While the automakers are bullish about a 10% rate cut, a GST relief could cause a revenue loss of about Rs 55,000-60,000 crore on an annual basis

The Goods & Services Tax Council will meet on September 20 in Goa to decide on a rate cut for automobiles, taxed currently at 28%.

While the automakers are bullish about a 10% rate cut, a GST relief could cause a revenue loss of about Rs 55,000-60,000 crore on an annual basis.

Finance minister Nirmala Sitharaman had indicated on Tuesday that more measures were in the pipeline for the auto sector.

The minister, however, remained noncommittal on the rate cut saying it was for the GST Council to decide.

Some states, including Kerala, West Bengal, Bihar and Punjab, are opposed to the cut. All states and union territories are members of the GST Council which unanimously decides on the proposals before it.

"It will be difficult for the states to forego their share of revenue on account of reduced collections due to a rate cut. The GST Council will be apprised of a cut's revenue implications. It is up to to them to decide whether to go for it after considering revenue loss," said an official on the condition of anonymity.

The government will lose about one-third of the revenue it gets from taxes and cess on automobiles if the Council favours a 10% rate cut.

Monthly tax collections from automobile are around Rs 15,000 crore, which has fallen to Rs 11,000 crore due to slowdown.

Another way being explored is an increase in cess on luxury and sin goods category, which includes cars, tobacco and soft drinks.

If the states don't agree with it, the Centre will have to compensate the states for any revenue shortfall on account of lower tax collections.

The Centre has made a commitment to the states to compensate for five years, if their annual GST revenue growth was less than 14%.

However, the central government finds it very difficult to compensate the states and expects them to take a hit. The central government's GST collections have remained below the expected Rs 1 lakh crore mark during this fiscal. Further lowering of the GST mop-up may strain the government's finances and make it difficult to meet the fiscal target.

GST fitment committee as well as states are not in favour of a rate cut. "If there is a rate cut, it may happen for a particular category of automobiles such as hybrid vehicles. But it is unlikely to be major. Anyway, a rate cut alone or a slight rate cut may not help the automobile sector much," said Pratik Jain, partner and indirect tax expert at PwC India.

"GST is not the only tool. The government also has other measures to incentivise the sector. Among other things, it can give more export incentives than the sector gets at present. Currently, tax rates are not higher than they were pre-GST," he said, adding it is debatable that GST is the reason for the slowdown in the sector as there could be several other factors.

Domestic passenger sales fell over 31% in August as compared to the year-ago period. Automakers have been forced to temporarily shutter plants as consumer demand continues to be weak for last several months.

With consumers postponing their purchases and companies unsure of consumer sentiment during this festive season, the auto industry is pinning its hopes on the rate cut for a sales revival.

"It is difficult to forecast how the festive season will be this year. We have stopped forecasting anything beyond four hours," Mahindra & Mahindra managing director Pawan Goenka had recently said in an interview.

Prashanth Agarwal, a partner at PwC India, said: "Industry believes that a GST rate cut could go a long way in boosting diminishing demand in the badly hit auto sector. It's a sensitive situation for the government as on the one hand it is trying every possible measure to support the economy but on the other, a cut could significantly dent the already falling GST revenues (which dipped below Rs 1 lakh crore last month). The government could look at a partial GST relief for auto in teh form of a reduction in rate for two-wheelers, hybrid cars and small cars. It would need to be seen how much positive impact such a cut could have considering the upcoming festive season."

![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

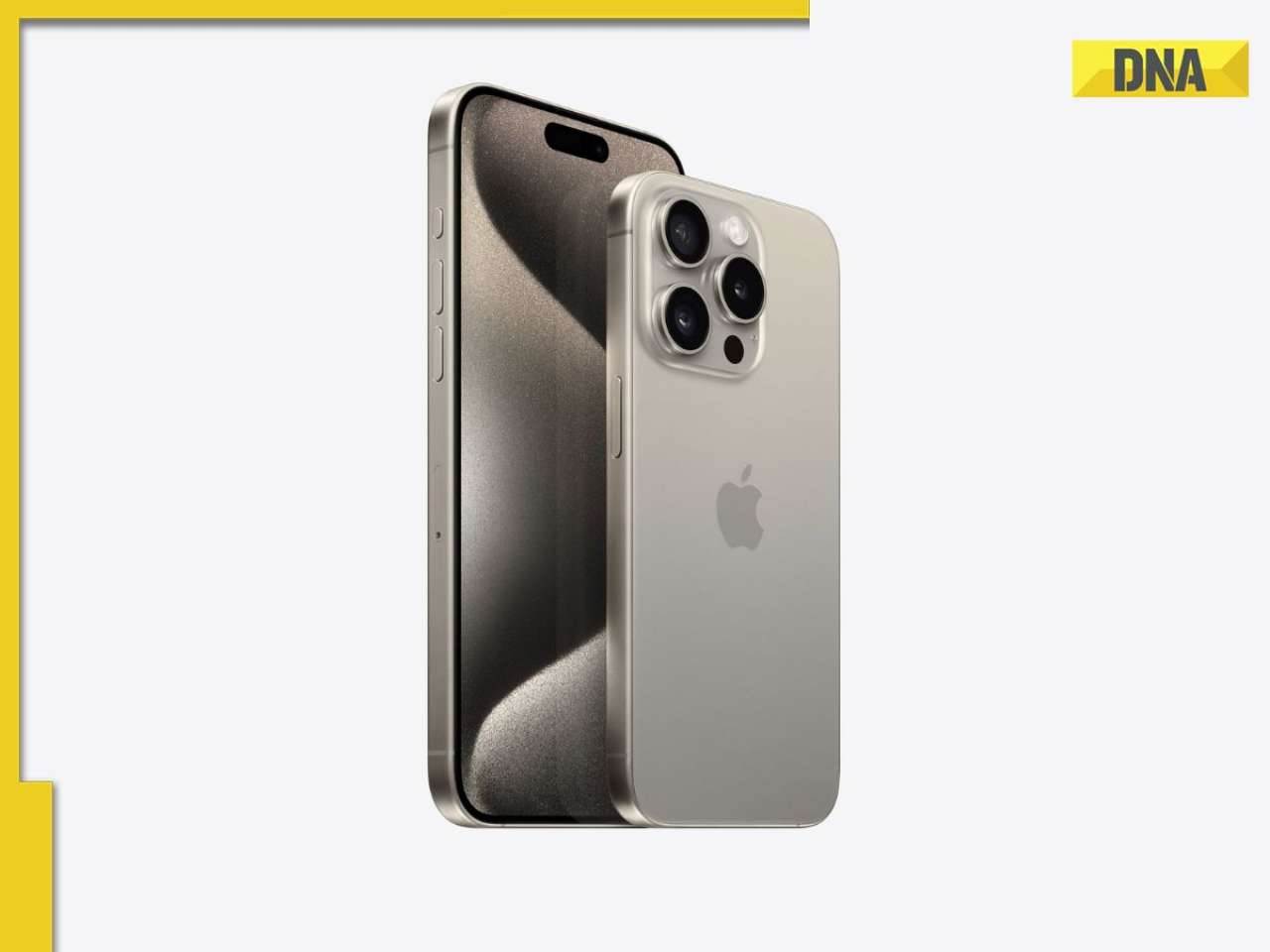

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() Apple iPhone camera module may now be assembled in India, plans to cut…

Apple iPhone camera module may now be assembled in India, plans to cut…![submenu-img]() HOYA Vision Care launches new hi-vision Meiryo coating

HOYA Vision Care launches new hi-vision Meiryo coating![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..

First Bollywood star to wear bikini was called greatest actress ever, later isolated herself, died alone, her body was..![submenu-img]() This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...

This film had no superstars, got slow start at box office, was made with budget of only Rs 60 lakh, earned Rs...![submenu-img]() Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans

Salman Khan to return as host of Bigg Boss OTT 3? Deleted post from production house confuses fans![submenu-img]() Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive

Manoj Bajpayee talks Silence 2, decodes what makes a character iconic: 'It should be something that...' | Exclusive![submenu-img]() Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now...

Meet star, once TV's highest-paid actress, who debuted with Aishwarya Rai, fought depression after flops; is now... ![submenu-img]() IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR

IPL 2024: Jos Buttler's century power RR to 2-wicket win over KKR![submenu-img]() GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

GT vs DC, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals

GT vs DC IPL 2024 Dream11 prediction: Fantasy cricket tips for Gujarat Titans vs Delhi Capitals![submenu-img]() 'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash

'I went to...': Glenn Maxwell reveals why he was left out of RCB vs SRH clash![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() Shocking details about 'Death Valley', one of the world's hottest places

Shocking details about 'Death Valley', one of the world's hottest places![submenu-img]() Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here

Aditya Srivastava's first reaction after UPSC CSE 2023 result goes viral, watch video here![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

)

)

)

)

)

)

)