The week that went by should be notable for ‘return of volatility’ in markets. The seeming thaw in trade tensions proved temporary as the US imposes more tariffs on Chinese imports. S&P and other major indices continue to extend recent advance. The US treasury yields closed the week above 3% and have priced in almost all of an expected rate hike later in the coming week when the US Federal Open Market Committee (FOMC) meets. In a disappointing development for hawks, OECD lowers global growth outlook while the much expected Brexit summit ends in a stalemate.

For the Indian markets, it was redux-2008 for many on September 21 as mayhem ruled for a large part of the day across both bond and equity markets and the home currency was yet again in free-fall in response to sell-off in asset classes. The panic was triggered by some secondary market deals where the traded levels in corporate bonds were way too off from on-going levels, which raised concerns of a credit and liquidity crisis.

Global markets extended the bullish mood as many equity indices continued to rise. The strong expectations of a rate hike by the US central bank this week is seen as a response to strong economic growth. The crude prices rose sharply too, almost $3.50 during the week as reserves’ drawdown in the US and supply disruptions from Venezuela and Iran pushed prices of the liquid gold higher. The nemesis of financial markets these days, Turkish lire and Argentine peso traded soft on the back of sharp rate hikes in the recent past from respective central banks.

In other developments, the US increased the list of tariffs on Chinese goods and it now stands at $250 billion. And it doesn’t stop there. President Trump also threatened to impose additional tariffs if China retaliates. What is missed in mainstream financial media is that China has been stealthily reducing its holding of US Treasuries, which dropped to an eight-month low. Many attribute the recent yield-spike in the US treasuries to such a sale by PBOC. Interestingly enough, If the escalating US-China trade battle is a concern for markets, it is not showing up in prices. Both S&P 500 Index and Dow Jones Industrial Average both posted record highs on Thursday, accompanied by solid. Helping to sustain the rallies was solid high-frequency economic data and a continued drop in jobless claims to a fresh 49-year low.

In other developments, the US increased the list of tariffs on Chinese goods and it now stands at $250 billion. And it doesn’t stop there. President Trump also threatened to impose additional tariffs if China retaliates. What is missed in mainstream financial media is that China has been stealthily reducing its holding of US Treasuries, which dropped to an eight-month low. Many attribute the recent yield-spike in the US treasuries to such a sale by PBOC. Interestingly enough, If the escalating US-China trade battle is a concern for markets, it is not showing up in prices. Both S&P 500 Index and Dow Jones Industrial Average both posted record highs on Thursday, accompanied by solid. Helping to sustain the rallies was solid high-frequency economic data and a continued drop in jobless claims to a fresh 49-year low.

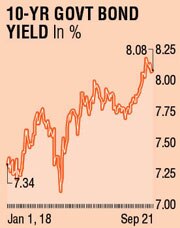

Indian markets haven’t found their place under the sun yet as the recent carnage in currency markets extended to equity and bond markets also. While bond yields have steadily been rising for almost a year now, calls for further sharp hikes in the coming October policy have become shriller. Announcements to calm panic in currency markets have not cut much ice as the measures have been seen as far too less to have a meaningful impact. The rate hike is seen as a more potent tool to check weakness in the rupee. At a time when inflation is low and well below the Reserve Bank of India’s (RBI) target range, it would require more than being pre-emptive if a rate hike were to happen. Cut-offs in the 91-day TBill and 1-year TBill yields have sharply risen. Bond spreads are all over the place.

An open market operation (OMO) auction went down without any impact. The system is now hostage to tighter liquidity (negative) and risk of a sharp rise in short-term money market yields. In such circumstances, the breakpoints are in corporate defaults and rating downgrades. We are seeing both. Benchmark bond yields closed softer last week. The correlation to currency markets is higher these days. As the rupee weakness has found a short-term reprieve, bond yields can be expected to hover closely around the 8.10% mark unless there is another repeat of a Friday like corporate mishap.

The writer is a market expert