A surprise no-retaliation reaction by Russia post attack on Syria by the US, British and French forces previous weekend, oil prices surging to three year highs, Reserve Bank of India-Monetary Policy Committee (RBI-MPC) minutes release that suggested a hawkish undertone thus betraying the sentiments on the policy day, the rupee’s breach of 66 levels – these were key events last week.

The global equities rose modestly as commodities provided a shot in arm even as the surprise silence from Russia over Syrian attack was watched with interest. Oil prices touched three-year high following a sharp drop in the US inventories.

President Donald Trump criticised the OPEC saying oil prices are artificially maintained at these highs with dozens of oil tankers on high seas, waiting for a berth. The US Federal Reserve governors upped their call for firming rates amid signs of inflation and growth. The US notes jumped 11 basis point (bps) as a result to move past 2.90%.

Volatility still remains elevated although somewhat lower from previous weeks. The IMF data suggested global economy grew at 3.7% annualised in 2017 and is expected to grow at 3.9% pace this year, albeit marred by trade tensions. The IMF cited growing trade tensions and dangers of a shift toward protectionist policies, tightening financial conditions and geopolitical strains as potential downside risks.

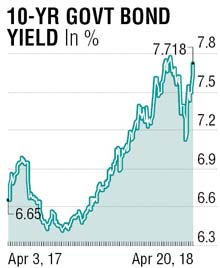

The Indian bond markets are back to the times that characterised the second half of FY2018. Yield moved past 7.70% in the benchmark bond as poor sentiment, largely driven by a more hawkish MPC minute than was perceived on the policy day, firming crude prices and weakness in currency spooked yields across tenors. Friday’s auction also showed surprise devolvement in the shorter end. Coming as it does at the start of the financial year, it will be quite a challenging task to complete auction calendar without severe disruptions.

RBI-MPC minutes suggested one more member joining the rate hike camp with Viral Acharya, deputy governor and a member of the panel, saying he would "decisively" vote for a "withdrawal of accommodation" in the next monetary policy meeting in June. MPC members voiced unequivocal concerns over the increase in minimum support prices for farmers and high and volatile crude oil prices, while the governor himself was seen as less hawkish, from the minutes. The rupee breached past 66 levels on strong demand and could be another reason to fuel in imported inflation. Overall, no respite for bond traders and investors.

There was, however, some cheer from the India Meteorological Department (IMD)’s forecasts that indicated normal rains this year and the probability of 2018 to be drought year was “very less”.

With liquidity being tight as seen from the sporadic spikes in Collateralised Borrowing and Lending Obligation (CBLO) rates and buying interest very low, there is fundamentally very little reason to jump into a buying mode. It is quite likely that Banks will continue to be seen as sellers as the regulatory permitted transfer from Held To Maturity (HTM) is still incomplete. Stale deeply out-of-money longs may still act as a hurdle for further acquisitions and traders may prefer to stay away almost totally. The weekly range is seen at 7.75-7.60%.

The writer is a market expert