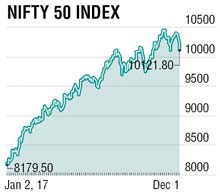

Post consolidation for two weeks, Bears finally made a dramatic come-back and tightened their grip over the Bulls on Friday. Nifty lost 2.58%, or 268 points week on week and closed at 10122. Midcap and small cap indices lost 1.46% and 0.77% respectively, still outperforming the Nifty.

All sectoral indices ended in the red in which PSU bank lost 6% in which PNB, SBI and Bank Baroda lost between 5-6%, and SBI gave a negative surprise by hiking interest rate on bulk deposits by 100 basis points. Metals melted 4% led by Hindalco, Vedanta and SAIL which lost 6% each. Energy sector lost 3% led by Reliance which lost 4%. Pharma stocks ailed 3% in which Glenmark and Aurobindo Pharma lost 6% each. IT stocks lost 3% in which Infosys nosedived 5%, private bank and auto lost between 1-1.5%. Realty sector managed to end in the green by 0.5%. FIIs continued selling equities worth Rs 2,466 crore and DIIs bought worth Rs 1,791 crore.

In US markets, Dow Jones and S&P 500 indices continued scaling new highs on better than expected third quarter (Q3) GDP growth data ignoring another test-fire of higher-range missile by North Korea. OPEC members in its meeting last week extended oil production cut till the end of 2018.

Indian economy saw a rebound as 2QFY18 GDP grew 6.3% and real GVA grew 6.1% led by manufacturing and mining activities and strong automobile sales growth for the November month failed to cheer the markets. Concern of fiscal deficit for April-December which reached to 96% of the government budgeted target and lower rollover of Nifty in the December series expiry which stood at 63% (vs 70% average) spooked the markets.

In key global events this week, US final services PMI and trade balance data (Tuesday), European Central Bank President Mario Draghi’s speech (Thursday), China trade balance and US monthly unemployment rate will be released on Friday. Reserve Bank of India (RBI) policy is scheduled on Wednesday and India Nikkei Services PMI data will be released on Tuesday.

In the last week, Nifty traded above the important level of 10380 post range breakout and made high of 10407. November F&O expiry day volatility dragged Nifty 1% and worries over widening of fiscal deficit, higher crude price, rising bond yield and reignited geopolitical tension by North Korea further pulled down indices another 1% on Friday and touched a low of 10108. For the week, interest rate-sensitive stocks like banking, housing finance and realty will be in focus on RBI policy event.

On monthly charts, pattern of higher highs and higher lows is intact since last 11 months, Nifty closed near to the previous-month low of 10094, a break below this level could follow weakness towards psychological 10000 mark and even lower. On the flip side, multiple hurdles are placed near 10250-10280 range.

The writer is vice president-retail research, Motilal Oswal Securities Limited