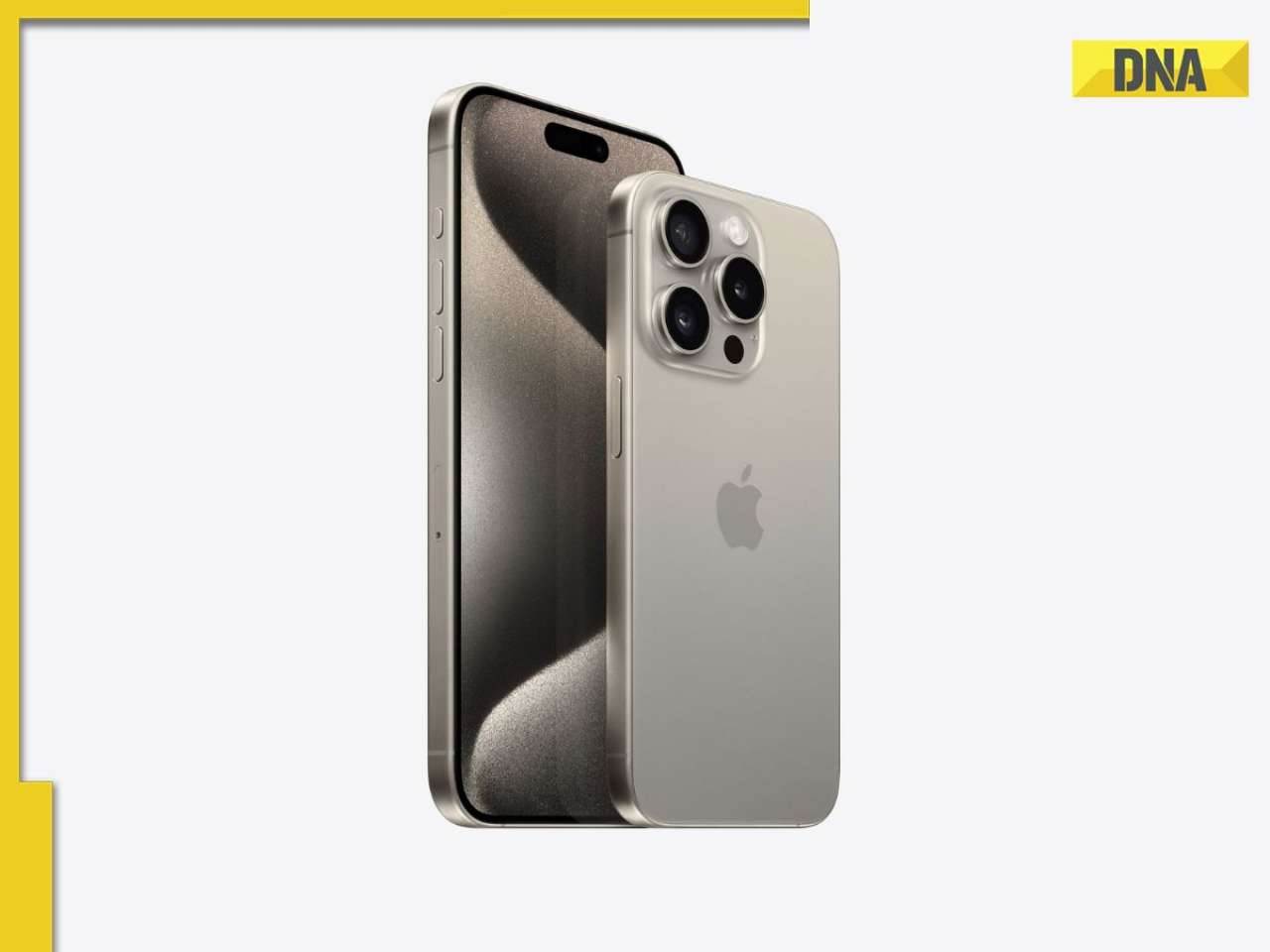

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)