Last week Greece was bailed out for the third time. The total bailout amounts to 82-86 billion euros. In order to access this money the Greek government has to follow a series of austerity measures like pension reforms, implementing the highest rate of value added tax for business sectors which currently pay a lower rate, etc.

Before the bailout was announced many economists were of the view that Greece should leave the Eurozone. Eurozone is essentially a term used to refer to countries which use the euro as their currency.

The logic offered by these economists is fairly straightforward: Greece needs to get out of the euro and start using its own currency, the drachma. In this situation, the drachma would fall in value against other currencies and in the process make the Greek exports competitive. This would help revive Greek exports as well as tourism, and in turn the Greek economy.

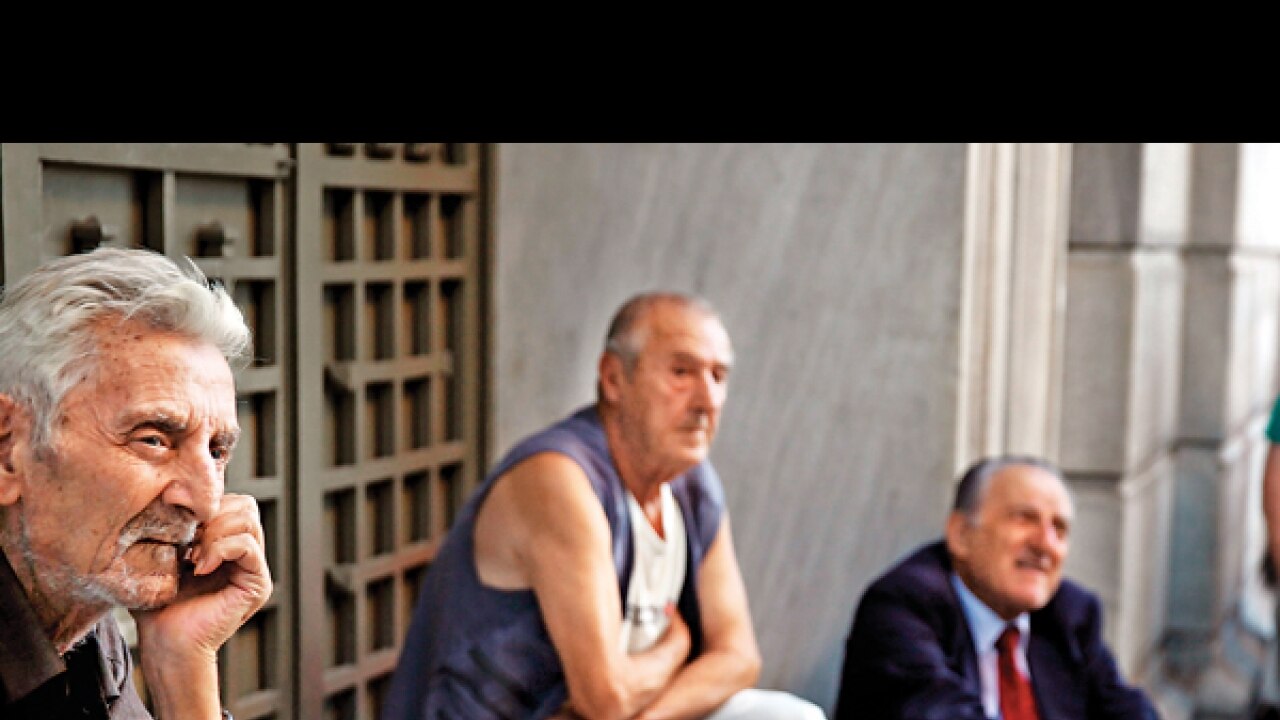

The austerity measures that Greece has had to follow since 2010, when it was first bailed out, have crippled the Greek economy. The economy has contracted by 25%. The unemployment is at 26%. Among youth it is over 50%. Small and medium businesses are shutting down by the dozen.

The government debt as a proportion of the gross domestic product (GDP) has jumped from 126.9% in 2009 to 175% currently. This has happened primarily because the size of the Greek economy has contracted leading to the total amount of debt as a proportion of the GDP (which is a measure of the size of an economy) shooting up.

If Greece leaves the euro and moves to the drachma, it will be in a position to devalue the drachma and in the process hope to revive its economy. This is something that it cannot do currently given that it uses the euro as its currency.

The economists who have been calling for Greece to leave the euro are looking at the situation just from an economic point of view. What they forget is that the euro has political origins.

The euro came into being on January 1, 1999. But it took a long time for the countries which originally started to use the euro as their currency to get there. A brief history is in order.

Before the euro came the European Union. The origins of the European Union can be traced to the European Coal and Steel Community (ECSC) and the European Economic Community (EEC) formed by six countries (which were France, West Germany, Italy and the three Benelux countries, ie, Belgium, Netherlands and Luxembourg) in 1958.

The goal of ECSC was to create a common market for coal and steel in Europe. The EEC on the other hand worked towards advancing economic integration in Europe. The economic integration of Europe was deemed to be necessary by many experts to create some sort of bond between different countries in a continent destroyed by extreme forms of nationalism during the Second World War.

As the Nobel Prize winning American economist Milton Friedman wrote in a 1997 column: “The aim has been to link Germany and France so closely as to make a future European war impossible, and to set the stage for a federal United States of Europe.”

The EEC and the ECSC organisations gradually evolved into the European Union (EU) which was established by the Maastricht Treaty signed on December 9 and 10, 1991. After the formation of the EU by the passage of the Maastricht Treaty, the members became bound to start a monetary union by January 1, 1999.

What this tells us loud and clear is that the euro was as much a political project as it was an economic one. Given this, asking Greece to leave the euro, is not an easy decision to make politically, as it goes against the basic idea of the United States of Europe. As long as the European politicians are serious about this basic idea, Greece will continue to stay in the Eurozone.

The issue has taken another political dimension with the United States (US) of America getting involved. The US isn’t directly involved but as is often the case, it is operating through the International Monetary Fund (IMF).

On July 14, 2015, the IMF released a four-page report in which it said that the Greek public debt is unsustainable. Public debt is essentially government debt minus government debt that is held by the various institutions of the government.

As the IMF report pointed out: “Greece’s public debt has become highly unsustainable…Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far.”

The IMF wants Europe to handle the Greece issue with more care. “There are several options. If Europe prefers to again provide debt relief through maturity extension, there would have to be a very dramatic extension with grace periods of, say, 30 years on the entire stock of European debt, including new assistance... Other options include explicit annual transfers to the Greek budget or deep upfront haircuts,” the IMF report points out.

Basically there are three things that the IMF wants. First, it feels Greece should be allowed more time to repay the debt that it owes to the economic troika of IMF, European Central Bank and European Commission. The IMF wants to give Greece a 30-year moratorium on its debt.

Second, it wants Europe to help Greece more by giving more money to the country every year. And third, it wants lenders of Greece to take a haircut, which basically means that they should let Greece default on a part of the debt that it has taken on.

The question is why are the Americans doing this? A simple explanation for this is that if Greece is abandoned by Europe, it could approach China or Russia for help. And this is something that the Americans won’t be

comfortable with. A television analyst used to making flippant statements could even call it the start of the second Cold War.

The trouble is that IMF released this report after the third bailout of Greece had been announced. As Albert Edwards of Societe Generale put it: “I simply do not understand why the IMF did not come out loud and clear…and say they would not participate in this charade without debt forgiveness.”

The mess in Eurozone just got messier.

The writer is the author of the Easy Money trilogy