For once, everyone in Indian financial markets ignored global market events and stayed focused on the developments around a jewellers’ suspected dubious transactions with a leading public sector bank. While these are initial days and the real story and the magnitude of financial damage will be known over time, for Indian markets it was not good news. Equity markets tanked, bond markets remained insulated from local disturbances and played tango to the US yields.

In general, however, global equities rebounded this week despite a rise in the US bond yields and an uptick in inflation. Oil recouped some of last week’s losses and volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), softened to 19 after brushing 50 in recent past.

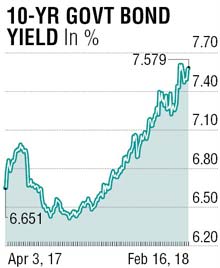

Strong global growth and increased inflation jitters have spurred the advance in the yields.

Turning focuses internally, India’s trade deficit shot up to a 56 month high with the gap now at $16.3billion. Import of crude oil and precious stones contributed against a backdrop of slowing exports. Indian rupee did not reflect the underlying concern as it gained to levels below 63.80 to a dollar in immediate sessions following the data release.

Turning focuses internally, India’s trade deficit shot up to a 56 month high with the gap now at $16.3billion. Import of crude oil and precious stones contributed against a backdrop of slowing exports. Indian rupee did not reflect the underlying concern as it gained to levels below 63.80 to a dollar in immediate sessions following the data release.

However, I see this as temporary and rupee should stay weaker over the next few months. Inflation data released last week showed mild surprise as both headline consumer and wholesale inflation numbers came in a tad lower than expectations. Retail inflation, fell to 5.07% in January from 5.21% in December and Wholesale Inflation WPI inflation eased to a six-month low of 2.84% in January. It was 3.58% in December 2017 and 4.26% in January 2017. In another piece of evidence that manufacturing activity is picking steam IIP, a measure of factory output stood at 7.1% in December as compared to 8.8% in November. This should augur well for the Q3 GDP data due to be released on February 28.

Bond markets continue to show lacklustre activity and subdued volumes. Price action suggests rallies are used to lighten portfolio size. Yields are broadly higher over end-December’s restated-levels. With less than 30 trading days left this financial-year and no signs of relief for bond positions, this could well be one of the worst year-end for investment books post Lehman crisis. The fact that SDF has been enabled by amendment in Parliament accompanied by the stony silence from all concerned over bond market mayhem suggests some positive surprises lie ahead.

In the short-term, Indian bond yields will take cues from the US benchmark yields and rupee liquidity in the system.

The writer is a market expert