If you have recently filed your tax returns for the previous financial year 2016-17 and have claimed certain benefits like HRA, LTA or your 80C investments deductions while doing your tax computation, then chances are there that you might have received an Income Tax Notice u/s 143(1).

What is Notice u/s 143(1) about?

Once you file your Tax Return, you may get a notice or an intimation from the department ranging from a simple enquiry to a critical one. Though there is no need to panic for every notice or intimation you receive, do make sure to handle every notice carefully, respond in time and as stated in the notice. There are multiple types of notices under section 143(1) and the one I am talking about in this article is the latest one initiated by the Income Tax department. This pertains to a mismatch of your income as per Form 16 or 16A and the income as filed by you in your Income Tax return.

What is this mismatch of income as per Form 16 and my tax return?

Let me explain this with an example. Let's say Manoj is a salaried person and is working with the Tata group. Now due to some reasons, Manoj could not submit his rent bills & 80C investment proofs to his employer and thereby did not get the benefit of HRA & section 80C both in his tax computation of TDS by his employer. Thereby, because of the non-submission of these documents, his tax liability increased and excess tax got deducted and paid to the government. But as you are aware that even if you do not claim these benefits from your employer, you do not lose these benefits and you still have a chance to claim it from the tax department while filing your tax return. And that is what Manoj did, while filing his tax returns in the last month. He claimed these benefits and thereby his taxable income got reduced and so his tax liability resulting in to him getting a tax refund. Now, this incident has created this particular “Mis-match of Income between his Form 16 & the income as reported by him in his tax filing”.

How to handle this 'mismatch' i.e. notice as received u/s 143(1)?

Till last year, the tax department was not asking for any documents from those taxpayers who had claimed the benefits like what Manoj did in our example. But now as per this new initiative, the tax department has started sending the notices u/s 143(1) asking the taxpayers to submit the proofs for all the deductions & exemptions as claimed by them while filing their tax return.

What are the some of the items one can get a notice for?

Following are some of the instances wherein you might have claimed the benefits while filing your tax return and the same have caused the mismatch and thereby the mismatch notice: -

Deductions as per chapter VI-A: If you have claimed the Chapter VI deductions while filing your tax return, like 80C benefits for your life Insurance premium, home loan principal, mutual funds ELSS etc. or a Donation made by you u/s 80G or your health insurance premium u/s 80D.

Various allowances as exempted under IT act:- Allowances like HRA or LTA not claimed with the employer but only at the time of filing your tax return.

TDS for previous year: This is with respect to the TDS, you have claimed in the latest filing but the same belonged to the Income offered in the previous year.

Interest Income on your FDs: If you have not declared the interest earned on your FDs in your tax return.

Other: There could be some more instances and in case your particular reason is not mentioned in the list then you can select the option, other.

Is there a reason to worry?

No, absolutely not, unless someone has declared and claimed any deductions or benefit which is unlawful, meaning if someone has not rented out a place, but still the person has claimed the HRA benefit. As long as everything is legal and rightfully done and something which you are eligible to claim, then don't worry. All the department is asking is to submit your reason for the mismatch and upload the relevant document to justify your claim. There is absolutely no need to worry panic. You need to select the option by either agreeing or disagreeing to the mismatch and select the reason out of all the available options as explained in the above-mentioned para.

What is the time limit to reply to this notice and what are the steps involved?

The time limit to reply to this notice is thirty days from the date of receipt of this notice. Following is a step-by-step infographic illustration to respond to the said notice:

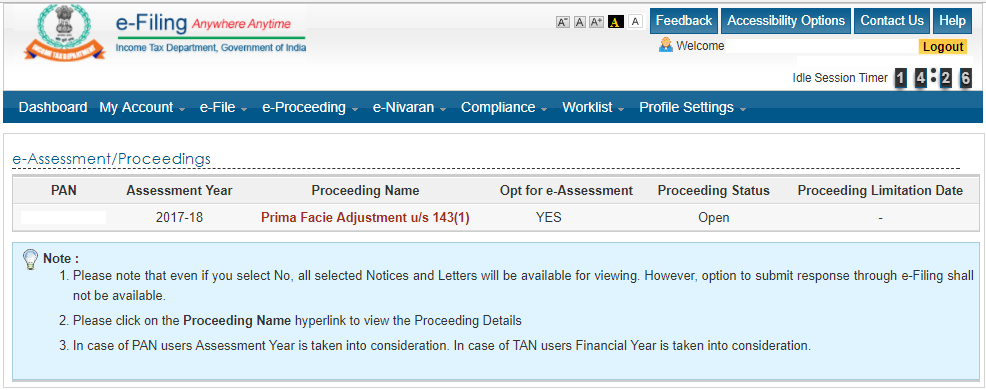

Step-1: Please login to your income tax account at https://incometaxindiaefiling.gov.in/ and click on the e-proceeding. In case you have received the notice, following page will be shown:

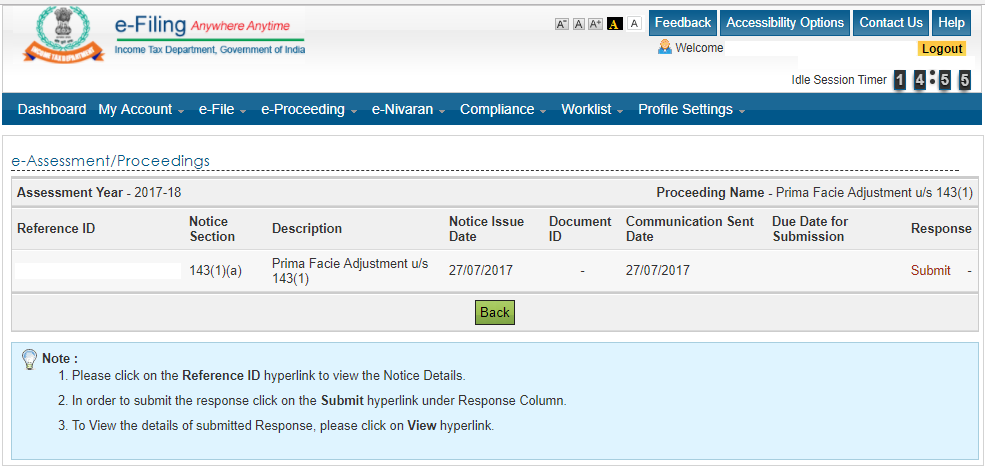

Step-2: Further you need to click on the “PROCEEDING” Name (hyperlink) to view the proceeding details. Then you will be able to see the following page with a Submit link under the “Response” tab, click on the same.

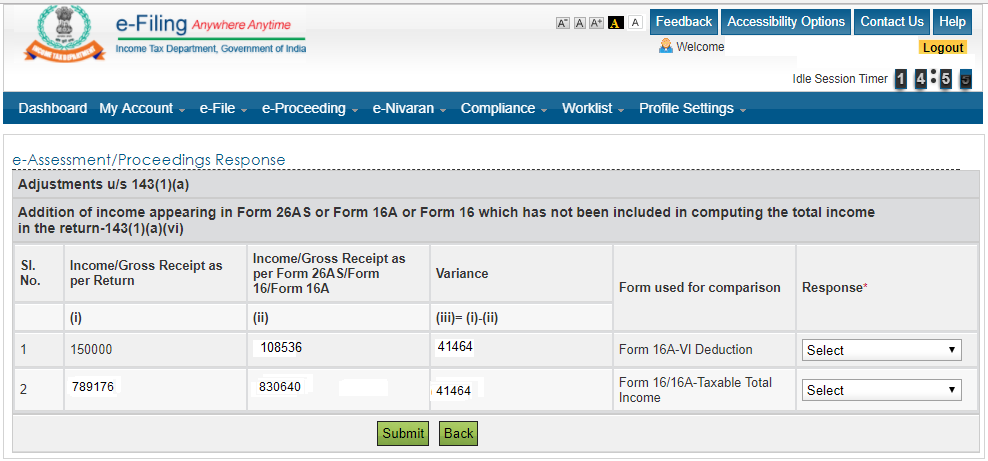

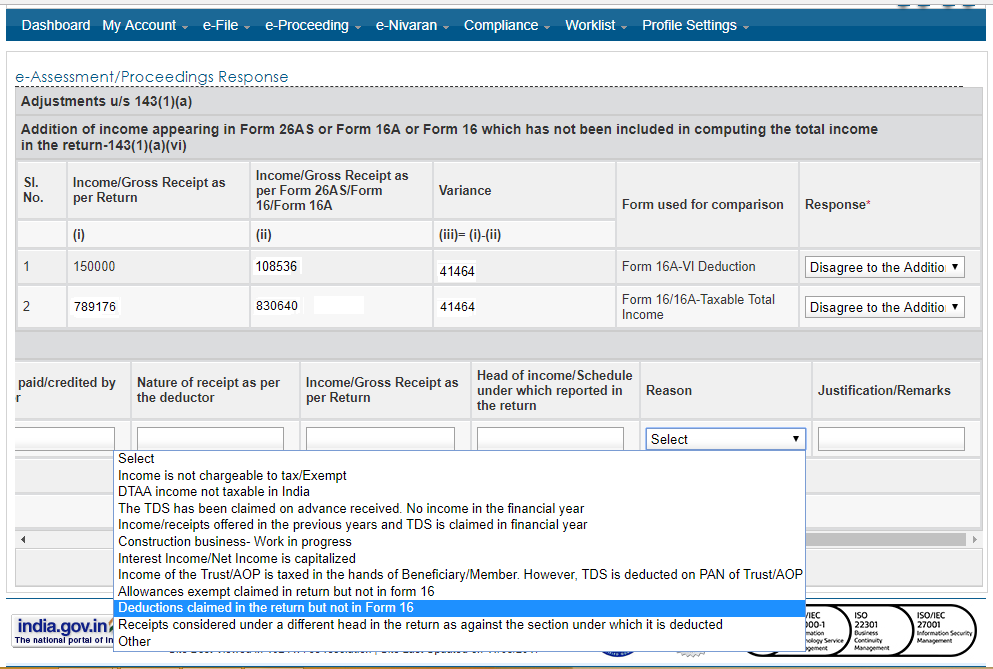

Step-3: Once you have clicked on the submit link, the following page will be seen, it will highlight the difference between your total income based on the return filed by you and as per your Form 16/16A or 26AS.

Example of a Mismatch due to your 80C deductions

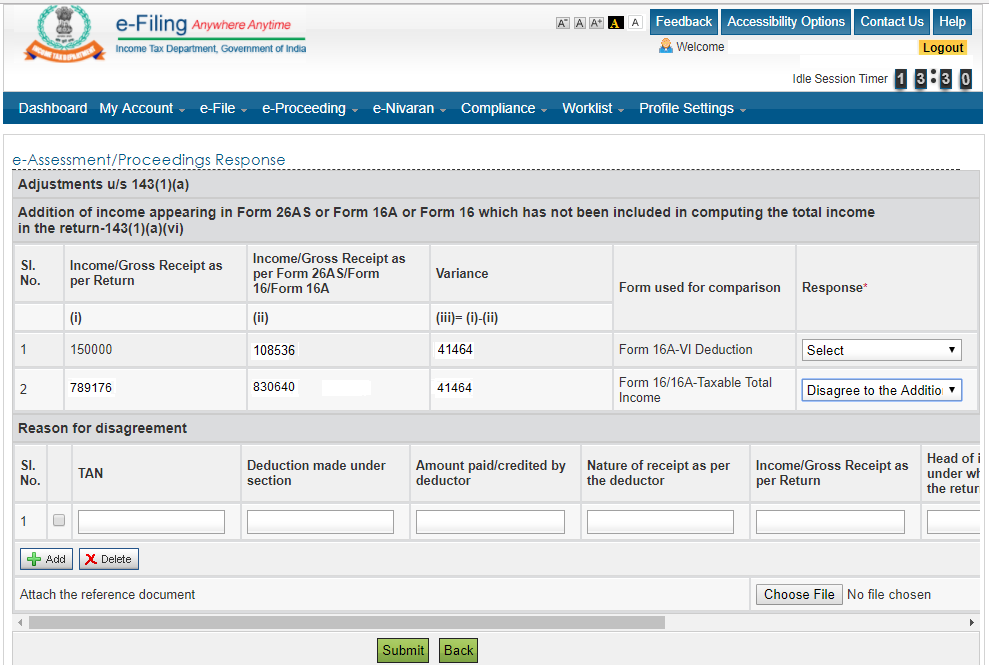

Step-4: Now, you have to identify the exact reason behind the difference between your claim as per the return filed by you and the relevant form as mentioned in the below image. You have to select whether you agree or disagree from the list as shown in the dropdown.

Step-5: If you do not agree to the addition then you need to mention the reason for your disagreement. You can select the reason from the given dropdown list and also submit the relevant documentary evidence in support of your claim.

(Rishabh Parakh is a Chartered Accountant and the Chief Gardener & Founder Director of Money Plant Consulting)