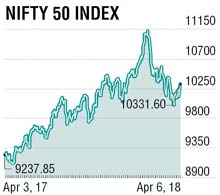

What a week that was! After witnessing roller coaster ride, Nifty started the new financial year with a ban gaining 2.15% to close at 10331. Renewed investor interest in mid cap and small cap stocks outshined the Nifty by gaining 4% and 5% respectively.

All the sector indices ended in green, auto sector stocks gained the most on better than expected growth in monthly sales across the segments. The PSU Banks stocks gained post-Reserve Bank of India (RBI) kept its policy rates unchanged citing lower inflation for 1HFY19 and rally in the bond market.

The 10-year G-Sec yield fell to 7.17% driven by a favourable macro environment and lower than expected government borrowing. The RBI allowed banks to amortise mark-to-market losses for the third and fourth quarter of the previous fiscal FY17-18 over four quarters thus providing a cushion on March quarter earnings and encourage the PSU Banks to re-enter bond market. FIIs sold worth Rs 1364 crore while DIIs bought worth Rs 2660 crore in equities.

Last week, the US trade war intensified further as China announced to levy 25% reciprocal tariffs on 106 US products including soybeans and automobiles against which the US threatened more levies and considered $100 billion in additional tariffs against China. The global market took a plunge and even the US markets ended with deep sell-off on last Friday post-Fed chairman Jerome Powell's statement to keep raising interest rates to keep inflation under control.

Key global events in this week, the US Federal budget balance (Wednesday), ECB Monetary policy (Thursday), India’s March month Consumer price inflation and February IIP data (Thursday) and March month trade balance data will be released on Friday. Q4FY18 corporate earnings season will start from this week with Infosys, RBL Bank and Gruh Finance declaring their results on Friday.

For the week, Indian markets will continue its volatility as the fresh trade war between the US-China-Russia and Fed rate hike fear will spook sentiment at the start of the week, however, NBFCs and PSU Banks will remain in action on lower G-Sec yield. Technically, Nifty support is at 10276 and 10130 levels while resistance at 10350-10450 levels respectively. The nifty trading range for the week could be between 10130-10450.

The writer is VP- Retail Research, Motilal Oswal Securities Limited