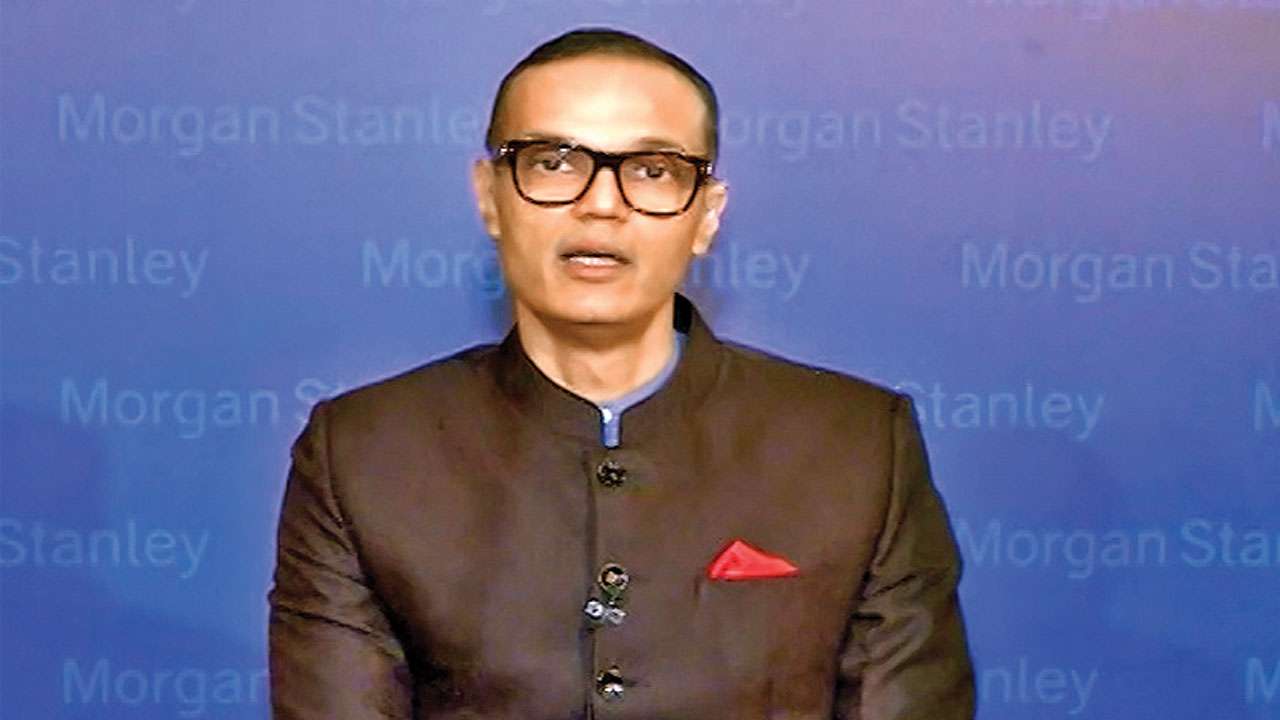

Ridham Desai, managing director, Morgan Stanley India, says India’s relative position in the world due to the global slowdown is attracting global investors. In an interview with Anil Singhvi, Desai said the US strategists of Morgan Stanley fear that the US may enter into the grip of recession if the trade tensions are not sorted out during the G20 meet.

There are different reasons. The first is India’s relative position in the world because global growth is slowing down. There is a slowdown, but India is growing, and it seems it will continue to grow in the future too. So the relative difference in growth is favouring us. The second thing is that in the last two-three years foreign investors were pulling out money from the market. By the end of last year, their position reached the lowest in the last 7-8 years. But now they feel that if India’s relative growth in moving in a positive direction, then it is time to bring back the money. The third thing is that the same government that has governed the country for the last five years has returned to power. This means that they are not supposed to learn anything new and are aware of the problems of the economy. A new government would have invested a few months learning about the problem areas and finding the rights and wrongs of the previous government. This would have been a waste of time, but the continuity in administration will save this time.

If there is a big slowdown, for instance, if the index falls 10-15% it will be a difficult task to go bullish on an absolute basis. So we will have to pay attention to the kind of recession that hits the market. If you ask me about the biggest risk factor for the Indian market, then I will say that the spillover effects of the glitches in the global markets are the biggest factor. Apart from this, I can’t see any other risk factor at this moment. If this is the biggest risk factor, then we must understand that if the American market falls by 10-15%, then Nifty’s absolute performance is at a risk, but India will outperform on a relative basis. But this will not have any impact on the domestic investors. However, foreign investors will have to take a decision because they will lose less money in the Indian market.

The existing policies like inflation rate, positive real rate and infrastructure will be expected. Secondly, the government should pay attention to the PSU banks and recapitalise it as the banks have deposits but are short of capital. The action will help them in growing their loan book, which will have a positive impact on the economy. The third thing is that the government should go for fiscal consolidation to stop slippages in the fiscal deficit. Apart from this, there is an environment where India has an opportunity to grow its exports.

One should focus on domestic sectors like big banks, real estate, auto and industrial as I think that there will an improvement in earnings in these sectors and that’s why their share prices will go up. One should distance themselves from defensive and costly sectors. At the same time, one should be selective in the case of the NBFCs as there is no need to buy/invest in every NBFC because several are facing business model challenges. Besides, the global sectors like tech and pharma can underperform. So, on a relative basis, one should maintain distance from these sectors.

— Zee Media Newsroom