The bygone week was notable for two global events – oil prices touching a three-and-a-half year high and the US benchmark 10-year note rising to a seven-year high as evidence of strong growth in the US and Iran sanctions weighed on sentiments.

A mix of solid data from the US and renewed concerns of the imposition of sanctions on Iran, which kept oil prices steadily higher was the major talking point. The break out above 3% in US benchmark 10year note and the consolidation above this psychological mark is seen portending sustained bearishness to rates markets.

Domestic markets continue to be plagued with a worsening market sentiment. The Indian rupee weakened past 68 mark and reported dollar selling by Reserve Bank of India (RBI) was the only supply that arrested sharp rupee depreciation.

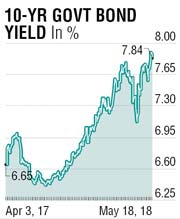

With international crude prices touching $80 for a barrel, statisticians will observe that the last time crude prices were around $80, the rupee was trading around 62 to a dollar. The combination of a weaker rupee and rising crude prices could have a deleterious effect on inflation. The benchmark 10y bond prices fell to a three year low as yields perilously edged towards the 8% mark.

With international crude prices touching $80 for a barrel, statisticians will observe that the last time crude prices were around $80, the rupee was trading around 62 to a dollar. The combination of a weaker rupee and rising crude prices could have a deleterious effect on inflation. The benchmark 10y bond prices fell to a three year low as yields perilously edged towards the 8% mark.

An open market operation (OMO), in which RBI purchased 10,000 crore of dated securities, was fully paid. The weekly auction following the OMO purchase finally saw no devolvement with a decent bid to cover.

Sensing stress and heightened negative sentiment in bond markets, the govt officials addressed a press meet late on Friday evening to allay fears of worsening economic conditions. While it did not specifically address issues surrounding bond markets and demand-supply mismatches, it does provide assurance that the authorities may not be tolerant of a sharp rise in yields

One of the dominant themes in the bond markets is the likelihood of an earlier than expected rate hike. The subsequent inflation readings between August and March will anyways be lower due to base-effects and therefore the data-driven need for further tightening would remain limited and may actually support markets.

The optimism that was built over the press-meet news may see some paring off early this week. If bond issuances are more in the 10-15 year segment for the remainder of the half-year, we may see some correction to this optically inverted rate curve. Any move towards 8% should be seen as a value buying opportunity as the weaker rupee may attract foreign buyers also.

The writer is a market expert