Before you set out to calculate your tax liability, you need to understand the category of taxpayer you fall into. Different categories of taxpayers need to pay taxes at a different rate as per their defined slab rate. For instance, if you are running a private limited company then you need to pay tax from the first rupee of your income, whereas if you are running your sole proprietorship business or working as an employee then the tax slabs are different. Hence it is very important to know the different types of taxpayers and the applicable tax slabs.

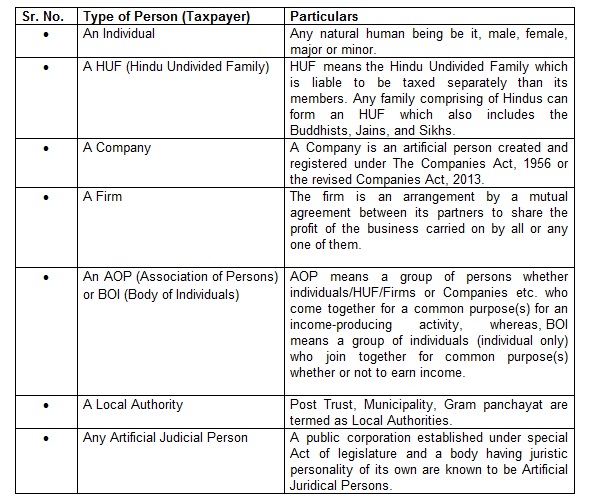

Let us understand the classification of taxpayers as per the Indian Income Tax Act. The taxpayer as per the act is termed as a “person” which carries a wide meaning as explained below:

Who is a “person”

The term ‘person’ is defined as per Section 2(31) of the Income Tax Act’ 1961 which covers both the natural and the artificial person as well. So as per the definition of the term ‘person’, an individual and an artificial person both will be liable to pay tax. Please find below a list of various types as defined under the act:

Income Tax Slab:

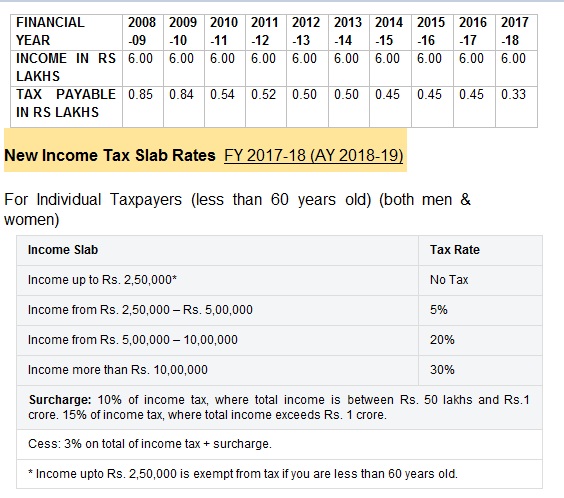

As explained above, there are different rates of taxes as applicable to the different type of person as defined under the act. Let us understand the tax slabs and its applicability to you as a salaried employee. The Income Tax Act 1961 governed the provisions for our income tax in India and these rates are usually revised every year in our union budget.

The following table shows a trend of change in income tax liability due to various changes in tax slab and rates levied, if the net taxable income of the male individual is considered as Rs 6 lakhs.

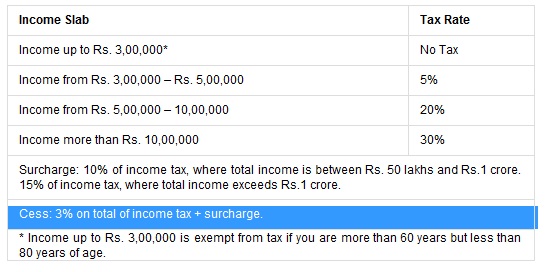

For Individual Taxpayers (60 years old or more but less than 80 years old) (both men & women)