The week that went by was yet another volatile risk-aversion week with the indefatigable Donald Trump going hard on his trade-rhetoric with measures against China. The US Federal Reserve hiked rates by a quarter percent as expected.

Global equities traded lower on the week due to increasing trade frictions between the United States and China. Yields on the US 10-year Treasury notes closed little net changed while the price of WTI crude rose more than $4 to $65.50 amid signs that OPEC may extend its production curbs. VIX, broader CBOE volatility index jumped to 23.25 from 15.5 a week ago.

The best expression of heightened volatility and risk aversion was seen in the Japanese Yen hitting a 16-month high against the US Dollar while the Turkish lire skidded to a record low as concerns over risking global trade frictions triggered some panic among investors. In his inaugural press conference as chairman of the Federal Open Market Committee (FOMC), Powell said committee members were wary of two major risks. One, the FOMC raises too fast too much, which could overshoot inflation targets. Two, the FOMC hikes not quickly enough thus letting the economy overheat and then forcing quicker hikes and pushing the economy into recession.

The committee also increased GDP forecasts and lowered unemployment rate. Clearly, the Federal Reserve has inflation as its mandate and one cannot help comparing it to our own MPC which is more inflation-focused, unlike the RBI era which also considered a few additional parameters for rate setting. Growth for one.

The committee also increased GDP forecasts and lowered unemployment rate. Clearly, the Federal Reserve has inflation as its mandate and one cannot help comparing it to our own MPC which is more inflation-focused, unlike the RBI era which also considered a few additional parameters for rate setting. Growth for one.

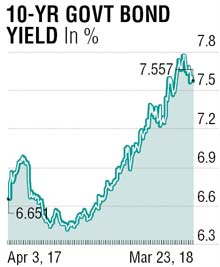

Indian bond markets had something to cheer about as bond prices trudged to six-week highs amid speculation that the borrowing calendar for H1 FY2019 will consider the current dismal outlook and total absence of interest by the financial markets sector. The borrowing programme will likely be announced today. The benchmark yields are still some 30 bases points (bps) higher over December levels. With not much room in the HTM portfolio (by courtesy a gradual convergence in SLR and HTM ratios) and with yields at year’s highs, unless there is a sharp drop in benchmark yields, FY2018 will go down as one of the worst years for bonds and investors. India’s foreign exchange reserves dropped after touching a record high of $421 billion. Indian rupee remained stable to stronger as hedging related sales of dollar helped gains. 10-y yield tested a low of 7.51 during the week. More chances it could move further lower as year-end buying from insurance and PF funds could support prices.

The writer is a market expert