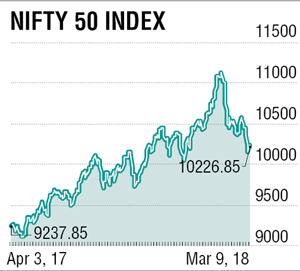

After consolidating in very narrow range for the whole February month, Nifty corrected sharply at the start of March and lost 2.2% week on week to close at 10227. Nifty Bank also lost 2.43% while mid and small cap indices underperformed the Nifty and lost 3.8% and 4.5% respectively. All the sector indices ended in red led by Metals, PSU Banks and Pharma stocks. Foreign institutional investors (FII) sold shares worth Rs 281 crore in equities while domestic institutional investors (DII) bought shares worth Rs 81 crore in the last week.

Nifty saw selling pressure on each day from higher levels throughout the week. Nifty made a low of 10141 as sentiment was spoiled after the US President imposed 25% tariff on steel import and 10% on aluminium except for Canada and Mexico which triggered sell-off across the metal sector stocks. PSU Banks and Pharma stocks continued to nosedive and lost 5.5% and 4.5% respectively. On the contrary, global markets are gaining stability and saw recovery from the lower levels of the last month. European Central Bank (ECB) kept rates and stimulus unchanged. Reserve Bank of India (RBI) will infuse Rs 1 lakh crore into the banking system through a special auction this month to manage additional demand for liquidity. Oil prices saw an uptick in the last week as the possibility of a meeting between the US President Trump and North Korea's leader eased some geopolitical risk.

Key global events in this week, US February inflation (Tuesday), China February month industrial production data will be released on Wednesday. India's January month IIP and February CPI (Monday), October-December current account deficit (Tuesday) and February WPI data will be released on Wednesday.

Key global events in this week, US February inflation (Tuesday), China February month industrial production data will be released on Wednesday. India's January month IIP and February CPI (Monday), October-December current account deficit (Tuesday) and February WPI data will be released on Wednesday.

Last week, post opening gap down Nifty failed to sustain at higher levels as if it was sold on rising strategy adopted by the traders. Nifty was in the range of 10428-10141 and manage to recover partially at the closing forming bearish belt hold pattern. For this week, important economic data will keep the market on a buzz, though on the downside strong support is at 10030 level and on the higher side resistance at 10450.

The writer is VP - Retail Research, MOSL