April 1, 2017, marks the beginning of the new financial year (FY) 2017-18. In many ways, FY 2017-18 is going to be a landmark one. First, this would the first FY when the budgetary outlays are available for expenditure right from the onset. This was made possible by preponing the Union Budget and realigning Parliament sessions to facilitate early passage of the Finance Bill 2017. Second, after decades of work in progress, Goods and Services Tax (GST) is finally expected to be rolled out from July 1, 2017. Possibly the biggest and boldest tax reform since Independence, GST seeks to overhaul the indirect taxation regime. And the logistics sector is likely to be one of its biggest beneficiaries.

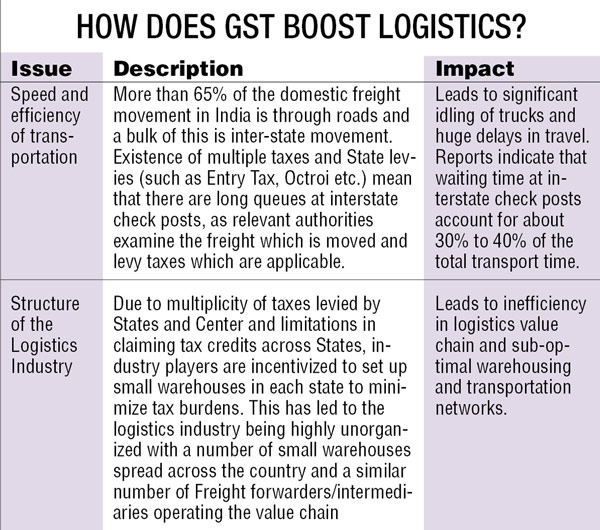

Studies estimate the average logistics cost in India to be around 13-14 per cent of GDP. This is much higher compared to other developed countries (which is around 8-9 per cent of GDP). Though various issues contributed to this, the structure of indirect taxes that exists today is a significant cause. Currently both Centre and states levy a bunch of taxes on goods. Note that we are saying “goods” here, as states are not empowered to levy service taxes. To continue, Centre’s levy includes taxes such as Excise, Customs, and Central Sales Tax, while states levy includes VAT/Sales tax, Octroi, Entry tax and Luxury Tax. Additionally, both Centre and States may levy other duties, cesses, surcharges over and above these. While levy of multiple taxes by Centre and states itself makes the tax structure complex, limitations to offset taxes paid along the value chain amplifies the problem further. For example, excise and VAT cannot be offset. So they cascade. So taxes get levied upon taxes. Further, it is difficult to claim VAT credits across states. For the Indian Logistics industry, these inherent complexities lead to the following: (Refer Table: inset).

The GST is poised to be a game-changer for the logistics industry. With GST, India will become a seamless unified market without any difference between inter-state or intra-state sales. This will essentially disrupt the existing inefficiencies and facilitate structural re-engineering of the logistics network. Service providers would be incentivised to leverage hub-and-spoke supply chain networks by operating large central warehouses and remodeling transportation routes. This can enable increased consolidation in the industry with large players operating efficiently. Phasing out the inter-state check posts would significantly reduce transportation costs and enhance “ease of doing business”. For industries, this would mean lower logistics cost and possible opportunities for increasing margins and/or reducing prices. For government agencies, all this may translate to increased formalisation and tax compliance. In fact, independent analyst estimates suggest that GST implementation can reduce overall logistics cost by around 30-40 per cent, thereby leading to an overall saving of about 0.3-0.4 per cent of GDP. All this would ultimately benefit the public.

That said, there are still some issues that need to be resolved. The All-India Transporters Welfare Association (AITWA) and All India Motor Transport Congress (AITC) had recently organised a technical session on GST. The authorities were apprised of key areas that need more clarity. There could be some teething troubles but the government is determined to sort all these as we go along. Meanwhile, there is another interesting development. The government is reportedly considering changing the fiscal year from April-March to Jan-Dec. An expert committee has recently submitted its recommendations which is yet to be made public. But, if the government does go ahead with effecting this change, then FY 2017-18 could as well be the last FY to start from 1st April. Will this impact the existing scheme of GST? Mostly should not, but we are not sure. Only time will tell.

The authors are economists with the Niti Ayog.Views personal. Dr Debroy tweets at @bibekdebroy