US Dollar had its best weekly close as stars aligned to lift the greenback to two-week highs against major currencies. While the global equities edged lower this week, Japan’s Nikkei struck a purple patch, closing at a 21-year high. Yields on US 10-year T-Notes continued to rise, ending the week at 2.42%, up from 2.38% a week ago with an intra-week high of 2.47%. India’s benchmark stock index rose yet again to record highs with the banking stock index surging closer to the July highs post the announcement on bank recapitalisation plan. The sentiment is upbeat. Bond yields continue to remain elevated as traders are caught in yet another round of uncertainty after the recapitalization news.

The US dollar advanced strongly late in the week, particularly against the euro, lifted in part by strong GDP data and by the European Central Bank’s relatively dovish shift toward a less accommodative monetary policy. US GDP showed the economy grew at a faster-than-forecast pace of 3% in the third quarter, handily beating 2.5% forecasts. Economists had expected slowdown because of the impacts of hurricanes Harvey and Irma. Consumer spending showed continued strength while core inflation was well below the US Federal Reserve’s 2% target.

In another significant development, the ECB delivered what many in the markets had been hoping for, a “dovish taper.” The ECB will buy €30 billion worth of European bonds each month starting January and ending September, a period longer than the six-month interval some had feared. ECB president Mario Draghi also said that rates will stay at present levels, well past the end of the quantitative easing programme, with the central bank keeping open the option of increasing the size and duration of QE if necessary. German 10-year bunds fell nearly seven basis points in yield on the news, to 0.41%, while the euro gave ground versus major currencies. News that Janet Yellen, the current Fed chairperson may not get reappointed also lent support to the US dollar. Japanese PM Shinzo Abe savoured a landslide victory paving the way for a push to amend the country’s pacifist Constitution.

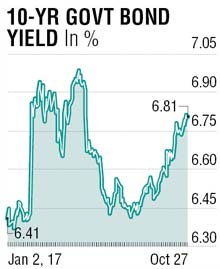

Indian market participants had mixed fortunes. While equities scorched to new highs, bonds continued to remain weak. Benchmark 10-year yield moved past 6.83 during the week, only to recover a few basis points by the close of the week. The recently released minutes of the October Monetary Policy Committee meeting first kept sentiments weak as the bar for the next rate cut is now set higher. Following this, the announcement of a mega bank-recapitalisation plan has caused more confusion in the minds of bond traders as the likely Rs 1.35 lakh crore recapitalisation programme is announced to be front-loaded on one hand and threatens to limit the demand and appetite for G-Secs on the other. While clarity is still awaited as to whether these bonds will enjoy an hold-to-maturity status or special dispensation that insulates them from being revalued, traders’ preference to err on the side of caution is hurting sentiment.

The good news for bond-supply-math is that these recap bonds will not impact the fiscal deficit, which is statedly on a ‘downward-glide’. The risk, however, is credit multiplier and therefore growth will gather momentum, which would logically signal the beginning of a new rate cycle. While uncertainties galore, there is juice in the 80-125 basis spread over overnight funding rates, and hence a correction in the sell-off is overdue. Benchmark 10-year yields should get supported around 6.75% while 6.87% acts as resistance.

The writer is CEO, Association of Mutual Funds of India