Indian markets are not showing any signs of fatigue even when the global market sentiment spooked on re-intensified trade war by the US with China. The former also imposed a tariff on items imported from Korea, Europe and also from India. All the countries have imposed an equal amount of tariffs against import items from the US in retaliation.

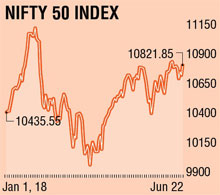

Last week, Nifty gained mere 4 points week on week and closed at 10822, highest post-January month. However, the mid and small cap indices are still facing pressure and closed with a loss of 1.15% and 2.57% respectively.

The Bank Nifty continued its outperformance with a gain of 1.32%, highest closing post-January led by private sector banks. All the sectors ended in the red except Private Banks and Pharma. Metals lost 3% due to concern over trade war, PSU Banks shredded 2.78% and profit booking dragged information technology (IT) sector by 2.44%.

In the absence of any major event, the 50-share index was trading in a very narrow range throughout the week till Friday. Last Friday’s OPEC meets decision to increase the crude oil output by 1mn barrels from July boosted the market sentiment. Nifty rallied in the last closing hour backed by Consumer and Private Financial sector stocks though crude price remained firm around $75 and India’s forex reserve dipped to $410bn.

The domestic institutional investors (DII) bought equities worth Rs 4,721 crore while the foreign portfolio investors (FPI) sold worth Rs 4,738 crore in the last week.

Among the key events, theUS Q1 final GDP data will be released on Thursday. India’s external debt, May month infrastructure output and fiscal deficit data will be released on Friday. June series F&O expiry is on Thursday.

Last week, Nifty traded in the narrow range from 10700 to 10840 and made a “Dragon Fly Doji” pattern on the weekly charts which indicate buying interest on dips. However, June series F&O expiry may lead to volatility. Nifty has strong support at 10700 and 10630 levels whereas resistance at 10888 and 10950 levels. For the week trading range could be between 10680 and 10950.

The writer is VP-Retail Research, Motilal Oswal Securities Ltd