Modinomics is not merely an economic philosophy but a tremendously powerful idea that is progressive,wealth-creating, egalitarian, welfarist, capitalist, meritocratic and entrepreneurial. More importantly, Modinomics is about technological prowess, optimum utilisation of resources, accountability and of course, empowering those who need it most, on the lines of Pandit Deen Dayal Upadhyaya's concept of "Antyodaya", which beliefs in "the last mile, the last citizen, the last house".

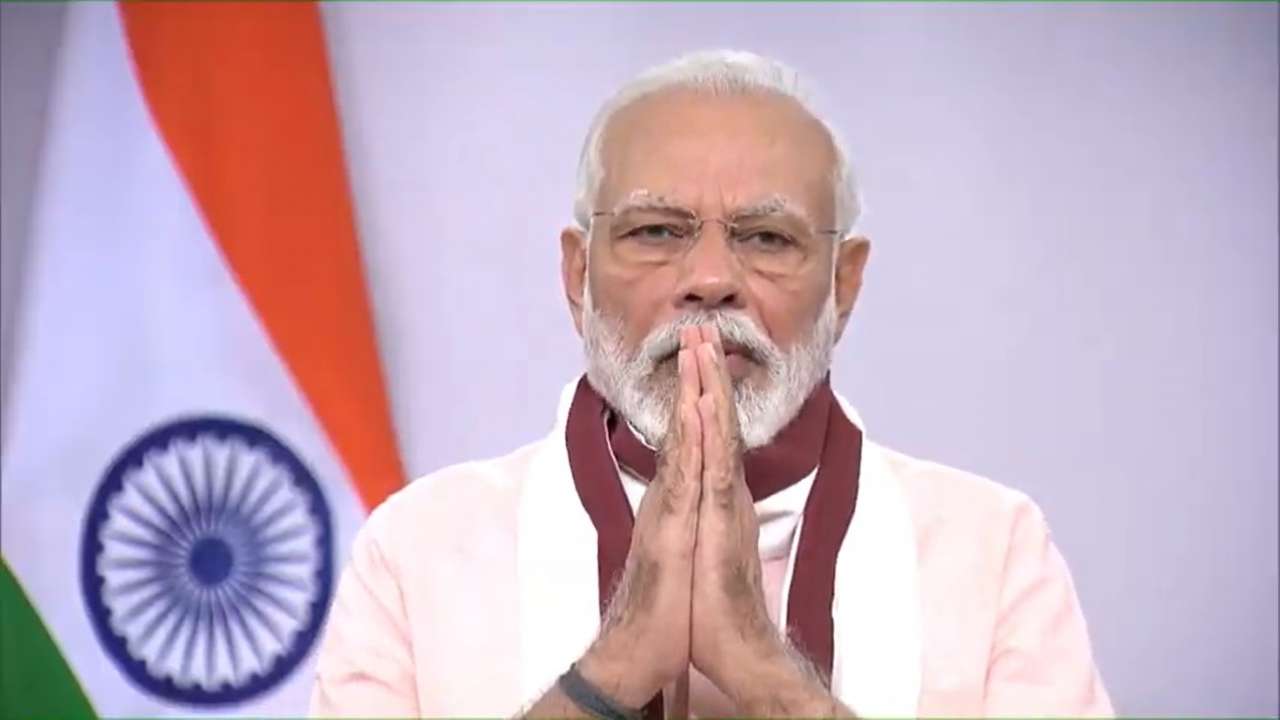

Even as the Coronavirus pandemic brings the mightiest economies to a grinding halt, Prime Minister Narendra Modi, undeterred by the enormity of the challenge, unleashed a Rs 20.97 lakh crore, the mega stimulus package, akin to roughly 10.48% of India's GDP. Also, Modi used this opportunity to give a huge fillip to the process of economic reforms that have been steadfastly underway, for the last 6 years. The plan for a self-reliant India, or "Aatmanirbhar Bharat", aims to focus on land, labour, liquidity and laws.

There are almost 67 million MSMEs operating in the non-agricultural sector in India, both unorganised and organised. Nowhere in the world is there such a large number of enterprises. Of these, almost 96.7% are micro or unorganised, employing less than 10 workers. Only 3.3% of all non-agricultural enterprises in India employ more than 10 workers, but much of the leftist media is ignorant about hard facts. Modi, acutely aware of the vices plaguing these micro-enterprises, has announced a plethora of reforms, both short term and long term in nature, to help MSMEs.

Tranche 1: MSME Related Measures

1) An emergency,collateral-free, automatic, credit line of Rs. 3 lakh crore for MSMEs from Banks and NBFCs, will be made available. The credit line will be up to 20% of all outstanding credit as on February 29, 2020, with a tenure of 4 years and a 12-month moratorium on the principal payment. This scheme is available until October 31, 2020. There will be no guarantee free, no fresh collateral required. 45 lakh MSMEs will benefit from this move.

Some have claimed that since this collateral-free facility is only for MSMEs with Rs 25 crore outstanding and a Rs 100 crore turnover, it is not material.

That is an entirely wrong assumption, though. There is also a clamour for interest on loans to be waived off rather than simply having a temporary moratorium on term loans and working capital loans taken by MSMEs. But such demands are impractical as banks are in the business of commercial lending. Weakening the very innards of our financial system, born out of summary waivers and write-offs, that eventually led to the NPA mess, is the worst legacy of the Congress-led UPA. The Modi government is hence, doing absolutely the right thing by not playing to the gallery on this count. A subsidy of roughly Rs 45,000 crore would be needed for a partial waiver of 50%. But in any case, MSMEs do not have reasons to complain, as the various measures listed below are far wider in scope, compared to what a flat dole out of Rs 45,000 crore would have achieved!

2) Also, stressed MSMEs will get Rs 20,000 crore of subordinate debt. Under this scheme, promoters will be given debt by banks, which will then be infused into the MSME as promoter equity.MSMEs which are stressed or classified as NPAs will be eligible for this. The government will buy the investment-grade (not high-quality) debt of non-banking finance companies (NBFCs), including HFCs and MFIs (micro-finance institutions) to the tune of Rs 30,000 crore. It will be a special liquidity scheme, fully guaranteed by the government and will particularly, benefit the housing sector.

3) MSMEs will be able to avail benefits of additional equity infusion of up to Rs 50,000 crore via "Fund of Funds".This "Fund of Funds" will be set up with a corpus of Rs 10,000 crore and will be operated through a "Mother Fund" and a "Daughter Fund".This move will also help in expanding the universe of MSMEs and encourage them to get listed on stock exchanges.

4) The Modi government has also given a new definition of MSMEs, which increases the threshold limit for investment in these units. The new definition will be both investment and turnover based. This move will help the MSME sector to expand their operations while still availing the benefits of MSME classification. The government needs Parliament nod to amend the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006. With parliament not in session, it will bring an ordinance.

As per the revised definition announced on May 13, 2020, any firm with investment up to Rs 1 crore and turnover under Rs 5 crore will be classified as "micro". A company with investment up to Rs 10 crore and turnover up to Rs 50 crore will be classified as "small" and a firm with investment up to Rs 20 crore and turnover under Rs 100 crore will be classified as "medium". On May 19, 2020, this definition was further revised, to raise the Rs 20 crore investment (criteria) to up to Rs 50 crore and turnover (limit) from Rs 100 crore, to up to Rs 200 crore.

5) The Indian government will now disallow tenders up to Rs 200 crore from foreign companies. The move is aimed at protecting MSMEs from unfair competition from foreign entities. Small units can now participate in the process of government purchases.

6) E-market linkage will be provided across the board, as meals, trade fairs etc., will get rarer in the post-COVID world. All the pending dues from the government or government-owned companies will be cleared in the next 45 days.

7) Reduction of tax deducted at source (TDS) and, tax computed at source (TCS) rates by 25% on non-salaried payments, will set free additional cash in the hands of vendors, professionals and businesses and will help increase liquidity in the economy. While some claim this is merely a cash flow adjustment, with no real reduction in the final tax burden, the fact is, more cash in hand, clearly, does matter.

8) State governments and real estate regulatory authorities will be allowed to leverage "force majeure" provisions and will be exempted from the need to obtain a fresh registration certificate or renegotiate contracts with their buyers, for an additional 6 months. These measures will go a long way in protecting jobs and ensuring income continuity. This, in turn, will have a positive bearing for potential homebuyers, especially in the affordable and mid segments.

9) Another significant measure is, allowing contractors involved in highway/infrastructure construction to avail a standstill period of 6 months, without any penalties.

10) The Modi government provided a Rs 90,000 crore bailout, to cash-starved electricity distribution companies (DISCOMs) and cash strapped independent power producers (IPPs).

11)To ensure greater liquidity in the hands of people, PF contribution of both employer and employee will be reduced to 10% each, from existing 12% each, for all establishments covered by EPFO for the next three months, till August 2020, amounting to liquidity support of Rs 6,750 crore. This will provide relief to about 6.5 lakh establishments covered under EPFO and over 4.3 crore employees. Unfortunately, large remnants of an ignorant opposition and an equally ignorant leftist media, are yet to understand the true impact of this very timely measure.

The central public sector enterprises (CPSEs) and state public sector undertakings (PSUs) will, however, continue to contribute 12%, as the employer contribution. This benefit is available for all establishments covered under the provident fund law, except those employees for whom support of provident fund (PF), the contribution is already provided under "PM Garib Kalyan" package. The EPF support essentially covers all those establishments who have less than 100 employees, with 90 % of those employees earning less than Rs 15,000 per month. Over 12 lakh employees have availed Rs 3,600 crore under this scheme.

Under this scheme, employees provident fund organisation (EPFO) subscribers can now, via, para 68 L (3) of the EPF Scheme, withdraw on a non-refundable basis,75% of their savings or up to a maximum of three months' basic pay and dearness allowance from their PF account, whichever is lower.PF contribution is calculated at 12% of basic wages + dearness allowance + retaining allowance.

Previously, the rate of 10% was applicable to establishments with less than 20 employees, sick industries, establishments where losses exceed networth, jute, beedi, brick, coir and gum industries. Expanding the scope of the 10% EPF support scheme, was, therefore, a much-needed measure.

Undeniably, the aforesaid eleven measures will help MSMEs to get back on their feet, as additional collateral and guarantee-free loans, equity funding options, better access to government procurement, e-market linkage and higher thresholds, are all strong enablers that will enable MSMEs to take centre stage, in making India "Aatmanirbhar" (self-reliant).

It would be apt to note here that, during the coronavirus-induced lockdown, Rs 16,394 crore has been paid to 8.19 crore farmers under the auspices of the "PM Kisan" scheme. Old-age beneficiaries and others have been paid the first instalment of Rs 1,405 crore and the second one of Rs 1,402 crore. As much as Rs 10,025 crore has been transferred to 20 crore women "Jan Dhan" account holders. Also, 6.81 free LPG cylinders have been given to the poor.

Apart from SMEs, the Modi government announced a plethora of measures for farmers and migrant workers, too. Over 3 crore farmers have already benefitted from Rs 4.2 lakh crore of loans given to them. Interest subvention and prompt repayment incentive on crop loans, due from March 1, 2020, onwards, have been extended up to May 31, 2020. 25 lakh new "Kisan Credit Cards" were sanctioned with a loan limit of Rs 25,000 crore in the last 2 months alone.

Central govt released Rs 11,002 crore in advance, to states, for helping states to set up shelters for migrant workers and provide them food. 12,000 self-help groups (SHGs) at urban centres comprising urban poor have produced 3 crore masks and 1,20,000 litres of sanitisers. 7,200 new SHGs of urban poor have been formed, during the lockdown period starting March 15, 2020.

For migrant workers who have returned to their homes, work is being made available through the MGNREGS. Till May 13 2020, 14.62 cr man-days of work had been generated. Work was offered to 2.33 crore wage seekers on a single day on March 12, 2020, in 1.87 lakh gram panchayats. 40-50% more workers were given work, compared to May 2019. Annual expenditure till date on migrant workers, by the Modi government, is Rs 10,000 crore. Average wage rate has risen to Rs 202, from Rs 182 in last fiscal.

Keeping in mind the gravity of the Covid-19 situation, a total of nine steps were announced recently, for migrant workers, MUDRA loanees, street vendors, tribals and small farmers.

Tranche 2: Measures For Migrants, Small Farmers & Street Vendors

1) Free Food: For those migrants who don't have National Food Security Act (NFSA) cards, 5 Kgs of wheat or rice per person and 1 Kg chana, per month, for next two months, will be provided. This will entail an outlay of Rs 3,500 crore and benefit over 8 crore migrants.

2) One Nation, One Ration Card: Portable PDS or universal ration cards can now be used in ration shops across the country. By August 2020, 67 cr beneficiaries or 83% of all PDS beneficiaries will get covered. By March 2021,100% will be covered, which is nothing short of outstanding.

3) Rental accommodation: Under "PM Awas Yojana", incentives will be offered to the private sector to develop affordable housing and convert vacant government-funded houses into affordable housing complexes for migrant workers, via the PPP mode.

4) MUDRA Shishu Loans: For those who have availed loans up to Rs 50,000, an interest subvention of 2% for the next 12 months, will be given, after the moratorium period extended by RBI ends. 3 crore people will get benefits of Rs 1500 crore.

5) Street Vendors: Special fund of Rs 5,000 crore for street vendors, will be made available, by giving each of them Rs 10,000 as working capital.

6) Affordable Housing: Credit linked subsidy scheme (CLSS) for middle-income households in the income group Rs 6-18 lakh per annum, has now been extended to March 2021. The CLSS scheme was initially operationalised from May 2017 and extended up to March 2020. Now, it has been extended till March 2021. This will lead to investments of Rs 70,000 crore in housing and kickstart sectors like steel, cement and create jobs.

7) For Tribals: Rs 6,000 cr worth of Compensatory Afforestation Fund Management and Planning Authority,(CAMPA), funds will be deployed to provide employment to tribals in forest management, wildlife protection and other forest-related activities.

8) For Small/Marginal Farmers: The government will be providing Rs 30,000 crore of additional capital emergency funds through National Bank of Agricultural and Rural Development (NABRD), for post-harvest Rabi and Kharif related activities for small and marginal farmers. This is over and above the Rs 90,000 crore to be provided by NABARD through the normal refinance route for this fiscal year. This facility will be a front-loaded, on tap facility, to 33 state cooperative banks, 351 district cooperative banks and 43 Regional Rural Banks (RRB). This will help over 3 crore farmers - mostly small and marginal.

NABARD has already provided refinancing worth Rs 29500 crore to Regional Cooperative Banks and Regional Rural Banks, in March 2020 alone.63 lakh loans worth Rs 86600 crore were approved in the agriculture sector between 1 March 2020 and 30 April 2020, as liquidity support measures, underpinning Prime Minister Narendra Modi's unflinching commitment to the cause of India's "Annadaata".

9) PM Kisan Credit Card: Rs 2 lakh crore of concessional credit to boost farming activities will benefit 2.5 crore farmers. Those in animal husbandry and fisheries will also be included.

It is worth mentioning here that, the Rs 1.7 lakh crore welfare package announced on March 26 2020, under the "Pradhan Mantri Garib Kalyan Yojana", to help the poor&marginalised, including migrant workers, has already transferred cash& incentives worth over Rs 52,606 crore, to over 41 crore people.

Apart from SMEs, migrant workers and small farmers, the Modi government's unwavering commitment to structural reforms across eight key sectors -- coal, minerals, defence, power, civil aviation, space, atomic energy and social infrastructure, are truly commendable. An ordinary leader would have shied away from taking a headlong and risky, deep dive into unchartered waters. But Narendra Modi is as extraordinary as they come and the good part is, he is acutely aware of the emerging recalibration that the post-COVID global order, will bring about. With that in mind, on May 15 2020, Modi did the unexpected but something only a leader of his towering stature could have pulled off, or even dated to attempt, by deciding to defang the outmoded APMC and Essential Commodities Act!

Tranche 3: Historic Agri-Reforms

1) The BJP led Modi government decided to defang via an amendment, both, the "Essential Commodities(EC) Act" and the outdated agricultural produce market committees (APMCs). "The EC Act" will be amended to deregulate trade in cereals, edible oils, oilseeds, pulses, onions and potatoes and stock limits for these will be imposed only in exceptional circumstances like say, national calamities.

2) A new central law will be formulated to provide barrier-free inter-state trade for farm produce and more freedom for farmers to sell directly or even online, will be permitted, so that they do not have to sell to only licensed entities like APMCs which are in turn, governed by "Market Committees", that work like oligopolistic trade cartels. Whom to sell, in kind or via e-trade,when to sell, how much to sell and where to sell, will now be the sole preserve of farmers and they will not be dictated by corrupt middlemen or commission agents. The third tranche dealing with the farm sector package to free up India’s fragmented agriculture market from trade curbs and stock limits, while offering a new framework to reduce risks and price uncertainties, has redefined the very ethos of the Indian farm sector, in an unprecedented manner.

3) Moreover, post these amendments, the central law will prevail, as agriculture is in the concurrent list. Hence, even those states that have not carried out APMC reforms in the past, will now mandatorily have to follow the central framework on this count. A separate legal framework will also be created to enforce a standard mechanism for predictable prices of crops, especially during the sowing season. Farmers will be able to engage with food-processing companies, retailers and exporters, and get assured returns or a fixed price for their produce.

4) The Rs 1.5-lakh-crore package in the 3rd tranche, which allows contract farming, seeks to strengthen farm gate infrastructure and logistics for the sector and build capacities for intervention if needed. It will include a Rs 1 lakh crore financing facility through National Bank for Agriculture & Rural Development (Nabard) for funding agriculture infrastructure projects at the farm gate and aggregation points for cooperatives and farmer producer organisations (FPOs), agriculture entrepreneurs and startups. This will immediately address funding gaps in the supply chain, contribute in shaping a competitive Agri value chain, boost Agri marketing, reduce wastages and, raise farmer incomes.

5) The government will also set up a Rs 20,000-crore fund, to support aquaculture and fisheries. A separate Rs 15,000-crore fund is proposed for animal husbandry infrastructure as well as Rs 4,000 crore to support herbal cultivation. Rs 500 crore for beekeeping and Rs 500 crore for strengthening supply chains, has also been provided for.

Tranche 4: Defence, Mining and Aviation

1) The reforms in the 4th tranche, including some very significant ones such as allowing commercial coal mining, raising foreign direct investment (FDI) in defence manufacturing units to 74%, from 49% under the automatic route, corporatisation of the "Ordnance Factory Board", easing of restrictions on Indian air space and privatisation of six more airports via the PPP mode, are game-changers. The additional investment by private entities in 12 airports, already bid out in the first two rounds, is expected to generate around Rs 13,000 crore.

2) In order to encourage domestic manufacturing of defence equipment, the government will prepare a notified list of weapons and platforms that will not be imported and, the list will be increasingly expanded to boost local manufacturing. Also, the government’s decision to open up air space for commercial flights would help airlines save about Rs 1,000 crore in terms of operational costs. Currently, only 60% of domestic airspace is freely available.

3) Fiscal support of Rs 50,000 crore for coal infrastructure development, Rs 8,100 crore of viability gap funding (VGF) in social infrastructure development and rationalisation of stamp duty on mining leases for power distribution, showcase the Modi government's eye for detail. Undoubtedly, the 4th tranche has been focussed more on pending industrial reforms, that were long overdue and, rightfully so.

4) By far, ending the monopoly of Coal India Ltd (CIL), by allowing private extraction on revenue sharing basis, via the PPP mode and allowing composite mining whereby production, processing and usage can be done simultaneously, are measures that will unshackle the mining industry from government control and also enlarge the availability of raw materials.

5) Undeniably, the radical and much-needed move to privatise all power DISCOMs in Union Territories (UTs), in a bid to eradicate cross-subsidisation, is yet another example of how a decrepit and outdated "Nehruvian Socialism", has no room in the transformative "Aatmanirbhar Bharat", that Prime Minister, Narendra Modi is assiduously shaping, for 1.37 billion aspirational Indians. Smart pre-paid meters, punishment for load shedders and new tariff policy for DISCOMs, will ensure wastage&sub-optimal utilisation of resources are eradicated.

Tranche 5: Space, Atomic Energy & Relief/Compensation to States

The 5th tranche focusses on MGNREGA, healthcare and education, de-criminalisation of the Companies Act, amendments to declog the National Company Law Tribunal (NCLT), ease of doing business (EODB), empowering public sector undertakings (PSEs) and of course, enhancing finances of states. Some of the key measures are enlisted below.

1) An additional Rs 40,000 crore allocation has been made for the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), to help provide jobs to migrant workers returning home. This is over and above the Rs 61,000 crore budgeted earlier for fiscal 2020-21.

2) Fiscal Responsibility and Budget Management Act (FRBM) has been increased to 5% of gross state domestic product (GSDP) from 3% at present for 2020-21, subject to states carrying out specific reforms. This will help them raise an additional Rs 4.28 lakh crore in their fight against the Covid-19 pandemic. Interestingly, while Congress-ruled states and West Bengal's perpetually unhappy CM, Mamata Banerjee, have been whining about the paucity of funds, it is indeed a shame that so far, states have utilised only 14% of their earlier 3% limit, which entailed resources of a solid Rs 6.41 lakh crore. Before making false allegations at the Modi government, will the likes of Pinarayi Vijayan, the Kerala CM, or the inept Uddhav Thackeray led "MVA" alliance, explain, why 86% of funds are still lying unutilised? Why are states demanding more money from the centre to fight the Coronavirus pandemic, without having bothered to exhaust even 20% of their existing limits? Why are some opposition ruled states hiding their incompetence, under the garb of funds' scarcity?

Worse still, why has India's leftist media failed to adequately highlight that the Modi government generously gave Rs 46,038 crore to states in April 2020, as per original "Budget Estimates", even though actual revenue trajectory shows an unprecedented decline for the central government, due to the Covid-19 related challenges. Also, "Revenue Deficit Grants" of Rs 12,390 crore were given to states on time, in April and May despite the centre’s stressed resources. Also, advance release under the State Disaster Relief Fund (SDRF), of Rs 11,092 crore happened in the first week of April 2020, including a release of over Rs 4,113 crore from the central health ministry, for direct anti-COVID steps.

3) Again, at the centre’s request, the Reserve Bank of India (RBI) increased Ways and Means Advance (WMA) limits of states by 60%. Also, the number of days states can be in continuous overdraft, has been increased from 14 days to 21 days and the number of days states can be in overdraft in a given quarter, has been increased from 32 to 50 days.

Therefore, it is both unfair and unacceptable, that instead of appreciating the Modi government's helpful and conciliatory approach, driven by vested interests, political pygmies like Rahul Gandhi, the jaded Congress scion, have been needlessly raking up controversies with respect to migrant workers. Article 246, List-2, Seventh Schedule of the Indian Constitution clearly says, public health is a "State Subject".The central government has done more than its fair share. Why are states abdicating their responsibilities? Why have states not come forward to help hapless migrant workers, despite getting sufficient allocation of funds from the Modi government?

4) States' net borrowing ceiling for 2020-21 is Rs 6.41 lakh crore (3% per cent of gross state domestic product GSDP). The special increase in borrowing limit now allowed by the central government from 3% to 5%, is indeed a big move. There will be an unconditional increase of 0.50% in borrowing limit. 1% in four tranches of 0.25 %, will be released, with each tranche linked to clearly specified, measurable and feasible reforms. Further, 0.50% will be given to states if milestones are achieved in at least three out of four reform areas. Clearly, Narendra Modi's "perform or perish" motto will be seen at work, on this front.

5) The government’s decision to allow private sector companies in the space sector, including satellites, launch vehicles and other space-based services is a pathbreaking move. Private entities will also be allowed to use the state-run Indian Space Research Organisation’s (ISRO's) facilities to improve their capacities. Even in the atomic energy field, the government has decided to set up a research reactor via public-private participation (PPP) mode, for the production of medical isotopes meant for the treatment of cancer and other diseases.

6) No fresh insolvency will be initiated for 1 year under the Insolvency &Bankruptcy Code (IBC), in a bid to give relief to companies defaulting on loans due to the Covid-19 stress. Also, coronavirus-related debt will be excluded from the definition of default. Minimum threshold to initiate insolvency proceeding has been raised to Rs 1 crore from Rs 1 lakh, to benefit SMEs, under Section 240A of the IBC. An Ordinance will be promulgated to bring this change in IBC. This is a move that shows how "Modinomics" blends transparency with compassion--Revenue maximisation by hook or by crook and tax terrorism, were the misguided administrative norms, under decades of Congress rule, spelling harakiri at every level. Prime Minister Modi, however, thinks differently. "Jaan Bhi, Jahaan Bhi", is his core work ethic.

7) Decriminalisation of the Companies Act for violations involving minor technical and procedural defaults, including shortcoming in CSR reporting, inadequacies in board reports, filing defaults and delays in holding annual general meetings (AGMs) and general body meetings (GBMs), are the other good measures. Majority of the compoundable offences sections will be shifted to internal adjudication mechanism (IAM). Seven compoundable offences under the Companies Act will be altogether dropped and five will be dealt with under an alternative framework.

8) Government to privatise non-strategic PSUs

A new “coherent” public sector enterprises policy will be formulated that will define strategic sectors which will have at least one but not more than four PSUs, in any given strategic sector. List of strategic sectors requiring the presence of public sector undertakings (PSUs) in the public interest will be notified. In other sectors, PSUs will be essential, privatised, which is unarguably a dramatic move, which only a leader with hard-nosed determination, like Modi, can pull off, as privatisation has always been a very touchy subject. To minimise wasteful administrative costs, if the number of enterprises in strategic sectors is more than four, they will be privatised, merged or brought under holding companies.

9) Also, the government has allowed companies to directly list securities in permissible foreign jurisdictions. Private companies, which list non-convertible debentures (NCDs), on stock exchanges, would not, however, be regarded as listed companies.

10) The launch of ‘PM e-VIDYA’ was also announced. One of the main components of the new programme is the ‘One Class One Channel’ initiative where classes will be conducted on dedicated television channels. Twelve DTH channels will be dedicated to the programme, with one channel, for each class from 1 to 12. The government has already launched "Swayam Prabha" DTH channels to support and reach out to those who do not have access to the internet. The Swayam Prabha initiative is the HRD ministry’s free-to-air education bouquet, which consists of a group of 32 DTH channels that provide educational content. The National Council for Educational Research and Training (NCERT) has already started working on the content for the channels.

11) One Nation, One Digital Platform

The other component in the "PM e-VIDYA" package is the "DIKSHA" portal (One Nation, One Digital Platform) which will provide quality educational content to researchers and students.100 eminent universities including IITs and IIMs will also provide educational content, online.

Modinomics Vs Others: The US has announced 2.3% of its GDP in "Paycheck Protection Program and Healthcare Enhancement Act, the (PPPHEA). It has committed 11% of its GDP in CARES Act. US lawmakers agreed on the passage of a $2 trillion stimulus bill called the CARES (Coronavirus Aid, Relief, and Economic Security) Act in March 2020, to blunt the impact of an economic downturn set in motion by the coronavirus pandemic. President Donald Trump signed the bill into law on March 27 2020. Well, India's stimulus of 10.48% of GDP compares very favourably with the 11% number of USA. Also, India's counter to the "PPPHEA", would be the mammoth, "Ayushmaan Bharat", which provides free health care& insurance cover to 10.74 crore families, totalling over 50 crore Indians, making it the largest healthcare scheme in the world!!

China announced 2.5% of its GDP in terms of fiscal measures. Additional measures such as the announcement of buyback of local bonds worth 1.3% of GDP have also been made. It has put 3.2% of GDP in liquidity infusion and another 1.7% of GDP in re-lending and rediscounting facilities. The People’s Bank of China has announced rate cuts in the range of 10-150 bps. In all, China's stimulus works out to a little over 8.7% of GDP, lower than the 10.48% committed by the Modi government. Again, India's RBI cut Repo rates by a solid 210 basis points, of which 135 bps happened in 2019 and a massive 75 bps in a single shot, on 27 March 2020.

Germany announced a stimulus of 10.7% of GDP, which technically speaking, is not a big deal, as Germany has been in the throes of an industrial recession since October 2019, with its automotive industry exports that are its lifeline, being on a ventilator for over 18 months now. In fact, a painfully flaccid Germany will be one the key reasons for a negative 7.5% GDP growth, that the Eurozone will witness in 2020. Germany could have and should have, done a lot more. In contrast, the 10.48% stimulus number in India's case, looks far superior.

The Math of Rs 20,97,053 Crore: This can be divided into "Pre-Tranche" measures that include two subsets--- (i) RBI's actions between 27 March 2020 and 12 May 2020 and (ii) "PM Garib Kalyan" package, announced on 26 March 2020.

Add the stimulus under the aforesaid "Five Tranches", to the "Pre Tranche" measures and one gets a giant sum total of Rs 20,97,053 crore worth of mega stimulus infused by the Modi government, into the Indian economy. The government has provided Rs 11,02,650 crore of stimulus in the "Five Tranches". Earlier," Pre Tranche" stimulus worth Rs 9,94,403 crore was infused in the system through fiscal and policy measures. Again, of the Rs 9,94,403 crore, RBI 's monetary measures work out to a sum of Rs 8,01,603 crore and "PM Garib Kalyan" package, another Rs 1,92,800 crore.

Pre Tranche: RBI’s Monetary Policy Actions

Key announcements by RBI on March 27, 2020, included cut in Repo rate by 75 bps and CRR reduction to 3% from 4%, ensuring additional liquidity worth Rs 1.37 lakh crore. The apex bank announced targetted long-term repos operation (TLTRO) of Rs 1 lakh crore, in the first round, to increase liquidity in the markets. Marginal standing facility (MSF) was decreased to 2% from 3%, allowing banks to avail an additional Rs 1.37 lakh crore worth liquidity under the liquidity adjustment facility (LAF) window. The central bank also announced special refinance facility worth Rs 50,000 crore to NABARD, SIDBI and NHB.

As Franklin Templeton closed six debt schemes due to redemption pressures, the RBI stepped in and offered Rs 50,000 crore special liquidity facility (SLF-MF) to the mutual fund industry, to maintain adequate liquidity.Rs 50,000 crore of additional stimulus through the second round of targetted long-term repo operations (TLTROs), was also provided.

The balance was made up through RBI' s purchase of government securities in the open market worth Rs 90,000 crore and other related liquidity support measures worth Rs 1,87,603 crore, which filled in the remaining gap, to arrive at the figure of Rs 8,01,603 crore.

Pre-Tranche: "PM Garib Kalyan" package

The Modi government announced the "Garib Kalyan" Package worth Rs 1.7 lakh crore on March 26 2020, a day after the first phase of lockdown was announced in India. The package comprised measures taken for poor, elderly, women and migrants. The government offered free rice/wheat and pulses; free cooking gas for three months; hike in MNREGS wages to Rs 202 a day from Rs 182; direct money transfer to elderly, poor widows and disabled and, direct money transfer to women Jan Dhan account holders. The centre also announced "PM Kisan" payouts; assistance to construction workers and, measures to prevent job disruption by paying 24% of monthly wages of employees earning less than Rs 15,000, directly into their PF accounts for three months. Through the Central Board of Indirect Taxes and Customs (CBIC), monies stuck in pending tax refund claims, the centre initiated refund and drawback disposal drive, under which Rs 7,800 crore was released, increasing cash in the hands of many.

The Modi government also announced emergency health response preparedness package worth 15,000 crore, which would be implemented in three phases till March 2024, to strengthen emergency COVID-19 response. Adding the above sums of Rs 7,800 crore and Rs 15,000 crore, to Rs 1.7 lakh crore, the actual size of the "PM Garib Kalyan" package, therefore, worked out to Rs 1,92,800 crore.

Conclusion: In terms of spending as a share of GDP, 6.48% or over Rs 12.95 lakh crore, has been committed to food security, direct cash transfers, rural job guarantee schemes, and credit guarantees to SMEs, among others. The Modi government, via monetary measures, policy rate cuts and other liquidity boosting measures at 4% of GDP or over Rs 8.01 lakh crore, has also given re-booted the economy in an age when uncertainty is the new normal and unpredictability, the new global template! In effect, the "Modi Bazooka" or mega stimulus, is equal to not 10%, but even higher, at a good 10.48% of GDP, which speaks glowingly about this government's bona fide intent to do what it takes, to build business and consumer confidence.

It would be apt to conclude with a memorable saying from an equally memorable movie--"Queen of Katwe", where the character, Robert Katende, pacifies his star student who is inconsolable, after her shocking loss, at a chess championship and wants to give up playing forever, overcome by despair and hopelessness. Katende tells her--"We all suffer losses but what matters is, how we reset the pieces and play again".

Katende's world-famous student, Phiona Mutesi, thereafter, goes on a record-breaking spree, winning many international laurels for her country, Uganda. With an indefatigable leader in Prime Minister Narendra Modi, at the helm of affairs in India and leading the global sweepstakes, in the fight against Covid-19, Robert Katende's words, ring true, again!!

Ms Sanju Verma is an Economist, Chief Spokesperson of BJP Mumbai and Author of the Bestseller, "Truth & Dare--The Modi Dynamic".