A seeming thaw in the US-China trade tensions after China agreed to re-look into its "Make in China – 2025" industrial policy was the key point in global markets. European Central Bank (ECB) cried halt to its asset purchase program, probably more in realisation QE has not helped. Brexit still a work-in-progress event and maybe a lesson to all future separatist regimes. The Indian central bank governor Urjit Patel resigned in a most shocking development. The government appointed Shaktikanta Das as his successor immediately. Electoral reverses for the ruling party and governor resignation gave Indian markets possibly the most volatile session in recent memory. The week however ended well for all asset classes

The negative effects of protectionism appear to have already impacted the Chinese economy on the basis of recent data. Both industrial production and retail sales data are disappointingly subdued and may well be beginning of an end. Eurozone too had a similar story with a poor PMI report, especially in France. Looks like after an unsynchronised growth period in 2017-18, where the US and a few emerging market (EM) countries reported strong growth, the year 2019 will see a synchronised downturn across economies. ECB has already downwardly revised both its inflation and GDP growth forecasts for 2019 and 2020.

In the US, about a quarter of the US government will run out of funding as some recalcitrance on Trump's part to sign the funding bill raises a potential crisis which has now become an annual event. Brexit veering towards a boring event as more stalemates than breakthroughs is the order of the day. The week's ignominy, however, belonged to Emmanuel Macron as he must have had the worst time of his political career with violent protests in France as he struggles to balance the budget. France could soon be a millstone in ECB policy decisions.

The week ahead will see the US Federal Open Market Committee's (FOMC) meeting for a rate decision. Investors will inevitably be watching the next FOMC meeting very closely as a rate hike is a given event but soft inflation and commodity prices, especially oil, should shape the Federal Reserve's new approach. Opposed to what everyone believed some months ago, tightening will no longer be on autopilot mode in the US as in 2018. It is widely expected that financial conditions could remain easy resulting in a lower dollar and rates lower in the US.

The week ahead will see the US Federal Open Market Committee's (FOMC) meeting for a rate decision. Investors will inevitably be watching the next FOMC meeting very closely as a rate hike is a given event but soft inflation and commodity prices, especially oil, should shape the Federal Reserve's new approach. Opposed to what everyone believed some months ago, tightening will no longer be on autopilot mode in the US as in 2018. It is widely expected that financial conditions could remain easy resulting in a lower dollar and rates lower in the US.

In Indian markets, the surprise resignation of Dr Urjit Pater, RBI governor set the tone for a volatile week. Markets woke up to this news on the day when election results of state polls were also due. Markets suffered a double whammy of governor's resignation and electoral losses for the ruling party. However, some strong intervention aided by the announcement of successor governor calmed markets later in the week.

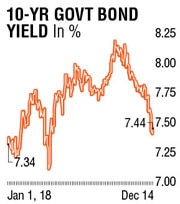

Indian bond yields have now moved to where the Financial Year started. At 7.40% for the benchmark its like a mean reversal. The markets have rallied on hopes that the new governor will favour an easy policy and apart from the promised liquidity-push measures, we could see a policy drift as well. Data on inflation has already ensured that a rate hike is off the table for now and the September NBFC-liquidity-crisis has already been calmed with abundant liquidity support in the form of OMOs. Open Market operations (OMO) on the buy side also result in a yield curve correction and sends signals on the future shape of the rate curve.

Towards that, the market is right in interpreting a flattening of the curve which means a bond-rally in the long end. As liquidity is likely to remain in supply-mode, duration chase may lead to lower yields. A test of 7.25% is on cards. 7.25-7.75% range will hold for the most part of the last quarter of FY19. Retail Inflation and Wholesale inflation came below estimates, auguring well for the rates market. Inflation has consistently undershot estimates in recent times. Maybe a course correction in policy direction could well be a possibility by February.

The writer is a market expert