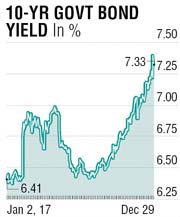

The final week of 2017 saw nearly unchanged stock markets across continents with US treasury yields cooling off in furtherance of flattening while Indian bond yields tested past 7.40 in sustained selling pressure.

Year 2017 certainly belonged to stock markets with all major indices registering record highs and international stocks outperforming US stocks for the first time since 2012. The Dow Jones Industrial Average rose more than 5,000 points, its largest ever point gain in a calendar year.

Crude prices remained nearly flat during the week and volatility remained subdued due to a truncated business week. The outlook for 2018 is more cautious as the broader rising optimism and nearly five years of above-average US stock market returns will warrant investors to put away their rose-coloured glasses and set realistic expectations for the years ahead.

Looking at it from another perspective, almost two years of low volatility may give rise to mean-reversal, largely due to higher inflation expectations across economies as liquidity tightening begins alongside disruptions from China. The low volatility seems to be due to the support provided by expansionary monetary policies around the world, which was also predicated on keeping liquidity plentiful. This is expected to end in the years ahead, leading to return of volatility and investors’ flight to safety.

The US dollar suffered some losses against major currencies in holiday-thin markets. Both euro and the UK pound benefited with no major fundamental issues driving sentiments. US tax concessions are seen as inflationary and may keep pressure on US dollar if the pace of rate hikes is slow.

USD/INR gained on Friday as tight liquidity conditions, where lenders were few and overnight rates remained anchored around the repo rate, leading to some Nostro balances liquidation.

Indian bond yields continued to defy gravity and registered an intra-week high of 7.4180, an 18-month low, before year-end demand and attractive carry forced fresh buying interest while short covering provided a fillip to select bonds. At around 7.31% (which was the closing level in benchmark yield on Friday), the curve is pretty steep and inverted in some parts in the longer end. It may be difficult to make a meaningful investment decision under such circumstances and volatility may remain high until normalisation of the curve happens. Much of the selling last week was post the announcement of additional borrowing to the tune of Rs 50,000 crore. While this was expected and was one of the factors that kept yields elevated for the last many weeks, the reality bit more than the expectations.

In the near term, bond yields will remain somewhat elevated on account of regular supplies. A new benchmark paper will likely be announced soon, and it will be more of a liquidity play as credit demand will keep pressure on bond prices. However, there is some light at the end of the tunnel if one takes note of the Australian Weather Bureau report, which is predicting La Nina, a phenomenon that is likely to support south-west monsoon next year. That should help cool inflation in the coming quarters.

The writer is a market expert