Nomination of Jerome Powell as the new Federal Reserve Board chair, an expected rate hike by Bank of England, a smaller than expected bounce-back in US payroll numbers and a relentlessly surging equity markets across the globe, with Nifty testing new highs yet again, in reaffirmation that investors are pricing in strong and sustained growth in the months ahead.

Geopolitical tensions did rear its ugly head again with US military drills over North Korea while speculation is rife that the latter would welcome Trump’s Asian tour with a retaliatory strike.

The year long speculation as to who would succeed Janet Yellen as chairperson of the US Federal Reserve (Fed) Board ended with the nomination of Jerome Powell as the new incumbent. While the economists’ camp welcomed this move as Powell is seen as a well informed and highly respected professional, bond markets responded somewhat with chagrin as the spread between two- and 10-year yields narrowed to its lowest in 10 years in a sign that the curve could invert in the coming days. The curve is nearly flat now and is often perceived as a precursor to recession. The immediate interpretation is that the Fed may end up raising rates when there is no real inflation and the proposed three hikes in 2018 may stand to question.

On the data front, the US economy created 261,000 new jobs in October as the labour market rebounded nicely from disruptions linked to the twin hurricanes. Although the bounce-back was somewhat smaller than what economists had forecast, the unemployment rate fell to 4.1%, a 16-year low. Average hourly earnings disappointed, coming in unchanged versus the prior month, and rising at a 2.4% rate year over year, down from 2.8% last month. On the rate decision front, US FOMC left rates unchanged with sufficient hints that a hike is nearly a done when the committee meets in December. On the other hand, UK’s Bank of England’s hiked its policy rate from 0.25% to 0.5% this week, the first increase in more than 10 years. The move comes in reaction surge in inflation, largely because of weakness in the pound sterling that resulted in rising import prices post the Brexit move. Pound fell nearly 1% and bonds sold off in knee-jerk reaction.

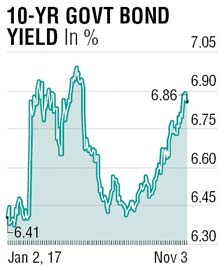

Indian bond yields finally showed a pause in its steady climb in the last few weeks. Data on fiscal deficit for September showed fiscal gap for the April-September period shrank by Rs 51,000 crore year on year and the April-September fiscal gap stood at 93.1% of FY18 budget target. There however was clear evidence that government had to cut expenditure, including on capex for a second month in a row, to control its fiscal deficit.

While this sort of reaffirms that the chances of a fiscal slippage are remote at this stage, it has still not changed the depressed sentiment in the bond street. Hopes of a rate cut are receding slowly and a possible hike by Fed in December and the recent hike by Bank of England will worry the doves among the bond investors in India. Volumes remain subdued and albeit good bid to cover ratio in auctions, the underlying sentiment is pretty weak.

For the week ahead, a test and break below 6.85% should lead to a move towards 6.78% with upside risks still present for a test of 6.93%. One might as well argue that 6.70-6.90% is the new normal range unless there is sufficient clarity that domestic economic conditions still beg lower rates.

The writer is a market expert