For any non-resident Indian, the incredible India advertisement campaign evokes a lot of sentiment. I have not been to most of the places shown in the campaign, but I think this would be true for most people I know.

However, despite the campaign’s appeal, India’s tourism sector has mostly flattered to deceive in the last twenty years.

India does not have significantly strong competition in the tourism sector in South Asia to vie for tourists. Despite Nepal, Sri Lanka and, recently, Bhutan bolstering their tourism industries, India still dominates the market in South Asia.

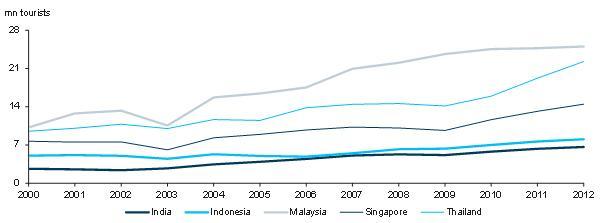

But the position flips when it comes to competition with South East Asia. In the last 10 years, India has welcomed close to 49 million tourists, according to the ministry of tourism. However, this number seems dramatically paltry when compared to tourist arrivals in Malaysia (201 million), Singapore (102.5 million) and Thailand (148 million). Indonesia too is ahead at 60 million tourists. There are several reasons why there are such large differences, but let us examine a few.

Comparing tourist arrivals: India and South East Asia

In all fairness, South East Asian economies, particularly Thailand, Singapore and Malaysia have spent more time and resources in improving their tourism infrastructure. But India has some disadvantages that these smaller, more open economies have taken care to avoid.

A smaller concentration of international airports: In South East Asia, major tourist destinations have excellent air connectivity. In addition, the surge in low cost airlines in this region and in North Asia, and in long distance budget travel, has facilitated the arrival of tourists.

This has not happened in India. To compare, Thailand, a country about one-sixth the size of ours, has seven international airports, while India has 26 international airports, and six customs airports (as per the AAI’s website). In India, some international airports do not have regular international flights, like Goa, Nagpur and Port Blair. This has been a major shortcoming, as India’s inflexibility on granting international status to tier 2 and tier 3 airports has hindered the ability of their cities to attract more tourists.

India can easily raise the number of its international airports to 40, and it will only be a start. If airports in important cities like Lucknow, Patna, Raipur, Indore, Ranchi, Vijaywada, Mangalore, Vadodara and Dibrugarh are given international status, the ability to grab some low hanging fruit is immense. Even if international flights are not immediately started, it makes sense to prepare in advance. It is interesting to note that 10 days after Bhubaneswar was granted international status, four airlines had already applied to connect it to Singapore, Dubai, Abu Dhabi and Bangkok. A general rule of thumb could be that cities with close to a million people living in or around it should plan to either build or upgrade to an international airport within a 100 km radius.

Troublesome visa process: India’s visa procedures are hopelessly cumbersome, and while things have improved of late, visas to India still remain notoriously difficult to obtain. One way to navigate this is the recent introduction of visa on arrivals. Thailand has run this scheme for years, and remains extremely popular. But India has opened up the service to a very select group of countries, with half of whom it does not have direct flights (like Indonesia and Philippines). A major shift in policy should allow tourists in India to obtain online visas, which can be administered in an easy, hassle-free manner. Allowing those who already have a visa from an OECD country (common practice in other countries) will also boost India’s ability to attract more tourists. Sri Lanka, Turkey, Singapore and Taiwan are important tourist destinations which already issue online visas, for instance.

High fuel surcharges and airport tariffs: The image of the discernible tourist being a cash cow has not waned completely. Delhi has once been named as the airport with the highest user development fee (see here). At the same time, many states use the aviation turbine fuel as a cash machine, with tax rates being as high as 30% in some states. While states like Odisha, Chhattisgarh and West Bengal have taken the first steps in reducing the fuel taxes, more needs to be done in order to re-align India’s aviation sector to meet the needs of India’s tourism industry.

Relative lack of mid-tier hotels: Indian hotels come in two sizes: luxury five star or small and dingy, and located in the seedier parts of town. The lack of a reliable Tier 2 hotel network outside the tourist trail compromises India’s ability to leverage on budget tourists. While some important progress has been made through brands such as Ginger, Holiday inn express, still more can be done. This will benefit both foreign and domestic tourists. A weaker rupee has unequivocally boosted India’s appeal for tourists, and the need to cash in on this boost is urgent.

So far, I have avoided any mention of safety issues, which have cropped up alarmingly frequently in recent years, with regard to tourists, especially female tourists and women, in India. While much has been said on these issues, I would emphasise on two things with regard to tourist safety. First, it is easy identify areas frequented by tourists, so creating a separate police force focusing solely on tourist safety would be an advantageous step. The tourism ministry has already initiated this move, and most states are expected to form their own tourist police.

Second, it is important to raise awareness about tourist safety amongst those who benefit from tourism, and encourage a ranking system amongst states that would allow the government to reward those states that take preemptive steps to ensure the safety of tourists. These steps will remain a work in progress, but can be taken up more aggressively by the next governments.

Rahul Bajoria is a regional economist based in Singapore with Barclays. Views are personal.