"In the land of the blind, the one-eyed man is king. We are a little bit that way,” said Raghuram Rajan, in April 2016 at an official gathering in Washington, US.

"Although social distancing separates us, we stand united and resolute. Eventually, we shall cure and we shall endure,” said RBI governor Shaktikanta Das, in April 2020, at a press conference, to enumerate steps being taken to fight Covid-19.

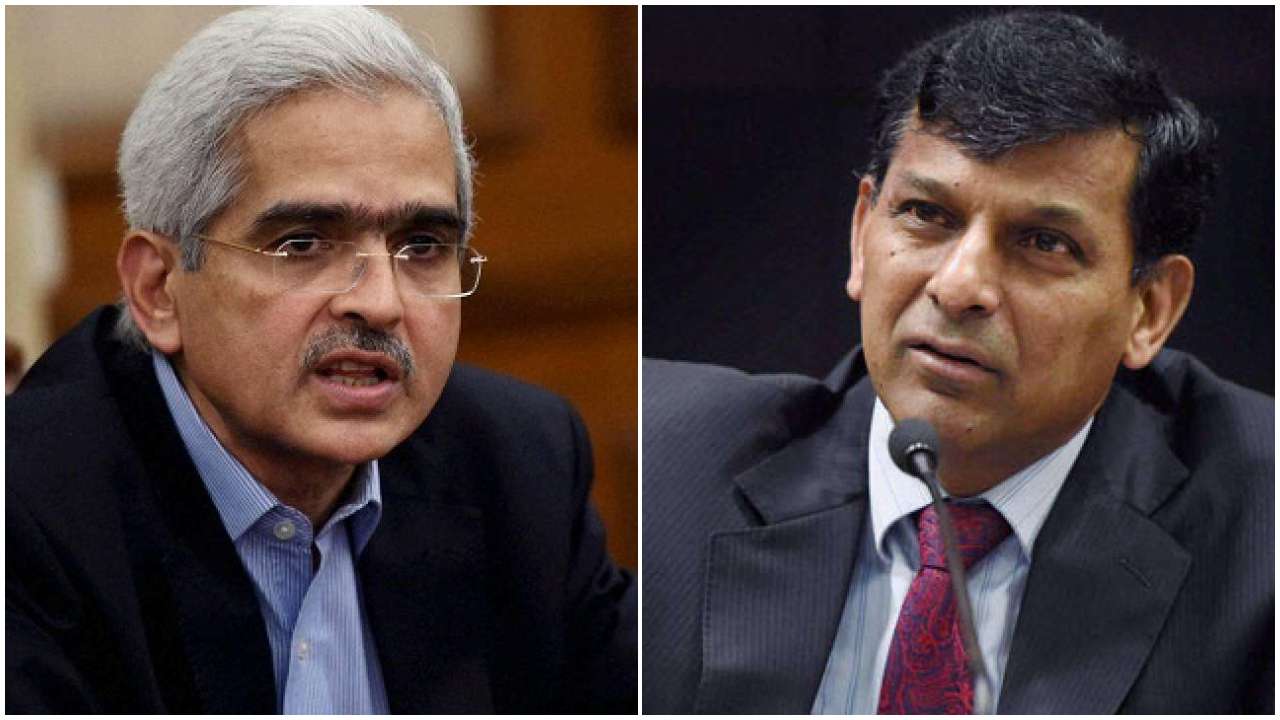

The above two statements showcase all that was embarrassingly wrong with Rajan who loved playing to the gallery and, all that is refreshingly right with the understated, yet determined, Das. Coming to Rajan, let it be told that modern-day central bankers are not like their counterparts of yore who were driven by just one singular agenda of controlling inflation by influencing aggregate demand, via the lever of interest rates. From Ben Bernanke to Janet Yellen and Jerome Powell at the Fed, from Mervyn King and Mark Carney to Andrew Bailey at the Bank of England, from Mario Draghi to Christine Lagarde at the ECB, central bankers have evolved in the last decade and a half. They understand that while inflation targetting is relevant, growth cannot be sacrificed at the altar of inflation management and this is where Rajan fumbled, faltered and tripped miserably. If India achieved an 8.2% growth in 2015-2016, it was not because of, but despite Rajan. A large part of the growth was due to massive public spending by the Modi government on rail, roads, infrastructure and social services.

It is true that interest rates alone cannot power an economy to grow. Equally, the role of interest rates cannot be undermined, more so when the global economy is going through severe slack and pump-priming by central bankers worldwide is the norm, not the exception. Rajan needs to take onus for the fact that his single-minded pursuit of controlling inflation, did more harm than good. A study of results of BSE-500 companies for 2015 shows that operating profit margins fell to 18% versus a 10-year average of 22%, thanks to high-interest costs which eroded profitability.

It must be brought to the notice of Rajan's fawning fans from leftist academia, how Rajan’s policy of elevated interest rates played a spoilsport. High-interest cost is equal to lower operating margins, lower operating profit, lower future Capex, lower jobs, lower purchasing power in hands of the consumer, lower household spending and lower private investments and lower GDP.

Rajan made unforgivable errors of judgement as a central banker and, repeatedly so. Nothing explains the fact that Repo rate stood at 7.5% after Rajan took over as RBI governor in September 2013, with oil prices at $112 per barrel and three years later in 2016, with oil at sub $50, Repo was still at 6.5%, down by just 100 basis points!Wholesale Price Index (WPI) was 7.5%, retail inflation at 11.47%, food inflation at 14.72% and bond yields at 8.5%,after Rajan took charge,in 2013. In June 2016, WPI stood at 0.8%, retail inflation was down to 5.7%&food inflation fell to 7.8%, but guess what? Bond yields were still exceptionally high at 7.5%, when ideally, they should have been far, far lower.

That is the whole point---the cost of money should have fallen significantly in line with falling inflation but that simply did not happen, as Rajan doggedly chose to keep interest rates artificially high and that is unforgivable, as elevated interest rates hurt the micro, small and medium enterprises, the most. And it is not just the industry, elevated interest rates are debilitating for the average salaried middle-class taxpayer too. Once headline inflation ebbed, Rajan should have abdicated his hawkish approach so that personal loans, housing loans, auto-loans et al, could have fallen sharply. But Rajan continued being a hawk and worse, he was always in a flamboyant mode, applying cowboy-style economic theories, without understanding ground realities.

Rajan is a jaded, overrated textbook economist who forgot that monetary policy which is divorced from public policy and global environment is meaningless. Rajan lowered the Repo rate by 150 basis points over an agonizingly long period of 17 months between January 2015 and April 2016, complaining that he was going slow because of lack of monetary transmission by banks, forgetting that rate cuts work with a lag of six months to nine months. Rule of thumb suggests, when a rate cut cycle starts, the cuts should be swift and chunky, to have the desired impact but alas, Rajan chose a lethargic approach.

Rajan chose hubris and inflation targetting over all else, even as core inflation ebbed. Again, monetary policy is supposed to tackle demand-side issues, which Rajan failed to take cognisance of. Rajan grudgingly tackled the NPA mess by merely tweaking the NPA recognition norms only mildly and again, it was too little, too late. Also, do not forget that while Rajan became RBI governor only in 2013, he had enough clout as the economic advisor to the Congress led UPA government of Manmohan Singh, between 2008 and 2013. The crux of the NPA problem actually started in 2008, wherein NPAs burgeoned from Rs 53000 crore to Rs 2.4 lakh crore in 2013, a massive jump of 352%!

Why, therefore, should Rajan, as the economic advisor to the then UPA government, not take any blame for the genesis of the NPA mess, which unfolded right in front of him? Stressed assets within the banking system were a huge problem in 2008. One fails to fathom why Rajan waited till 2012-2013 before he decided to even remotely acknowledge the problem of NPAs? By 2013, stressed assets were already 9.2% of the total outstanding loans in the banking system, but Rajan kept pussyfooting on this issue, with no clear NPA resolution plan. Why? At whose behest did Rajan choose to keep a stoic silence. Was it at the behest of his mentor, the much disgraced, out on bail, ex-finance minister, P.Chidambaram? Was it at the behest of Manmohan Singh, who did precious little in his tenure, in any case? These are pertinent questions that merit a response. In fact, the credit for resolving the poor legacy of NPAs left behind by the Congress and Rajan goes singularly to Prime Minister Narendra Modi's masterstroke--the Insolvency and Bankruptcy Code (IBC).

Coming back to Rajan, he has always been hungry for media attention and is a vociferous and glib talker, under the glare of cameras. Speaking out of turn and out of context, are "virtues", he is equipped with. Hence his uncanny silence on the NPA mess that festered right under his nose, during the Congress-led UPA dispensation, is both inexplicable and worrisome. After quitting the RBI, of course, Rajan has been making unwanted statements about his tenure under the Modi government, giving unsolicited advice on what should be done and what should not have been done. For instance, a few days back, he said, India post Covid-19, would need a new covenant for growth or it would "crawl", reminding one of the famous adages--'It is so much easier to be smarter in hindsight".When he had the opportunity, Rajan missed it and completely lost the plot. Shaktikanta Das, on the other hand, is doing a pretty good job of the mandate given to him. Proactive measures to fight the emerging challenges from the Coronavirus pandemic, taken by the RBI, with Das leading from the forefront, are enlisted below.

Measures by Das (TLTRO) 1.0

In his statement on March 27, 2020, Das indicated that RBI’s liquidity injection was about 3.2% of GDP, since the February 2020 MPC meeting. Systemic liquidity surplus, in fact, averaged at a healthy Rs. 4.36 lakh crore during the period March 27- April 14, 2020. As announced on March 27, the RBI undertook three auctions of targeted long term repo operations (TLTRO), injecting cumulatively Rs. 75041 crore to ease liquidity constraints in the banking system and de-stress financial markets. Another TLTRO auction of Rs.25000 crore was conducted on April 17. In response to these auctions, financial conditions eased considerably, activity in the corporate bond market picked up appreciably, with several corporates making new issuances. Reduction in the cash reserve ratio (CRR) from 4% to 3%, TLTRO 1.0 to the tune of Rs 1 lakh crore and hike in MSF limit from 2% of statutory liquidity ratio (SLR) to 3%, amounting to a stimulus of Rs 3.74 lakh crore or 1.87% of GDP, were timely measures by Das, to fight back Covid-19.

Liquidity Management

The RBI, under Das, moved in a studied fashion to ensure conducive financial conditions and normalcy in the functioning of financial markets and institutions. The initial efforts to provide adequate system-level liquidity were reflected in the sizable net absorptions under reverse repo operations. With this achieved, the RBI undertook measures to target liquidity provision to sectors and entities which were experiencing liquidity constraints and/or hindrances to market access. Long term repo operations (LTROs) to ensure adequate liquidity at the longer end of the yield curve, exemptions from the cash reserve ratio for the equivalent of incremental credit disbursed by banks as loans in certain select areas/segments and targetted LTROs or TLTROs, fell in this class of sector-specific measures.

(TLTRO) 2.0

RBI decided to conduct targeted long-term repo operations (TLTRO 2.0) for an aggregate amount of Rs 50000 crore, to begin with, in tranches of appropriate sizes. The funds availed by banks under TLTRO 2.0 should be invested in investment-grade bonds, commercial paper, and non-convertible debentures of NBFCs, with at least 50% of the total amount availed, going to small and mid-sized NBFCs and MFIs. As in the case of TLTRO auctions conducted hitherto, investments made by banks under this facility would be classified as held to maturity (HTM) even in excess of 25% of total investment permitted to be included in the HTM portfolio. Exposures under this facility will also not be reckoned under the large exposure framework( LEF).

Refinancing Facilities for All India Financial Institutions (AIFIs)

All India financial institutions (AIFIs) such as the National Bank for Agriculture and Rural Development (NABARD), the Small Industries Development Bank of India (SIDBI) and the National Housing Bank (NHB) play an important role in meeting the long-term funding requirements of agriculture and the rural sector, small industries, housing finance companies, NBFCs and MFIs. These AlFs raise resources from the market through specified instruments allowed by the Reserve Bank, in addition to relying on their internal sources. In view of the tightening of financial conditions in the wake of the COVID-19 pandemic, these institutions were facing difficulties in raising resources from the market. Accordingly, it was decided by Das, to provide special refinance facilities for a total amount of Rs. 50000 crore to NABARD, SIDBI and NHB to enable them to meet sectoral credit needs. This will comprise Rs. 25000 crore to NABARD for refinancing regional rural banks (RRBs), cooperative banks and micro finance institutions (MFIs); Rs. 15000 crore to SIDBI for on-lending/refinancing; and Rs. 10000 crore to NHB for supporting housing finance companies (HFCs). Advances under this facility will be charged at the RBI’s policy repo rate at the time of availment. Rs. 50000 crore of TLTRO 2.0, along with the refinancing facility of Rs. 50000 crore to NBFCs and another special liquidity facility for mutual funds (SLF-MF), for Rs. 50000 crore, to ease redemption pressures, working out to a total of Rs. 1.5 lakh crore or 0.75% of GDP, have been calibrated measures by Shaktikanta Das, to ensure financial stability.

Liquidity Adjustment Facility

The surplus liquidity in the banking system had risen significantly in the wake of government spending and the various liquidity enhancing measures undertaken by the RBI. On April 15, the amount absorbed under reverse repo operations was Rs 6.9 lakh crore. In order to discourage lazy banking and encourage banks to deploy these surplus funds in investments and loans in productive sectors of the economy, Das decided to reduce the fixed-rate reverse repo rate under the liquidity adjustment facility (LAF) by 25 basis points from 4.0% to 3.75%, with immediate effect. Remember, the policy Repo had been reduced from 5.15% to 4.4%, in one fell sweep on March 27. With the reduction in Repo to 4.4%, the marginal standing facility (MSF) rate and the Bank Rate also fell from 5.4% to 4.65%.

Ways and Means Advances for States

On April 1, 2020, the RBI announced an increase in the ways and means advances (WMA) limit of states by 30%. It was decided to increase the WMA limit of states by 60%, over and above the level as on March 31, 2020, to provide greater comfort to the states for undertaking COVID-19 containment and mitigation efforts, and to plan their market borrowing programmes better. The increased limit will be available till September 30, 2020.

Regulatory Measures

On March 27, 2020, the Reserve Bank announced certain regulatory measures to mitigate the burden of debt servicing brought about by disruptions on account of COVID-19 and to ensure the continuity of viable businesses.

Asset Classification

On March 27, 2020, the RBI permitted lending institutions (LIs) to grant a moratorium of three months on payment of current dues falling between March 1 and May 31, 2020. It was recognized that the onset of COVID-19 had exacerbated the challenges for such borrowers, to honour their commitments that had fallen due on or before February 29, 2020, in Standard Accounts. Therefore, Shaktikanta Das decided that in respect of all accounts for which lending institutions decided to grant moratorium or deferment, and which were standard as on March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there would be an asset classification "standstill", for all such accounts from March 1, 2020, to May 31, 2020. NBFCs, which were required to comply with Indian Accounting Standards (IndAS), may be guided by the guidelines duly approved by their boards and as per advisories of the Institute of Chartered Accountants of India (ICAI) in recognition of impairments. In other words, NBFCs were given the flexibility under the prescribed accounting standards, to consider this needed relief to their borrowers. With the objective of ensuring that banks maintain sufficient buffers and remain adequately provisioned to meet future challenges, they would have to, however, maintain the higher provision of 10% on all such accounts under the standstill, spread over two quarters, i.e., March 2020 and June 2020. These provisions can be adjusted later on against the provisioning requirements for actual slippages in such accounts.

Liquidity Coverage Ratio (LCR)

The Reserve Bank has been proactively taking measures to address the systemic liquidity issues through a slew of monetary and market operations. In order to ease the liquidity position at the level of individual institutions, the LCR requirement for Scheduled Commercial Banks was brought down from 100% to 80%. The requirement shall be gradually restored back in two phases – 90 per cent by October 1, 2020 and 100 per cent by April 1, 2021.

NBFC Loans to Commercial Real Estate Projects

In terms of the extant guidelines for banks, the date for commencement for commercial operations (DCCO) in respect of loans to commercial real estate projects delayed for reasons beyond the control of promoters, could be extended by an additional one year, as per the decision taken by RBI, under Das, over and above the one-year extension permitted in the normal course, without treating the same as restructuring. Das also decided to extend similar treatment to loans given by NBFCs to commercial real estate.

Conclusion

In the final analysis, Raghuram Rajan, for all his well-crafted poise, failed in his stint as RBI governor, by simply not being able to strike the much-needed poise between growth and inflation. He let down the dignity of the sensitive position he occupied at RBI's famous Mint Street office, by getting into needless controversies with North Block and whipping the media into a frenzy at regular intervals, with his controversial statements, which were simply not befitting of either his stature or, the chair he held.

Prime Minister Narendra Modi, in his trademark style, complete with extraordinary grace, tolerance and statesmanship, never reacted to provocative and misguided remarks by Rajan. Shaktikanta Das, in sharp contrast to both Rajan and the equally forgettable, Urjit Patel, goes about his business at RBI, with a studied, professional,business-like approach, never stepping out of the line and maintaining harmonious relations with North Block.

Both Raghuram Rajan and Rajan's acolyte and former deputy governor of RBI, Viral Acharya, who quit in June 2019, after complaining about lack of autonomy at RBI, have been cut from the same cloth. Theirs was presumably, a case of rank insubordination, bordering on gross unprofessionalism. Why is it so difficult for anyone to understand that despite the autonomy it enjoys, the RBI is within and not outside the Indian financial system. The RBI does not function in isolation. Surely, autonomy cannot be a reason to always be at loggerheads with North Block or South Block, on frivolous grounds! There is a thin line between constructive criticism and puerile recklessness--institutional autonomy needs to be respected and not used as a tool to mock the popular mandate represented by those driving policymaking, from South Block.

If India, under Prime Minister Narendra Modi, overtook France to become the 6th largest economy globally in 2019 and the 5th largest in February 2020, it is despite career fascists like Rajan and Acharya. If anything, the resilience of democratic institutions that had been selfishly compromised under a Congress-led UPA dispensation for decades has only strengthened in the last six years, because Modi is a leader, who is supremely secure and confident in his own skin.

Ms Sanju Verma is an Economist, Chief Spokesperson for BJP Mumbai and Author of the Bestselling, "Truth & Dare--The Modi Dynamic".