The last month has been quite eventful for the markets influenced by the rating upgrade of India by Moody’s from Baa3 to Baa2 with stable outlook. This helped the capital markets to reverse the earlier losses and create new highs. It also invigorated the appetite of foreign portfolio investors (FPI) for the rupee-denominated assets. It did influence all the three active markets – currency, equities and Interest rates.

Somehow, the interest rate markets could not sustain the gains in view of lower indirect tax revenue collections post GST regime for October, leading to a higher expectation of fiscal slippages. The system now has the data that suggests revenue shortfall on account of RBI dividend by Rs 30,000 crore, GST normalisation (shift from 28% bucket to 18%) resulting in an expected shortfall of Rs 20,000 crore and finally, the interest on bank recapitalisation bonds of nearly Rs 10,000 crore (this number would depend on when exactly the bonds are issued).

Thus the revenue shortfall could be anywhere between Rs 50,000 to 60,000 crore vis-a- vis the budgeted numbers. The GST's teething problems are yet to be over, and the data for October suggested a shortfall of Rs 7,000 crore as against the average of the earlier three months.

On the other hand, the GDP numbers for the second quarter suggest that the growth had bottomed out in the first quarter and the graph is likely to move northwards in the coming quarters. To balance the fiscal math, it is quite likely that the government will have to contract its expenditure. Revenue expenditure has the least elasticity and hence the contraction may happen in the capital expenditure. That may not be a good omen in isolation, but if the public expenditure is substituted by the long awaited private expenditure, it may not hit the growth that adversely.

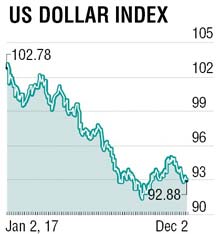

Forex reserves have climbed up to regain the $400 billion mark which partly would have been contributed by the rating upgrade and corresponding FPI capital inflows to acquire rupee assets.

Liquidity condition is moving towards near neutral. The notified OMO of Rs 10,000 crore was cancelled a couple of days before the auction date. That gave boost to the bond market and the benchmark bond rallied by nearly 10 basis points. However, the rally was short-lived and all the gains were reversed due to fiscal strains and likely slippage of fiscal deficit target from the budgeted goal of 3.2% of GDP due to the reasons and data points mentioned above. The cancellation of OMO and the current net liquidity position suggests that the liquidity has reached near neutral levels and no more OMOs will be needed to further absorb the liquidity.

It is to be noted that the current liquidity is no more an outcome of demonetisation and corresponding deposits placed with the banking system in lieu of the currency notes deposited. The issuance of the fresh currency and its systemic circulation has absorbed that liquidity. The current liquidity is an outcome of the absorption of surplus greenbacks by repeated RBI intervention in currency markets and is demonstrated by the rise in forex reserves by nearly $30 billion in last one year. Every dollar bought by RBI to absorb the supply to prevent the rupee’s undesired appreciation results in an increase in rupee liquidity by an equivalent amount.

The two major data points likely to emerge in the next two weeks are the change in the repo rate, if any, as an outcome of Monetary Policy Review by RBI on December 6. Going by the market feedback and the economist polls, any change in the repo rate is not expected. The other major data point is the usual monthly Consumer Price Index for the month of November. As the monetary authority is focused on price stability, it has become the most important data point. Due to adverse base effect the CPI number is likely to move upwards and may slightly overshoot the RBI predicted number of 4.2% to 4.6% for the second half of the financial year. This may not immediately warrant a rate action unless the deterioration is acute.

In view of the above factors, the exchange rate is likely to move between 64.25 and 65.00 during the month. If no rate action is taken and the tone is neutral, the ten year benchmark sovereign rate may trade between 6.75% to 7.10% in the current month.

In the second half of the month, most of the traders will proceed on holidays and therefore, the volumes are likely to remain thin in most parts of the market. The traders will resume in the first week of January with fresh ammunition due to new allotments for emerging markets.

The writer is executive director, Federal Bank