Car manufacturers today face a threat from the very segment that’s driving sales — cab aggregators, which provide mobile app-based services.

A CRISIL study indicates that compared with a scenario where there are no app-based cabs and only traditional taxis abound, there would be 20 per cent fewer cars on the road by 2025. This is because the surging population of app-based cabs will reduce the requirement of cars on the road to serve the same mobility needs.

In India, personal cars get ‘old’ because of age rather than the distance driven. Typically, such cars clock 1,10,000-1,30,000 km over a decade. However, as the cab aggregators expand their fleets, more cars will be run for 1,80,000-2,00,000 km, which is considered their full lifespan. To be sure, the average annual running of these cabs is ~50,000 km compared with ~12,000 km for personal cars.

Such higher utilisation will reduce the demand for new cars and also stretch replacement cycles of personal cars. As a result, CRISIL believes passenger car sales could decline as much as 1.5 per cent (compound annual growth rate) through 2030.

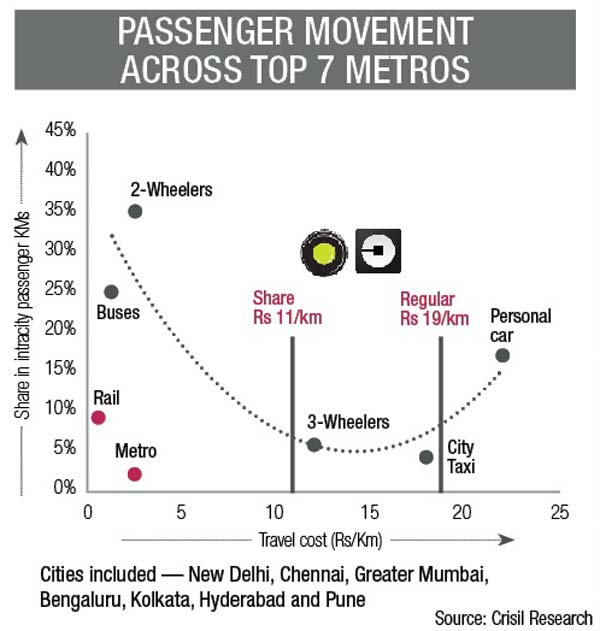

Driving demand for app-based cabs is the convenience and affordability they offer. Though the cost per kilometre for a passenger is ~Rs 19 — a notch above ~Rs 18/km in traditional taxis — these cabs score on convenience, including doorstep pick-ups, air-conditioning and even Wi-Fi in select options. This has helped app-based cabs emerge as a viable alternative to personal cars, where the cost (including fixed and variable costs) is ~Rs 22/km.

The study indicates that a personal car would be cheaper only if the distance driven is more than 15,000 km annually. And with a chauffeur, that distance doubles to 30,000 km. Further, the introduction of shared cabs — at a price point of ~Rs 11/km — has provided a viable alternative to three-wheelers (~Rs 12.5/km) and AC buses (~Rs 4/km). At an aspirational level, even users of trains and buses (less than Rs 2/km) and two-wheelers (~Rs 2.5/km) are potential customers.

Consumer surveys have indicated that while a person will likely buy his first car anyway — since it is an aspirational goal — those who are planning to buy a second car would likely defer their purchases. Also, shared cabs, which cost lesser, are attracting non-car users — such as those of buses, three-wheelers and two-wheelers. These were not immediate buyers of passenger cars, but with a shift in their mobility towards cars, it will cushion the decline in passenger car sales in medium to long term.

Not only are these cabs finding increasing preference, but also the companies are buying supply (cars and drivers) at a premium (in terms of higher remuneration).

We believe, based on the network optimisation of app-based services, the waiting time also reduces for cabs, giving them better profitability. Higher user preference and prospects of better profitability could persuade traditional taxi operators to uptrade and become a part of the cab aggregator ecosystem in future. This, along with higher penetration of such cabs, will take their contribution in proportion of sales (of total passenger cars) from 4 per cent today to about 15-20 per cent by 2025.

Indeed, the increasing shift towards cab aggregator services has huge ramifications. As people give up their second car ownership and more cars are on the road for longer hours, parking woes could ease to an extent. However, traffic congestion, somewhat counter-intuitively, is expected to worsen because of the marginal shift from mass transport such as buses to cabs.

Owing to their higher running, cab owners prefer to use more fuel-efficient cars to optimise lower running cost compared with personal car users.

This could lead to faster adoption of cleaner electric vehicles. This is based on the premise that their higher annual running will amortise the higher initial cost better and completely intra-city usage would mean limited concerns on having charging infrastructure. This would also mean lesser vehicular emissions in the fuming Indian cities.

The upshot of all this is that car manufacturers will need sharper strategic focus on cab aggregators, which are expected to account for 15-20 per cent of total demand by 2025. CRISIL Research believes it would involve making cars more fuel efficient, reliable and durable, and improving driver and passenger comfort. After-sales services could also be improved a few notches through better availability of parts and faster servicing times. Focusing on cab aggregators would also help car manufacturers bring down the cost of reaching out to customers.

The author is Director, Industry & Customised Research, CRISIL Research