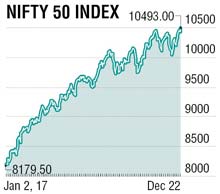

As predicted last week, BJP’s win in Gujarat with majority triggered a rally on the D-Street. The week started with strong enthusiasm and confidence, the mood was intact throughout the week for the pre-Christmas celebration. Nifty gained 160 points or 1.55% week on week to close at 10493. Mid and small cap indices outperformed the Nifty by a wide margin and gained 4.4% each. With all-round buying across the sectors, all the sector indices ended in the green. Metals, auto and infra gained 4-5%. Increased base metal prices on LME hardened Hindalco by 10%; SAIL was up by 9%; Vedanta gained 6%.

In auto, Hero MotoCorp gained 7.7%, Maruti 6%, Tata Motors and Bajaj Auto gained 4% each; Amar Raja and Exide also gained 7%.

Pharma sector gained by 2.5% in which Glenmark gained 6% and Cipla gained 4%. Wockhardt gained whopping 26% as the company announced to offer Waluj formulation plant for US FDA inspection in early 2018.

The IT sector gained 2% in which Mindtree was up 5.65% and Wipro 4% post the closure of buyback; TCS gained 3.6% on securing $2.25 billion renewal contract from Nielson. FIIs sold equities worth Rs 2,621 crore while DIIs bought shares worth Rs 3,526 crore in the last week.

US markets also soared to new highs. The tax cut bill got preponed and signed last Friday as a Christmas gift to the US Citizens and Corporates. The Bill will spark business investment, hiring and wage growth.

Indian markets rose to a record close and touched a new record high of 10501. BSE’s market capitalisation achieved a new milestone, crossing Rs 150 lakh crore for the first time, at a growth of 49% - the highest worldwide. Market-cap-to-GDP crossed 100% after five years.

There are no major global events due to the festive season and yearly closing. Data on India’s November month infrastructure output, the external debt will be out on Friday. December month F&O series expiry is on Thursday.

Last week, Nifty kick-started with a strong note and sustained the momentum and closed at a record high level. In this truncated week, markets may witness volatility due to F&O expiry and likely short covering in large-cap stocks; mid and small cap stocks will continue to remain in action.

Technically, Nifty has formed a bullish pattern post breaking out of the wedge pattern formed since last 10 weeks. Multiple supports are in 10330-10350 range; if Nifty sustains above 10400, rally can continue till 10550-10650 levels.

The writer is VP - retail research, Motilal Oswal Securities Ltd