Trade war spat continues as the US targets more tariffs on Chinese imports. The UK publishes a somewhat controversial Brexit blueprint, which showed that disagreement over the government’s approach was so severe that two of Theresa May’s most senior ministers, resigned in protest.

The plan proposes to keep the UK closely aligned with the EU rules on trade in goods while allowing the UK a freer hand on services. Global equities remained elevated despite the tensions with optimism that renewed talks may market sentiments. The US Treasury yields were a tad higher. Indian equities had a dream run with both Sensex and Nifty touchy lofty levels.

To start with, the bygone week witnessed more trade skirmishes with China retaliating with tariffs on the same amount of the US goods days after US tariffs of $34 billion on Chinese imports. In reality, though, China is apparently mindful of the risk of an anti-US backlash hurting the Chinese operations of US multinationals and resulting in job and revenue losses. Trade data released by China last week suggested widening Trade Deficit.

Indian markets had a satisfying close as equities scorched to record highs, bond yields dropped 5-7 basis points across the curve and the rupee gained by nearly a per cent from its recent lows. Retail Inflation (CPI) came in at 5%, much lower than market estimates, led by a drop in food inflation. Core inflation, however, rose in line the marginal increase in the underlying headline inflation. This could be the only risk as it could feed into wholesale inflation. The headline inflation is likely to come off in the next few months and remain in the range of 4.5-5% until the MSP impact seeps into prices.

Indian markets had a satisfying close as equities scorched to record highs, bond yields dropped 5-7 basis points across the curve and the rupee gained by nearly a per cent from its recent lows. Retail Inflation (CPI) came in at 5%, much lower than market estimates, led by a drop in food inflation. Core inflation, however, rose in line the marginal increase in the underlying headline inflation. This could be the only risk as it could feed into wholesale inflation. The headline inflation is likely to come off in the next few months and remain in the range of 4.5-5% until the MSP impact seeps into prices.

India’s May IIP came in at 3.2%, below market estimates. With manufacturing growth slowing down significantly, growing at 2.8%. The May IIP print was below consensus but momentum is likely to pick up in the coming months. The other dampening data was on Monsoon – which was 14% below normal as opposed to 19% for same period last year. There is still some months left for the catching up.

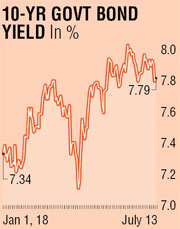

Bond markets breathed some hope with a mini-rally and broad-based value buying. The weekly auction went well with a full subscription. The 10-year benchmark yield moved close to the mid 7.70s and if the current momentum continues the yield could well test the 7.70 mark. Trading activity will start factoring in the August MPC decision in the coming weeks.

The writer is a market expert