It has been seen that many times salaried taxpayers end up paying extra tax, especially during the end of a financial year, mostly due to the last-minute declaration of their investment proofs with their employer. Let us see some of the smart tax planning tips to optimise your Section 80C investments as there is hardly any time left so let’s understand this better:

Follow the basics: During the last-minute rush, it is always advisable to follow the basics, you should not invest in a financial product which you do not understand and which is also not aligned to your overall financial goals. You may also come across various so-called financial advisors or wealth managers who mushroom during this time, but who are not the real advisors but more of a sales agent. So don’t rush and stay away from any non-productive financial products.

Make sure to exhaust the entire limit U/S 80C for Rs 150,000:

Section 80C allows you to get a tax deduction up to a limit of Rs 1.5 lakh. You should not miss to exhaust this limit at any cost because whatever amount you invest under this section will straight away reduces your taxable income and increase your in-hand income. Say, Manasi earns Rs 9 lakh and invests only half of the total Rs 1.5 lakh limit, due to this, she has to pay an additional tax of nearly Rs 15,000 (i.e. Rs 75,000 x 20% tax rate based on her income tax slab). You need to simply look at like this, on investing Rs 1.50 lakh u/s 80C, you are making returns of 20% straight away, so now which product gives us this kind of returns. On top of it the returns you will make on this investment will be an added advantage, so one should never miss this option. The benefit of 20% will become 30% in case your taxable income is more than Rs 10 lakh.

Here is the list of available tax savings avenues u/s 80C.

Options linked to investments:-- You have many options to invest in like EPF, PPF, NSC, premium on life insurance policies, Tax saving Bank FDs locked in for five years, deposits with post office, ELSS i.e. mutual fund - equity linked savings schemes.

Options linked to expenses: You also get a deduction on account of certain expenses you incur like Tuition fees for your children's education, Principal part of your home loan and stamp duty, registration charges on buying a house.

The key is to use these options to maximise tax savings by minimal investments and optimally utilising these benefits. For example, you don’t need to invest in entirety because if you have an existing life insurance policy or ongoing tuition fees for your kids then the overall investments you need to make will come down.

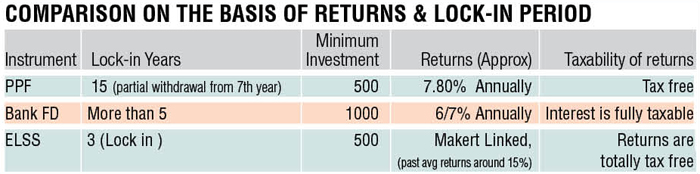

Public Provident Fund : PPF is an investment option which can never go wrong, but if you are young and have a long-term horizon, then you should not invest in it beyond 5-10% of your total asset allocation, and for tax saving also you can opt for other lucrative tax option like mutual funds ELSS.

Bank fixed deposits: One can also get a tax deduction on account of an investment in a tax saving FDs which are locked in for five years, but an important point to note is that the entire interest you earn on your bank FDs will be fully taxable as per your tax slabs. Many taxpayers get confused that their bank have deducted tax i.e. TDS so they don’t have to pay anything else. But note that your TDS rate is only 10% and if your income is more than Rs 5 lakh and Rs 10 lakh then your tax rate is 20% and 30%, respectively, so you need to pay the differential tax accordingly.

Mutual funds ELSS: ELSS is by far the best investment tool to save tax u/s 80C because it has a huge potential to generate way higher returns than any other tax saving options. It also has an advantage like low-cost and is very transparent and comes with the least lock-in period of only three years as compared to any other options as listed above. To top it all, the returns from ELSS are totally tax-free.

You should always make tax saving also a part of your overall financial planning and invest in any product after a thoughtful comprehensive financial planning.

The writer is a chartered accountant and chief gardener at Money Plant Consultancy