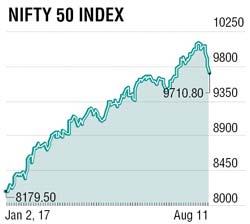

Bears finally turned the tide and severely mauled the bulls. Last week saw the Nifty ending at 9710.80, down 3.53%, falling on all five days. The broader indices Mid Cap 100 and Small Cap 100 shed around 6% each, indicating that the broad market was weaker than that indicated by the headline indices. Every sectoral index ended in the red, the main casualties being realty 9%, PSU banks 8.57%, media 7% and auto 6%. Among the Nifty stocks, Tata Steel added over 4% while most others were shattered. In auto, Tata Motors and Bosch were down 13% and 8%, respectively, following disappointing quarterly results, Eicher Motors fell 6% on profit-taking after its recent sharp rise. Pharma continued to ail with Sun Pharma off 11% and Dr Reddy's Laboratories 10% on disappointing results. Bank of Baroda fell 10% in anticipation of poor results and SBI declined 8% on mounting non-performing assets (NPA) worries. The Nifty has broken below its 50-day simple moving average (SMA) at 9774. The 100-day SMA is lower at 9538. For the August F&O series, the Nifty stands sandwiched between its pivot 9861 and support one at 9607.

Important events this week are China and euro zone industrial production (Monday), US retail sales (Tuesday), Euro GDP (Wednesday) and India WPI inflation and trade balance data (Monday). In the final stage of corporate earnings, companies like Coal India, Granules, Grasim will announce their first quarter results today.

The Nifty rally of creating new highs since last five weeks suddenly halted and reversed on increasing geopolitical tension between North Korea and the US, which melted all the global indices last week. Nifty saw its worst weekly decline in the last 18 months. India industrial production declined 0.1% in June 2017, worst in last four years as manufacturers reduced inventories ahead of GST rollout. In mid-term Economic Survey, inflation was projected to remain below 4% by March 2018, downside risk to FY18 GDP forecast 6.75% to 7.5% on various reasons like farm loan waiver, increasing stress in power, telecom and agricultural sectors. The rupee weakened 1% to 64.14 in last week post touching 63.58 levels recently. Last week FIIs sold shares worth Rs 2,516 crore while domestic institutional investors were buyers to the tune of Rs 4,500 crore.

This week, traders will await cues from the global developments and maintain a cautious stance to avoid any jerks as markets reopen on Wednesday (tomorrow being a holiday on account of Independence Day). In absence of any major events, the market will take cues from the global markets especially on geopolitical developments. For the week, volatility will still remain at higher levels, the Nifty trading range could be in the range of 9550-9900.

This week, traders will await cues from the global developments and maintain a cautious stance to avoid any jerks as markets reopen on Wednesday (tomorrow being a holiday on account of Independence Day). In absence of any major events, the market will take cues from the global markets especially on geopolitical developments. For the week, volatility will still remain at higher levels, the Nifty trading range could be in the range of 9550-9900.

Technical Outlook:

On the weekly charts, Nifty formed 'Bearish Engulfing' pattern as geopolitical tension surfaced. Nifty closed below its 50-day SMA for the first time since January 2017. However, Nifty still remains in a strong uptrend on the weekly scale. Major support on the immediate basis at 9680-9700, break below 9680 would mean more decline towards 9610-9550, can expect a bounce back up to 9880 if Nifty surpasses 9775 level.