Another eventful week went by that saw UK dive into uncertain political times and the Reserve Bank of India (RBI) move into neutral gear in preparation to a possible reversal of course.

Domestic market looks like extending its good run after RBI left rates unchanged. Bond yields have continued to ride over the optimism of a new-found-dovish Monetary Policy Committee (MPC) stance cues of a more cautious turn-around ahead to being accommodative.

Bond traders and money-market yields had prepared for an unchanged policy outcome with expectations of commentary that would favour a reversal towards being accommodative. While MPC did not exactly drift in that path, it acknowledged the softening of inflationary pressures.

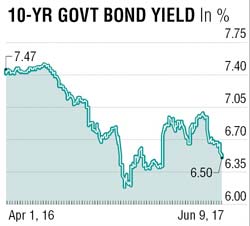

Bond yields have trended lower and the new 10-year benchmark is lower about 30 basis from its auction date. Long tenor yields continue to compress and the market is in no mood to relent on its buying spree. A cut in the next policy is widely getting priced in.

Bond yields have trended lower and the new 10-year benchmark is lower about 30 basis from its auction date. Long tenor yields continue to compress and the market is in no mood to relent on its buying spree. A cut in the next policy is widely getting priced in.

The move to announce a 50 basis cut in SLR will release liquidity of a permanent nature and should be seen more as progrowth measure.

This week will see data releases in US and EU besides rate setting meetings in the US, UK, Switzerland and Japan. And inflation data back home. The FOMC is expected to stay on hold after a disappointing pay-roll data. Short- term money market yields place the likelihood of the next hike towards the year-end. Indian markets may shrug off any shock and the ten-year yields is expected to trade a 6.45-6.52% range.

The writer is executive director, Lakshmi Vilas Bank