The week started with enthusiasm on Gujarat election and positive global cues, but was short-lived.

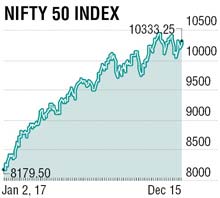

Nifty touched a low of 10141 on Thursday, post the second round of voting But with exit polls showing likely win for BJP, Nifty opened gap up and closed the week with a gain of 67 points at 10333.

Mid-cap and small-cap indices underperformed Nifty, ending in negative with a loss of 0.26% and 1%, respectively. IT sector gained 1%, in which OFSS rose 4% and Mindtree gained 3.6%. Media sector gained 0.5% led by Sun TV which jumped 3.6%, metals sector gained 0.5%, in which Vedanta gained 2.2% and Hindalco gained 1.25%. Realty sector lost 2%. Stocks like Maruti and HDFC Bank made their record highs. HDFC Bank plans to raise funds through QIP, stock surged to a record high of 1888. FIIs sold equities worth Rs 610 crore and DIIs were also sellers worth Rs 600 crore.

Last week the US markets surged to record highs, US Federal Reserve (Fed) raised interest rate by 25 basis points to 1.5% citing economic growth, lower inflation and lower unemployment data. European Central Bank kept interest rates unchanged at 0.50%. India July-September current account deficit came at 1.2% and 1.8% for 1HFY18, consumer price inflation reached to 15-months high at 4.9% and wholesale price inflation at 3.93% due to rising food and vegetable prices. The October Industrial Production rose 2.2% vs 3.8% in September on the back of slowdown in basic goods and consumer durables.

Last week the US markets surged to record highs, US Federal Reserve (Fed) raised interest rate by 25 basis points to 1.5% citing economic growth, lower inflation and lower unemployment data. European Central Bank kept interest rates unchanged at 0.50%. India July-September current account deficit came at 1.2% and 1.8% for 1HFY18, consumer price inflation reached to 15-months high at 4.9% and wholesale price inflation at 3.93% due to rising food and vegetable prices. The October Industrial Production rose 2.2% vs 3.8% in September on the back of slowdown in basic goods and consumer durables.

Key global events this week, Bank of Japan monetary policy and US 3Q GDP data will be announced on Thursday.

Gujarat election results will be the key trend decider for the markets and for upcoming 2018 state elections. YES Bank and IndusInd Bank will get included in Sensex replacing Cipla and Lupin.

Last week, till Thursday Nifty was on the downward trend touched low of 10141, the exit poll results triggered rally on short covering as well as fresh buying across the large cap stocks on the last day of the week and made high of 10373 forming a “Hammer” candle pattern on weekly scale which indicates that Bulls regained the charge. Nifty has been oscillating in a falling wedge from last eight weeks. Election results outcome will trigger further volatility with implied volatility levels which are already at very high price points ahead of event will subside in Nifty Option premium. A decisive hold above 10330 level can rally towards 10490 and 10650 levels while on the downside supports are shifting higher at 10150 and 10000 levels.

The writer is vice president-retail research, Motilal Oswal Securities Ltd