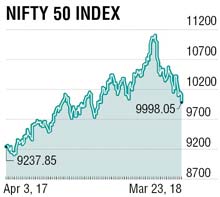

It was nothing short of a bloodbath in global markets last week, which saw the Indian markets continuing their losing streak for the fourth straight week. On a weekly basis, Nifty slumped 1.93%, posting its longest stretch of weekly losses in 16 months and ended at 9998, but outperformed the broader markets.

Mid and small cap indices lost 3% and 5.3%, respectively. All sectoral indices ended in the red. The PSU Banks, Realty and Metal indices lost the most, falling 6-7%. The US markets also lost 5-6% in the last week.

Choppy start of the last week turned bearish with heavy selling in the PSU bank and metal stocks on last Friday amid fears of a trade war when US President Donald Trump announced tariffs Chinese imports on Thursday. China, in turn, retaliated with reciprocal tariffs on the import of select goods worth $3 billion. This statement ignited global trade war fear across the globe and world markets corrected sharply.

The Fed raised interest rate by 25 basis points in its meeting last week and signalled two more rate hikes in 2018. Crude surpassed $65 mark on production cut extension till 2019 by Saudi Arabia. Nifty closed below 10000 mark and corrected almost 11% from the all-time high on state polls this year, bank frauds, Fed rate hike, escalating trade tensions among global economies and long-term capital gains (LTCG) issues and market capitalisation now fell to Rs 139.30 crore.

The Fed raised interest rate by 25 basis points in its meeting last week and signalled two more rate hikes in 2018. Crude surpassed $65 mark on production cut extension till 2019 by Saudi Arabia. Nifty closed below 10000 mark and corrected almost 11% from the all-time high on state polls this year, bank frauds, Fed rate hike, escalating trade tensions among global economies and long-term capital gains (LTCG) issues and market capitalisation now fell to Rs 139.30 crore.

This week, US GDP and India’s April-February fiscal deficit data will be announced on Wednesday. March series F&O expiry is on Wednesday, automobile companies will also announce their March sales data.

In this truncated week, markets will remain closed on Thursday and Friday. The US markets are also shut this Friday. Indian markets will remain volatile ahead of global trade war repercussions, March F&O expiry, financial year closure etc.

Technically, on weekly charts, Nifty has formed “bearish engulfing” pattern which indicates further weakness in the trend. Nifty closed below its 200 DMA of 10160 and also breached major support of 10070 levels, next support is at 9850 level and higher side resistance remains at 10070-10160. For the week trading range could be 9850 to 10150.

The writer is VP- Retail Research, Motilal Oswal Securities Ltd