The last month of the calendar 2018 started with a whimper. Uncertainties galore and volatility remains elevated. The bygone week had a raft of market events that could well set the tone for the year 2019. The US payroll data did not inspire confidence for the hawks. Opec ruling on production cut was on expected lines and may fail to provide support to weakening crude prices. Trade talks got some breather as a 90-day moratorium appears to have been cast on the simmering tensions. Brexit vote approaches and weakens May's position. India's rate-setting arm Monetary Policy Committee (MPC) left key rates unchanged with some tweaks that primarily address liquidity issues and the Central Bank appears setting itself for a reversal of stance. And lastly, exit results of bye-elections in key Indian states will exacerbate the poor sentiment in the Indian markets.

The global financial markets have been pricing in a December rate-hike by the US Federal Open Market Committee (FOMC) and also at least three hikes in the next year. However, this presupposition took a knock as payroll data disappointed with a modest gain of 155k, data released on Friday suggested. While hourly wages rose less than expected and the unemployment rate remained steady, the data clearly suggests wage pressures are subdued. Both bond yields and equity markets moved lower, signalling growth concerns. The more serious signal appears to be coming from the yield curve, with the 5year over 2year inverting. An inverted yield curve is often seen as a precursor for recession.

In other developments, alongside the G-20 meet, trade talks between the US and China agreed for a 90 day negotiation period. Subsequent tweets by Trump possibly dented the optimism and markets are on edge. Opec, in its 175th meeting held in Vienna, decided to cut production by 1.2mbpd. While this may a salutary effect in pushing prices a tad higher, demand-supply mismatch and the gradient of global economic growth will determine the trend in the larger picture. It has to be noted that the US is not happy with the Opec decision and therefore another area of conflict gets created.

Indian markets had yet another volatile week. The much-awaited Reserve Bank of India's (RBI) bi-monthly MPC meeting for December announced its results last week and the committee left the key repo rate unchanged as widely expected. A section of the markets had expected a CRR cut to address structural liquidity issues. The committee, on the contrary, announced a forward guiding SLR cut by 150 points spread over six quarters. The rationale for the SLR cut is mentioned as an effort to align to Liquidity Coverage Ratios. While this may arithmetically be acceptable, in practice the borrowing program of the Government is sustained by demand for securities issued by the GOI. There could be a possibility that limits are further eased for foreign buyers in the coming quarters. Excess SLR securities are already pledged for liquidity purposes to a very large extent and with special dispensations for dipping into the LCR ratio, the real liquidity picture is somewhat obfuscated.

Indian markets had yet another volatile week. The much-awaited Reserve Bank of India's (RBI) bi-monthly MPC meeting for December announced its results last week and the committee left the key repo rate unchanged as widely expected. A section of the markets had expected a CRR cut to address structural liquidity issues. The committee, on the contrary, announced a forward guiding SLR cut by 150 points spread over six quarters. The rationale for the SLR cut is mentioned as an effort to align to Liquidity Coverage Ratios. While this may arithmetically be acceptable, in practice the borrowing program of the Government is sustained by demand for securities issued by the GOI. There could be a possibility that limits are further eased for foreign buyers in the coming quarters. Excess SLR securities are already pledged for liquidity purposes to a very large extent and with special dispensations for dipping into the LCR ratio, the real liquidity picture is somewhat obfuscated.

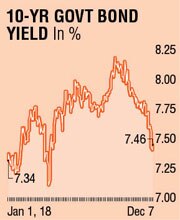

The policy also provided itself with a platform to reverse to neutrality or being accommodative when the governor clearly highlighted that, if some of the inflation risks do not materialise in the near future, there could be space for 'commensurate policy action', clearly indicating a fair amount of probability of a change of stance. And the added commitment that Open Market Operation (OMO) purchases could continue till March 2019 to address liquidity issues was the best part that market instantly cheered. With inflation expectations lowered sharply and liquidity infusion to be regular, bond yields may remain depressed within a 7.25-7.75 range for the rest of the year.

Near-term, exit polls suggest a knife-edge contest and outcome from the bye-elections. Final results, however, would be more important. Coming weeks should see elevated volatility in Indian bourses and bond street. Advance tax outflows could find offset from OMO purchases. The spread over repo rate has compressed from nearly 150-175 basis to 100 basis now. Further compression to about 70-90 basis would be in order. The shorter end of the rate curve will see more volatility. Within a 7.25-7.50% range, the benchmark yield should trade with a downward bias.

The writer is a market expert