The bygone weak was for the financial market records. Major US indices S&P 500, Nasdaq 100 and Russell 2000 had hit new record highs last week, bolstered by easing trade tensions, strong US economic growth, a multi-year high in consumer confidence and signs of optimism regarding a Brexit agreement. Indian indices also recorded highs before ending the week flat on renewed tensions over the US-Sino trade agreements.

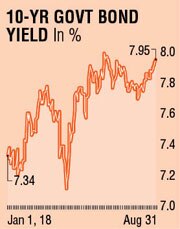

The yield on benchmark US treasury closed at 2.84%, up 2 points, while Indian benchmark closed at 7.95%, perilously close to the 8% mark amid weak and negative sentiments. Reserve Bank of India's (RBI) annual report predicted a strong recovery in growth. The Indian rupee touched its lowest level in recorded history as a larger than expected financial market crisis looms over Argentina and Turkey.

The high point for the week was a robust GDP growth for Q1 of the financial year 2018. Data released by the CSO showed the economy grew at a two year high and registered a year-over-year growth of 8.2% on account of strong performance in manufacturing and agriculture sectors. GDP at constant prices with 2011-12 base grew at 5.6%. Amid sharply weakening rupee, rising crude prices, widening trade deficit, external uncertainties in the form of global trade tensions and currency rout in some emerging market (EM) countries, the strong GDP data is heartening. Especially, global growth has turned into an uneven two-pronged gradient, where the US continues to be on an uptrend while Europe and China have reversed the trend in the last few quarters.

Of larger concern is the unidirectionally weakening Indian rupee, which has now slid more than 10% this FY. Rising crude prices, the economic crisis in Argentina (which now has the highest interest rates) and Turkey and ever-escalating trade tensions between major economies have had their prominent share in Indian Rupee's weakening. The investor community has unfortunately clubbed all CAD countries in the same basket and the risk of treatment has impacted India the most. The authorities also appear to be in agreement with the weakening rupee as INR gets tagged as the worst performing Asian currency. With strong GDP growth, endorsing a momentum in the economy, elevated crude prices and a sharply weaker domestic currency, it is highly probable that the RBI may look at a nudge in key benchmark rates in the October policy. Bond markets perhaps have read this a tad sooner and the recent test of 7.95% in benchmark 10-year yield is a testimony.

Of larger concern is the unidirectionally weakening Indian rupee, which has now slid more than 10% this FY. Rising crude prices, the economic crisis in Argentina (which now has the highest interest rates) and Turkey and ever-escalating trade tensions between major economies have had their prominent share in Indian Rupee's weakening. The investor community has unfortunately clubbed all CAD countries in the same basket and the risk of treatment has impacted India the most. The authorities also appear to be in agreement with the weakening rupee as INR gets tagged as the worst performing Asian currency. With strong GDP growth, endorsing a momentum in the economy, elevated crude prices and a sharply weaker domestic currency, it is highly probable that the RBI may look at a nudge in key benchmark rates in the October policy. Bond markets perhaps have read this a tad sooner and the recent test of 7.95% in benchmark 10-year yield is a testimony.

It is interesting to see a small increase in the FX reserves alongside a wreaking rupee. The annual report for the financial year 2017-18, released by RBI on Wednesday suggested a strong growth trajectory lay ahead for country's economy. While RBI's balance sheet grew by 9.49%, the fiscal year ended with a half-a-lakh crore surplus, almost 60% higher than the previous year.

In global markets, hectic parleying for the Nafta renegotiation, the US consumer confidence touching a 18-year high, prospects for a smoother than feared Brexit deal, China's attempts to arrest currency weakness (reintroduction of the 'countercyclical factor', a method regularly used in the past for managing currency levels) were the key points. Volatility remained elevated with the VIX index closing at 13.6. News that the Governor of Turkey's central bank contemplated resigning and Argentina's 15% increase in absolute terms of its key benchmark rates (it stands at 60% now) were other major events that spooked markets.

Indian bond yields threaten again to test 8%, driven by currency weakness. With strong GDP data that was released late on Friday, early opening in the week ahead should help cap bond yields. 7.90-8.00% range for the week ahead. The markets look askance for support both in terms of higher and regular open market operations (OMO) and a more accommodative liquidity stance.

The writer is a market expert