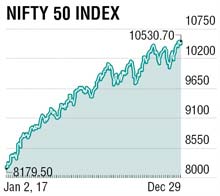

Dalal Street bade farewell to 2017 in a celebration mood by closing at the highest level on the last trading day of the year at 10531, a gain of 38 points week on week. Nifty rallied 30% and Sensex 28% in 2017, while BSE’s Small cap and Mid cap indices outperformed with a gain of 60% and 48%. The market cap hit highest ever at Rs 157 lakh crore, making 2017 a memorable year. Among the sectoral indices, realty sector gained the most 112%, MNCs 54%, metals 49%, bank 41%, energy 40%, auto and FMCG 32%. Only pharma sector was a drag losing 5%, mainly due to US FDA import ban on API manufacturing plants of many pharma companies. Foreign institutional investors invested Rs 50,800 crores in 2017 while mutual funds saw a record inflow of Rs 1.17 lakh crore into equities, reflecting a sea change in the country’s traditional savings culture post demonetisation last year.

Investors shifted from traditional physical savings to financial savings into mutual fund schemes. The rupee appreciated by 5.5% in 2017, while India’s forex reserves surged to a new lifetime high of $404.92 billion.

All the major global markets are shut today on account of New Year. The key global events to watch this week are US ISM manufacturing PMI (Wednesday), ADP Non-Farm Employment (Thursday), US unemployment data and trade balance on Friday. India’s December month Nikkei Manufacturing PMI (Tuesday) and Nikkei Services PMI on Thursday.

In the last week summary, the Lok Sabha passed a Bill for goods and services tax (GST) cess hike on luxury vehicles from 15% to 25%, April-November 2017 fiscal deficit crossed 112% of the FY18 budgeted target on faltering GST collection. SBI approved raising Rs 8,000 crore via masala bonds to meet Basel III norms, small saving schemes interest rates cut by 20 bps, the government planned to borrow extra Rs 50,000 crore in the fourth quarter of 2018, resulting in spike in 10-year bond yield to 7.3%. Reliance Jio announced it will buy out Reliance Communicatons’s wireless assets in an all-cash deal.

Although the journey of 2017 was challenging due to a slow start post demonetisation and then GST implementation, which impacted the GDP growth, a second consecutive good monsoon triggered improved consumption-led demand and reversed the corporate earnings trend from the second quarter improvised GDP to 6.3% in the second quarter of fiscal 2018 and yet Nifty has delivered a 30% return in 2017. Going ahead in 2018, returns from equities are likely to moderate with volatility as investors will start 2018 by tracking earnings growth of the third quarter of 2018 because of a low base effect on account of demonetisation last year, early Budget speech this time in February and return of businesses to normalcy post six months of GST implementation, state elections. Finally, speculation about the 2019 elections will keep market more volatile in the second half of 2018 along with increasing macro concerns such as rising fiscal deficit, higher borrowings, faltering GST collections, rising crude and inflation.

Technically, Nifty has a bullish candle on the weekly chart by closing at the highest level; if it sustains above 10550 level, the rally can extend towards 10650-10700 while on the downside immediate support is at 10450-10400 zone.

The writer is VP-retail research, Motial Oswal Securities Ltd