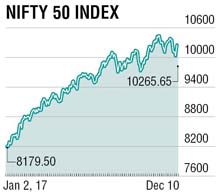

The bout of rounds between Bulls and Bears continued last week. After losing in the previous week Bulls got the grip back over Bears in the second half and managed to close at 10266, gaining 144 points, or 1.42%, on a weekly basis. Mid cap and Small cap indices gained 1.64% and 0.7%, respectively.

Notably, all the sector indices ended positive. FMCG sector gained the most 3%, in which Hindustan Unilever topped the chart with a gain of 5.2%, Colgate rose 4% and ITC gained 2.5%. IT sector gained 2% in which Tech Mahindra, HCL Technologies and Infosys gained 4.5-5%. Bharti Airtel was the biggest gainer in Nifty at 8%, following news that it was interested in buying Nigerian telecom company 9Mobile. Coal India and Hero Moto lost 2.6% each.

Companies such as Britannia, HUL, Maruti, Mothersons, PC Jewellers, Pidilite and TVS Motors made new lifetime highs. FIIs continued to be sellers in equities, offloading Rs 4,773 crore worth of stocks, while DIIs bought worth Rs 5,015 crore in the last week. Equity mutual funds saw inflows of Rs 20,308 crore, reaching August month high of Rs 20,362 crore.

In the US, Dow and S&P 500 ended at records high after the tax cut announcement and November jobs report came in much stronger than expected, underlining the economy’s strong fundamentals. Reserve Bank of India (RBI) kept policy rates unchanged, citing rising inflation and maintained gross value-added growth of 6.7% for the current fiscal. India’s forex reserves rose to $402 billion on steady dollar inflows. Future Supply Chain IPO was subscribed 7.5 times.

Key data to watch out this week is US FOMC meeting for interest rate decision on Wednesday, China Industrial Production, ECB meeting and US flash and services PMI on Thursday and US industrial production on Friday. India’s November month trade balance will be released today, Q3 Current Account deficit, October month IIP and CPI on Tuesday, while WPI will be announced on Thursday.

In the last week, Nifty dragged further down and made low of 10040 on Wednesday amid caution ahead of Gujarat elections, but buying sentiment bolstered post the opinion polls showed edge to the BJP in the Gujarat elections, and rallied for the rest of the week on strong domestic buying and short covering. The first phase of the voting for 89 seats was completed last Saturday and final phase of voting is on Thursday. For the week, markets will take cues from the developments from FOMC meeting, Gujarat election opinion polls and the economic data throughout the week, which will propel the volatility further.

On the weekly charts, Nifty made a “Hammer” candle, indicating that Bulls are back in the action. For the week, if Nifty sustains above 10178, it can rally towards 10350-10400 levels while on the downside strong support is at 10150 and 10090.

The writer is vice president-retail research, Motilal Oswal Securities Limited